Answered step by step

Verified Expert Solution

Question

1 Approved Answer

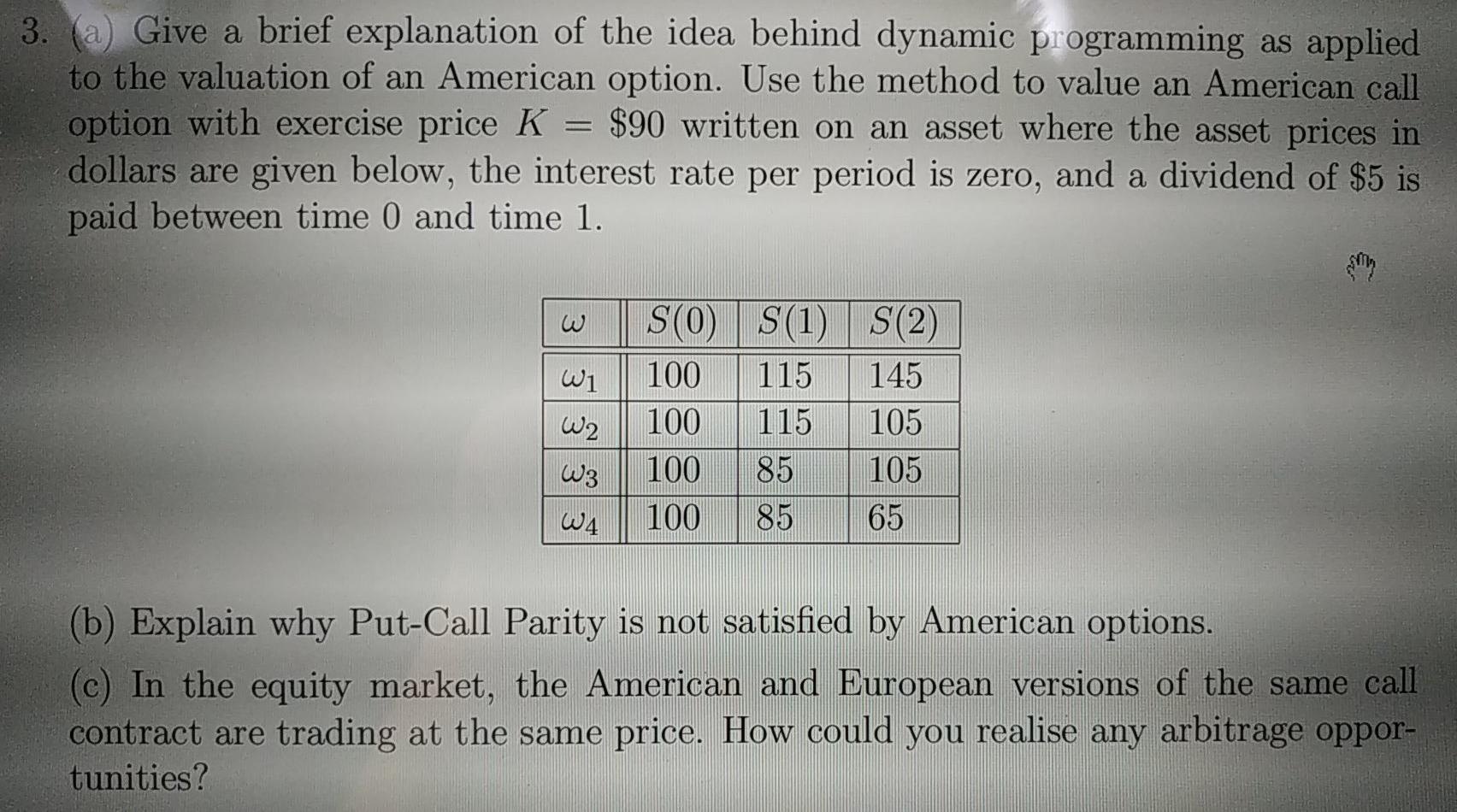

3. (a) Give a brief explanation of the idea behind dynamic programming as applied to the valuation of an American option. Use the method to

3. (a) Give a brief explanation of the idea behind dynamic programming as applied to the valuation of an American option. Use the method to value an American call option with exercise price K = $90 written on an asset where the asset prices in dollars are given below, the interest rate per period is zero, and a dividend of $5 is paid between time 0 and time 1. w W1 W2 S(0) S(1) S(2) 100 115 145 100 115 105 100 85 105 100 85 65 W3 W4 (b) Explain why Put-Call Parity is not satisfied by American options. (c) In the equity market, the American and European versions of the same call contract are trading at the same price. How could you realise any arbitrage oppor- tunities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started