Answered step by step

Verified Expert Solution

Question

1 Approved Answer

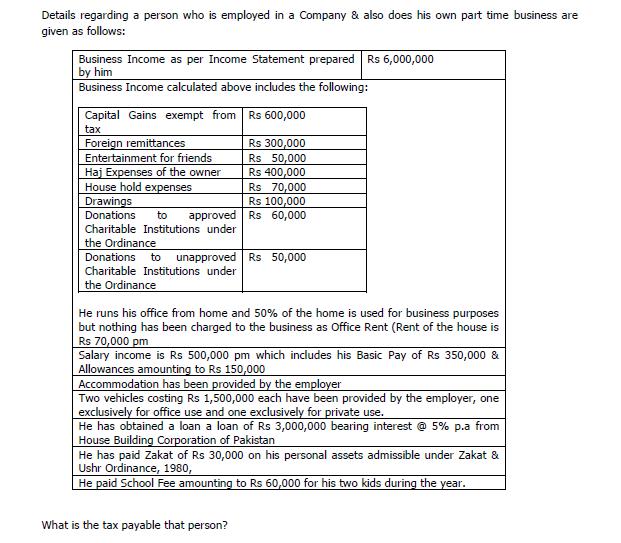

Details regarding a person who is employed in a Company & also does his own part time business are given as follows: Business Income

Details regarding a person who is employed in a Company & also does his own part time business are given as follows: Business Income as per Income Statement prepared Rs 6,000,000 by him Business Income calculated above includes the following: Capital Gains exempt from Rs 600,000 tax Foreign remittances Entertainment for friends Haj Expenses of the owner House hold expenses Drawings Donations to approved Charitable Institutions under the Ordinance Donations Charitable Institutions under the Ordinance Rs 300,000 Rs 50,000 400,000 Rs Rs 70,000 Rs 100,000 Rs 60,000 to unapproved Rs 50,000 He runs his office from home and 50% of the home is used for business purposes but nothing has been charged to the business as Office Rent (Rent of the house is Rs 70,000 pm Salary income is Rs 500,000 pm which includes his Basic Pay of Rs 350,000 & Allowances amounting to Rs 150,000 Accommodation has been provided by the employer Two vehicles costing Rs 1,500,000 each have been provided by the employer, one exclusively for office use and one exclusively for private use. He has obtained a loan a loan of Rs 3,000,000 bearing interest @ 5% p.a from House Building Corporation of Pakistan He has paid Zakat of Rs 30,000 on his personal assets admissible under Zakat & Ushr Ordinance, 1980, He paid School Fee amounting to Rs 60,000 for his two kids during the year. What is the tax payable that person?

Step by Step Solution

★★★★★

3.68 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

PARTICULARS Rs SALARY INCOME Basic pay 35000000 Allowance pay 15000000 ADD accom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started