Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. A firm is doing energy saving works. This firm wants to make an economic feasibility assessment of an investment that will save energy by

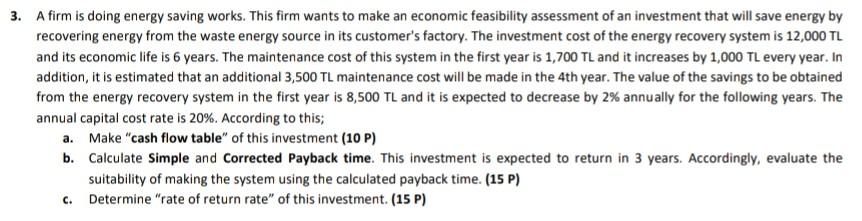

3. A firm is doing energy saving works. This firm wants to make an economic feasibility assessment of an investment that will save energy by recovering energy from the waste energy source in its customer's factory. The investment cost of the energy recovery system is 12,000 TL and its economic life is 6 years. The maintenance cost of this system in the first year is 1,700 TL and it increases by 1,000 TL every year. In addition, it is estimated that an additional 3,500 TL maintenance cost will be made in the 4th year. The value of the savings to be obtained from the energy recovery system in the first year is 8,500 TL and it is expected to decrease by 2% annually for the following years. The annual capital cost rate is 20%. According to this; a. Make "cash flow table" of this investment (10 P) b. Calculate Simple and corrected Payback time. This investment is expected to return in 3 years. Accordingly, evaluate the suitability of making the system using the calculated payback time. (15 p) c. Determine "rate of return rate" of this investment. (15 p)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started