Answered step by step

Verified Expert Solution

Question

1 Approved Answer

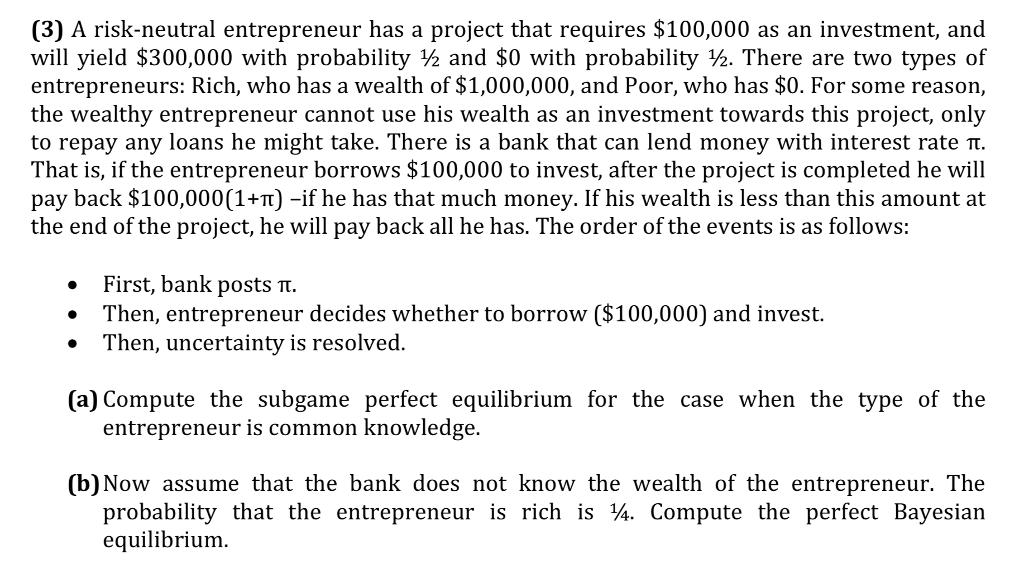

(3) A risk-neutral entrepreneur has a project that requires $100,000 as an investment, and will yield $300,000 with probability and $0 with probability 2.

(3) A risk-neutral entrepreneur has a project that requires $100,000 as an investment, and will yield $300,000 with probability and $0 with probability 2. There are two types of entrepreneurs: Rich, who has a wealth of $1,000,000, and Poor, who has $0. For some reason, the wealthy entrepreneur cannot use his wealth as an investment towards this project, only to repay any loans he might take. There is a bank that can lend money with interest rate . That is, if the entrepreneur borrows $100,000 to invest, after the project is completed he will pay back $100,000(1+) -if he has that much money. If his wealth is less than this amount at the end of the project, he will pay back all he has. The order of the events is as follows: . First, bank posts . Then, entrepreneur decides whether to borrow ($100,000) and invest. Then, uncertainty is resolved. (a) Compute the subgame perfect equilibrium for the case when the type of the entrepreneur is common knowledge. (b) Now assume that the bank does not know the wealth of the entrepreneur. The probability that the entrepreneur is rich is 14. Compute the perfect Bayesian equilibrium.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started