Answered step by step

Verified Expert Solution

Question

1 Approved Answer

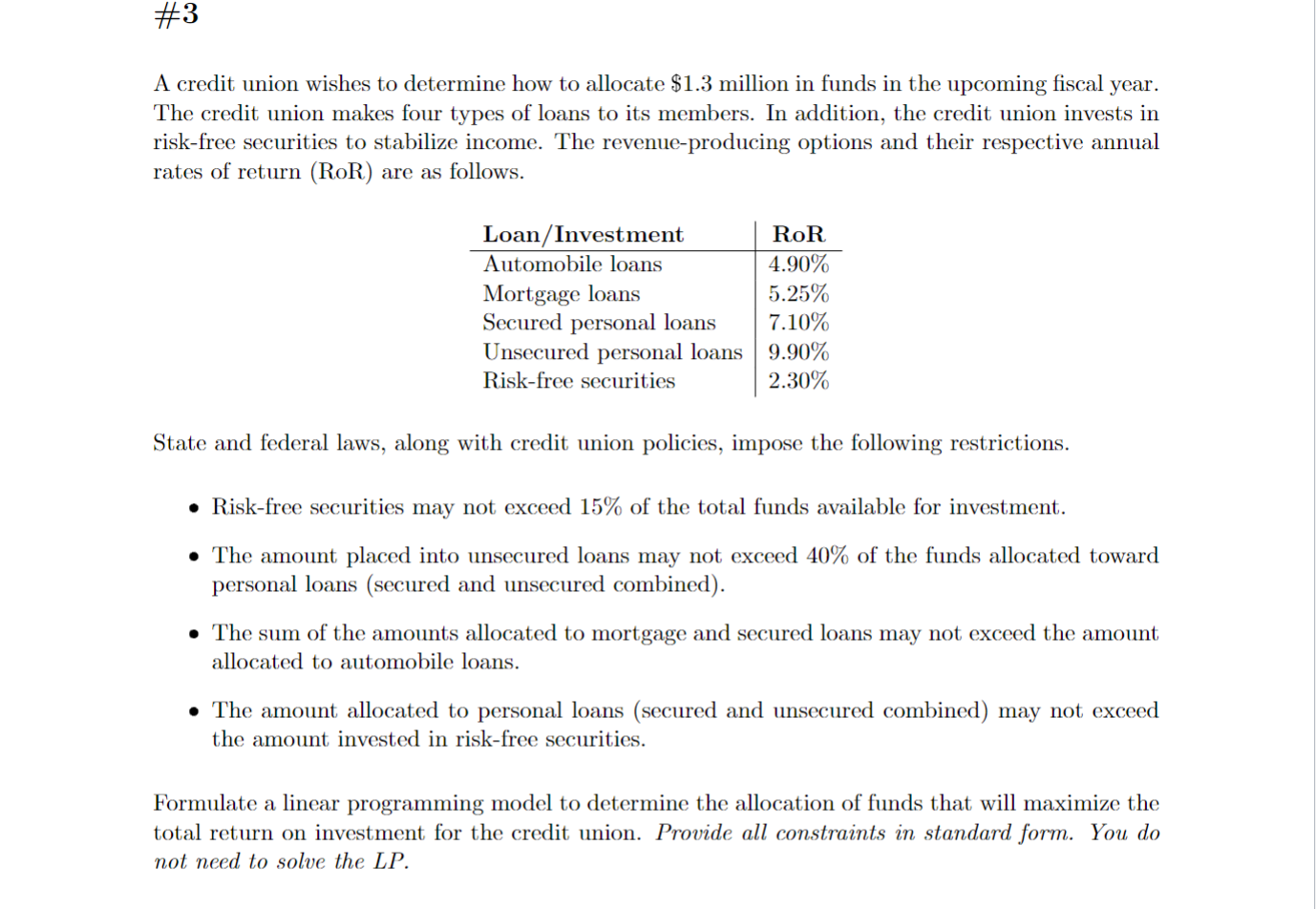

# 3 A credit union wishes to determine how to allocate $ 1 . 3 million in funds in the upcoming fiscal year. The credit

#

A credit union wishes to determine how to allocate $ million in funds in the upcoming fiscal year.

The credit union makes four types of loans to its members. In addition, the credit union invests in

riskfree securities to stabilize income. The revenueproducing options and their respective annual

rates of return RoR are as follows.

State and federal laws, along with credit union policies, impose the following restrictions.

Riskfree securities may not exceed of the total funds available for investment.

The amount placed into unsecured loans may not exceed of the funds allocated toward

personal loans secured and unsecured combined

The sum of the amounts allocated to mortgage and secured loans may not exceed the amount

allocated to automobile loans.

The amount allocated to personal loans secured and unsecured combined may not exceed

the amount invested in riskfree securities

Formulate a linear programming model to determine the allocation of funds that will maximize the

total return on investment for the credit union. Provide all constraints in standard form. You do

not need to solve the LP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started