Answered step by step

Verified Expert Solution

Question

1 Approved Answer

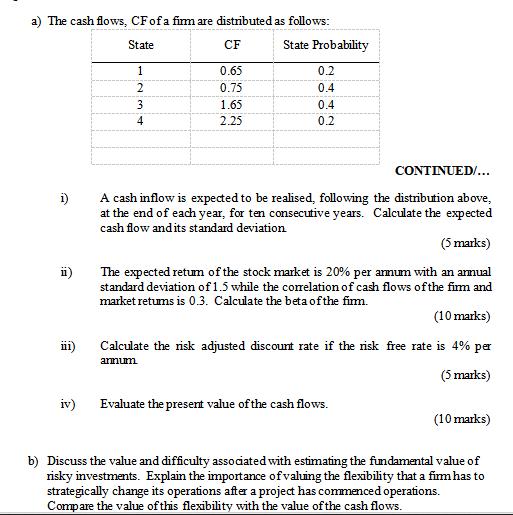

a) The cash flows, CF of a firm are distributed as follows: i) State CF State Probability 1 0.65 0.2 2 0.75 0.4 3

a) The cash flows, CF of a firm are distributed as follows: i) State CF State Probability 1 0.65 0.2 2 0.75 0.4 3 1.65 0.4 4 2.25 0.2 CONTINUED/... A cash inflow is expected to be realised, following the distribution above, at the end of each year, for ten consecutive years. Calculate the expected cash flow and its standard deviation (5 marks) The expected return of the stock market is 20% per annum with an annual standard deviation of 1.5 while the correlation of cash flows of the firm and market retums is 0.3. Calculate the beta of the firm. (10 marks) Calculate the risk adjusted discount rate if the risk free rate is 4% per 111) annum iv) Evaluate the present value of the cash flows. (5 marks) (10 marks) b) Discuss the value and difficulty associated with estimating the fundamental value of risky investments. Explain the importance of valuing the flexibility that a firm has to strategically change its operations after a project has commenced operations. Compare the value of this flexibility with the value of the cash flows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started