Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. A financial institution entered into an interest rate swap with company X. Under the term of the swap, it receives 6% fixed rate and

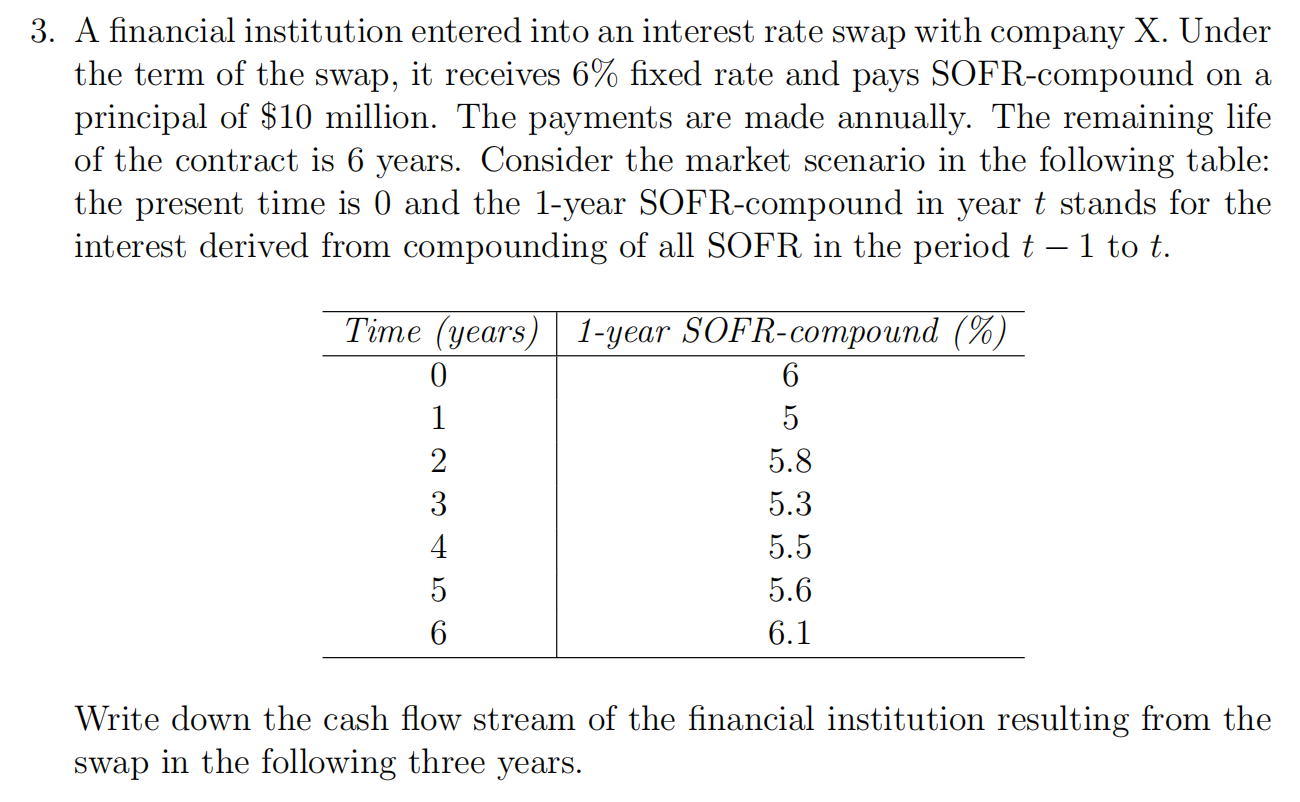

3. A financial institution entered into an interest rate swap with company X. Under the term of the swap, it receives 6% fixed rate and pays SOFR-compound on a principal of $10 million. The payments are made annually. The remaining life of the contract is 6 years. Consider the market scenario in the following table: the present time is 0 and the 1-year SOFR-compound in year t stands for the interest derived from compounding of all SOFR in the period t1 to t. Write down the cash flow stream of the financial institution resulting from the swap in the following three years

3. A financial institution entered into an interest rate swap with company X. Under the term of the swap, it receives 6% fixed rate and pays SOFR-compound on a principal of $10 million. The payments are made annually. The remaining life of the contract is 6 years. Consider the market scenario in the following table: the present time is 0 and the 1-year SOFR-compound in year t stands for the interest derived from compounding of all SOFR in the period t1 to t. Write down the cash flow stream of the financial institution resulting from the swap in the following three years Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started