Question

Additional information 1. The depreciation charge in the year was 12,000 for buildings and 68,000 for plant and equipment. 2. Within Plant and Equipment there

Additional information

1. The depreciation charge in the year was £12,000 for buildings and £68,000 for plant and equipment.

2. Within Plant and Equipment there is a piece of machinery that at 1 January 2021 had a carrying amount of £40,000. Due to a change in technology its value in use has dropped to £22,000 and it could now be sold for £15,000 net of selling costs.

3. There was a disposal of a piece of machinery in the year which had a carrying amount of £5,000 and gave rise to a £4,000 profit on disposal.

4. Within trade and other receivables there is a balance that relates to interest receivable of £800 for year ended 2021 (£1,500 year ended 2020).

5. There were no acquisitions or disposals of intangibles in the year.

6. There was an ordinary share issue in the year.

7. New information became available regarding ongoing litigation based on which Brimstage’s legal provision was revised.

8. Brimstage paid an ordinary dividend in December 2021.

Requirements

Prepare a statement of cash flows for Brimstage in accordance with IAS 7 Statement of cash flows for the year ended 31 December 2021. The indirect method should be used starting with profit before tax.

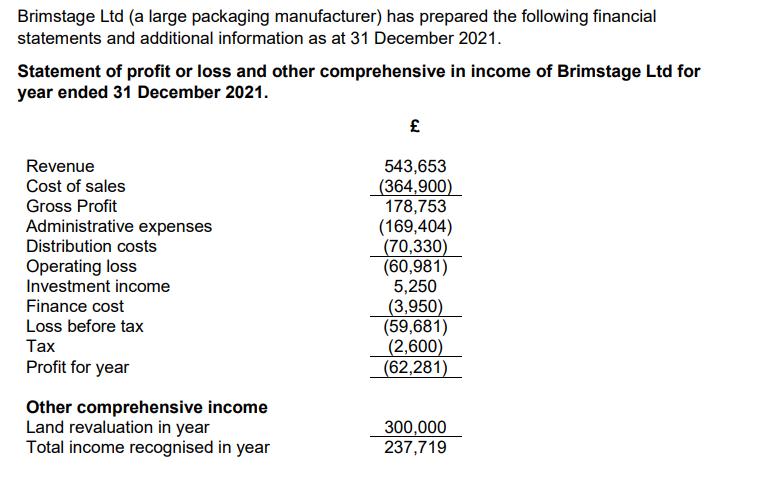

Brimstage Ltd (a large packaging manufacturer) has prepared the following financial statements and additional information as at 31 December 2021. Statement of profit or loss and other comprehensive in income of Brimstage Ltd for year ended 31 December 2021. Revenue Cost of sales Gross Profit Administrative expenses Distribution costs Operating loss Investment income Finance cost Loss before tax Tax Profit for year Other comprehensive income Land revaluation in year Total income recognised in year 543,653 (364,900) 178,753 (169,404) (70,330) (60,981) 5,250 (3,950) (59,681) (2,600) (62,281) 300,000 237,719

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Statement of Cash Flow Brimstage Ltd Statement of Cash Flow For the Yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started