Answered step by step

Verified Expert Solution

Question

1 Approved Answer

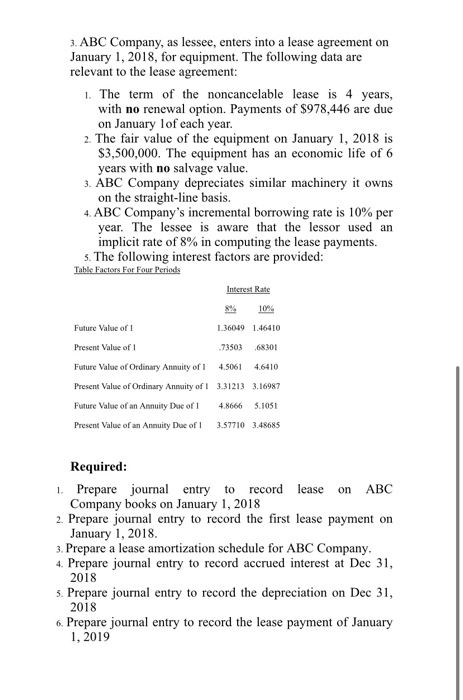

3. ABC Company, as lessee, enters into a lease agreement on January 1, 2018, for equipment. The following data are relevant to the lease agreement:

3. ABC Company, as lessee, enters into a lease agreement on January 1, 2018, for equipment. The following data are relevant to the lease agreement:

1. The term of the noncancelable lease is 4 years, with no renewal option. Payments of $978,446 are due on January 1of each year.

2. The fair value of the equipment on January 1, 2018 is $3,500,000. The equipment has an economic life of 6 years with no salvage value.

3. ABC Company depreciates similar machinery it owns on the straight-line basis.

4. ABC Companys incremental borrowing rate is 10% per year. The lessee is aware that the lessor used an implicit rate of 8% in computing the lease payments.

5. The following interest factors are provided:

Table Factors For Four Periods

Interest Rate

8%

10%

Future Value of 1

1.36049

1.46410

Present Value of 1

.73503

.68301

Future Value of Ordinary Annuity of 1

4.5061

4.6410

Present Value of Ordinary Annuity of 1

3.31213

3.16987

Future Value of an Annuity Due of 1

4.8666

5.1051

Present Value of an Annuity Due of 1

3.57710

3.48685

Required:

1. Prepare journal entry to record lease on ABC Company books on January 1, 2018

2. Prepare journal entry to record the first lease payment on January 1, 2018.

3. Prepare a lease amortization schedule for ABC Company.

4. Prepare journal entry to record accrued interest at Dec 31, 2018

5. Prepare journal entry to record the depreciation on Dec 31, 2018

6. Prepare journal entry to record the lease payment of January 1, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started