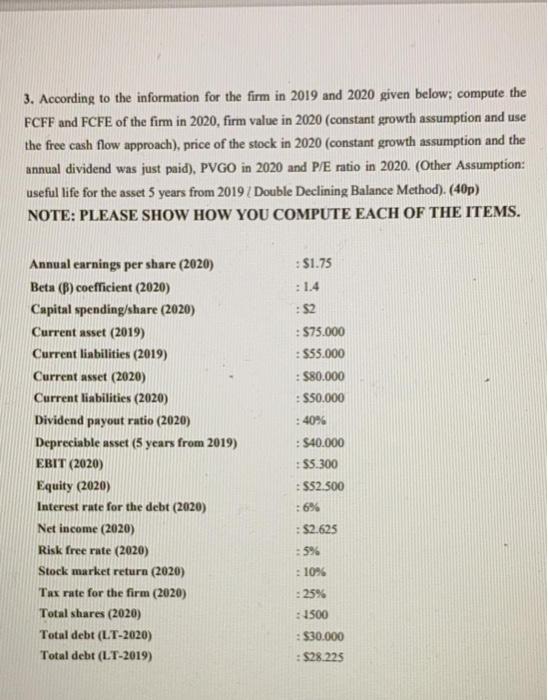

3. According to the information for the firm in 2019 and 2020 given below; compute the FCFF and FCFE of the firm in 2020, firm value in 2020 (constant growth assumption and use the free cash flow approach), price of the stock in 2020 (constant growth assumption and the annual dividend was just paid), PVGO in 2020 and P/E ratio in 2020. (Other Assumption: useful life for the asset 5 years from 2019 Double Declining Balance Method). (40p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. : $1.75 : 1.4 Annual earnings per share (2020) Beta (B) coefficient (2020) Capital spending/share (2020) Current asset (2019) Current liabilities (2019) Current asset (2020) Current liabilities (2020) Dividend payout ratio (2020) Depreciable asset (5 years from 2019) EBIT (2020) Equity (2020) Interest rate for the debt (2020) Net Income (2020) Risk free rate (2020) Stock market return (2020) Tax rate for the firm (2020) Total shares (2020) Total debt (LT-2020) Total debt (LT-2019) : $2 : $75.000 : $55.000 : $80.000 550.000 : 40% : S40.000 :55.300 S$2.500 : 6% : $2.625 - 5% 10% = 25% : 1500 : $30.000 $28.223 3. According to the information for the firm in 2019 and 2020 given below; compute the FCFF and FCFE of the firm in 2020, firm value in 2020 (constant growth assumption and use the free cash flow approach), price of the stock in 2020 (constant growth assumption and the annual dividend was just paid), PVGO in 2020 and P/E ratio in 2020. (Other Assumption: useful life for the asset 5 years from 2019 Double Declining Balance Method). (40p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. : $1.75 : 1.4 Annual earnings per share (2020) Beta (B) coefficient (2020) Capital spending/share (2020) Current asset (2019) Current liabilities (2019) Current asset (2020) Current liabilities (2020) Dividend payout ratio (2020) Depreciable asset (5 years from 2019) EBIT (2020) Equity (2020) Interest rate for the debt (2020) Net Income (2020) Risk free rate (2020) Stock market return (2020) Tax rate for the firm (2020) Total shares (2020) Total debt (LT-2020) Total debt (LT-2019) : $2 : $75.000 : $55.000 : $80.000 550.000 : 40% : S40.000 :55.300 S$2.500 : 6% : $2.625 - 5% 10% = 25% : 1500 : $30.000 $28.223