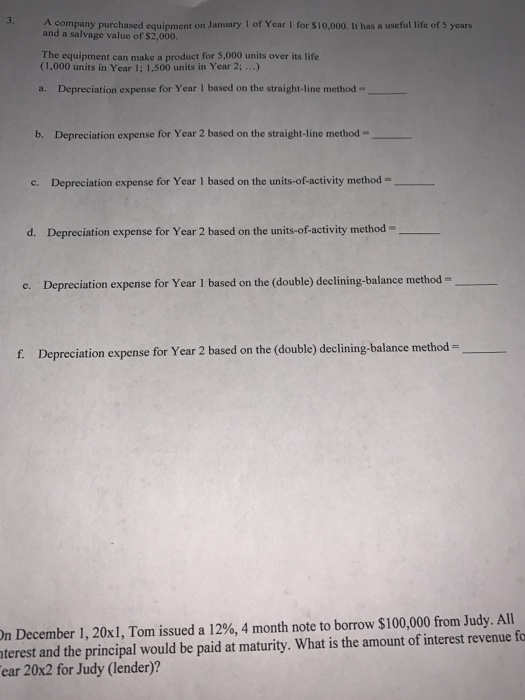

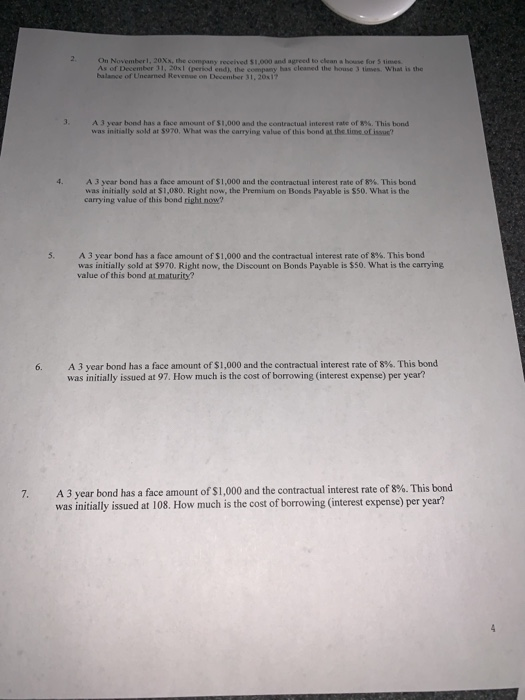

3. A company purchased equipment on January 1 of Year I for $10,000. It has a useful life of 5 years and a salvage value of $2,000. The equipment can make a product for 5,000 units over its life (1,000 units in Year 1: 1.500 units in Year 2;...) Depreciation expense for Year 1 based on the straight-line method- a. b. Depreciation expense for Year 2 based on the straight-line method- c. Depreciation expense for Year 1 based on the units-of-activity method- d. Depreciation expense for Year 2 hased on the unite of-activity method- e. Depreciation expense for Year 1 based on the (double) declining-balance method- f. Depreciation expense for Year 2 based on the (double) declining-balance method- n December 1, 20x1, Tom issued a 12%, 4 month note to borrow $100,000 from Judy. All terest and the principal would be paid at maturity. What is the amount of interest revenue fo ear 20x2 for Judy (lender)? On November1, 20XX, the company received $1.,000 and agreed to clean a house for 5 times As of December 31, 20x1 (period end), the company has cleaned the house 3 tinves What is the balance of Unearned Revenue on December 31, 20s117 3. A 3 year bond has a face mount of $1,000 and the contractual interest rate of 8%. This bond was initially sold at $970, What was the carrying value of this bond at the sime.oisou 4. A 3 year bond has a face armount of S l ,000 and the contractual interest rate of. This bond was initially sold at S1,080. Right now, the Premium on Bonds Payable is $50. What is the carrying value of this bond right now? A 3 year bond has a face amount of $1,000 and the contractual interest rate of 8%. This bond was initially sold at $970. Right now, the Discount on Bonds Payable is $50. What is the carrying value of this bond at maturity? 5, A 3 year bond has a face amount of $1,000 and the contractual interest rate of 8%. This bond was initially issued at 97. How much is the cost of borrowing (interest expense) per year? A 3 year bond has a face amount of S 1,000 and the contractual interest rate of 8%. This bond was initially issued at 108. How much is the cost of borrowing (interest expense) per year