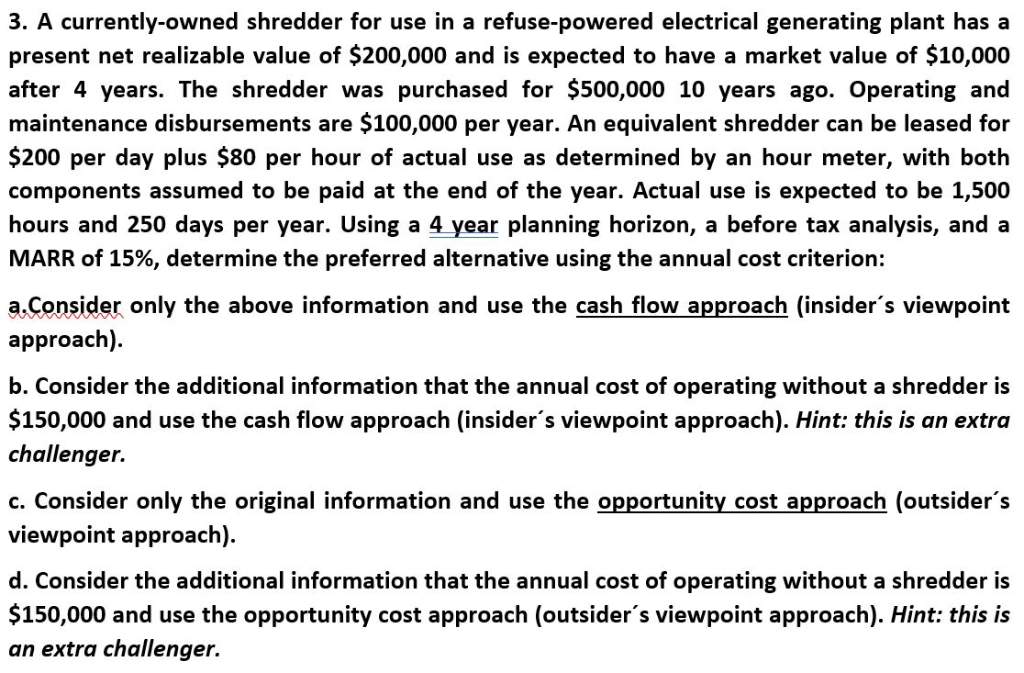

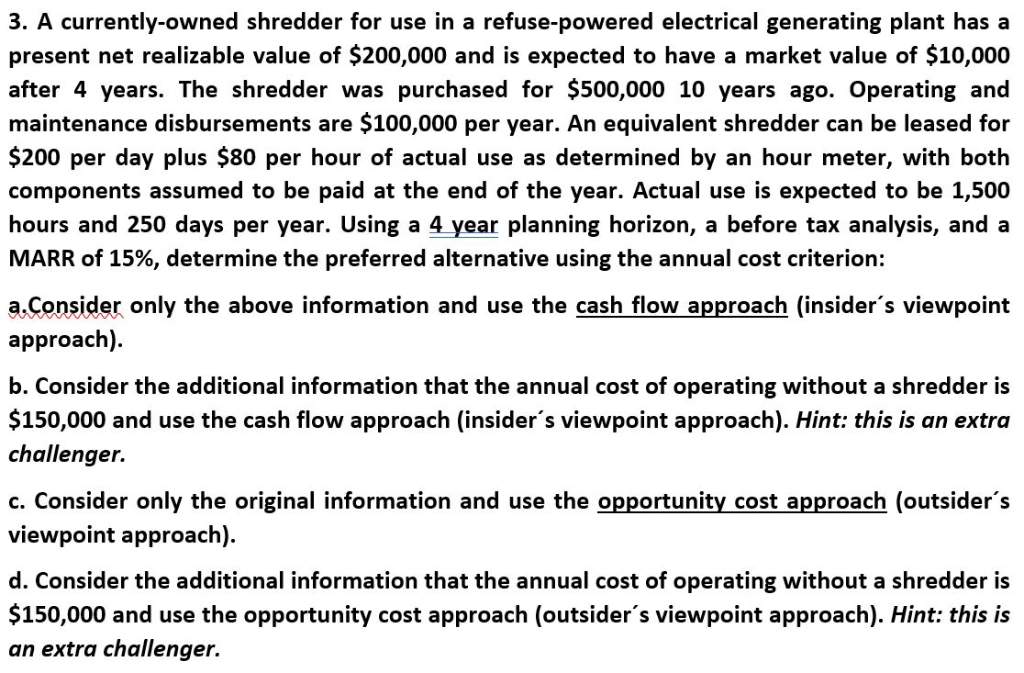

3. A currently-owned shredder for use in a refuse-powered electrical generating plant has a present net realizable value of $200,000 and is expected to have a market value of $10,000 after 4 years. The shredder was purchased for $500,000 10 years ago. Operating and maintenance disbursements are $100,000 per year. An equivalent shredder can be leased for $200 per day plus $80 per hour of actual use as determined by an hour meter, with both components assumed to be paid at the end of the year. Actual use is expected to be 1,500 hours and 250 days per year. Using a 4 year planning horizon, a before tax analysis, and a MARR of 15%, determine the preferred alternative using the annual cost criterion: a.Consider only the above information and use the cash flow approach (insider's viewpoint approach). b. Consider the additional information that the annual cost of operating without a shredder is $150,000 and use the cash flow approach (insider's viewpoint approach). Hint: this is an extra challenger. c. Consider only the original information and use the opportunity_cost approach (outsider's viewpoint approach). d. Consider the additional information that the annual cost of operating without a shredder is 150,000 and use the opportunity cost approach (outsider's viewpoint approach). Hint: this is an extra challenger. 3. A currently-owned shredder for use in a refuse-powered electrical generating plant has a present net realizable value of $200,000 and is expected to have a market value of $10,000 after 4 years. The shredder was purchased for $500,000 10 years ago. Operating and maintenance disbursements are $100,000 per year. An equivalent shredder can be leased for $200 per day plus $80 per hour of actual use as determined by an hour meter, with both components assumed to be paid at the end of the year. Actual use is expected to be 1,500 hours and 250 days per year. Using a 4 year planning horizon, a before tax analysis, and a MARR of 15%, determine the preferred alternative using the annual cost criterion: a.Consider only the above information and use the cash flow approach (insider's viewpoint approach). b. Consider the additional information that the annual cost of operating without a shredder is $150,000 and use the cash flow approach (insider's viewpoint approach). Hint: this is an extra challenger. c. Consider only the original information and use the opportunity_cost approach (outsider's viewpoint approach). d. Consider the additional information that the annual cost of operating without a shredder is 150,000 and use the opportunity cost approach (outsider's viewpoint approach). Hint: this is an extra challenger