Answered step by step

Verified Expert Solution

Question

1 Approved Answer

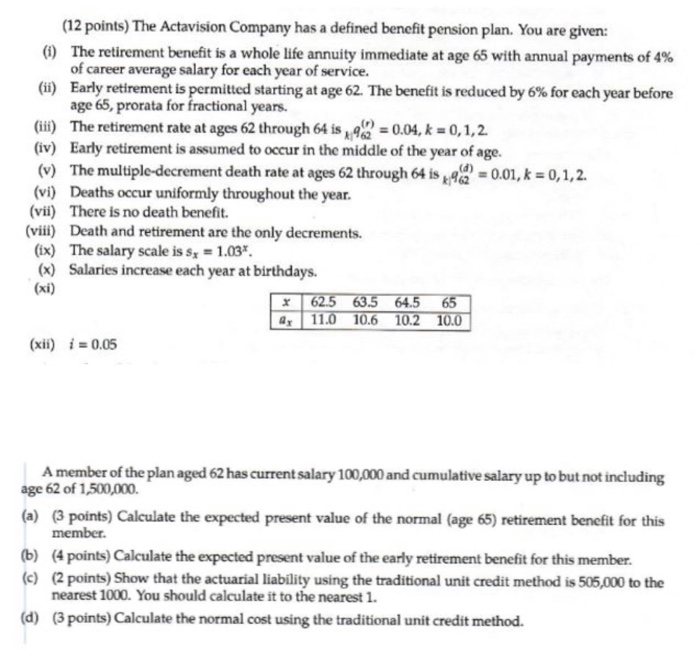

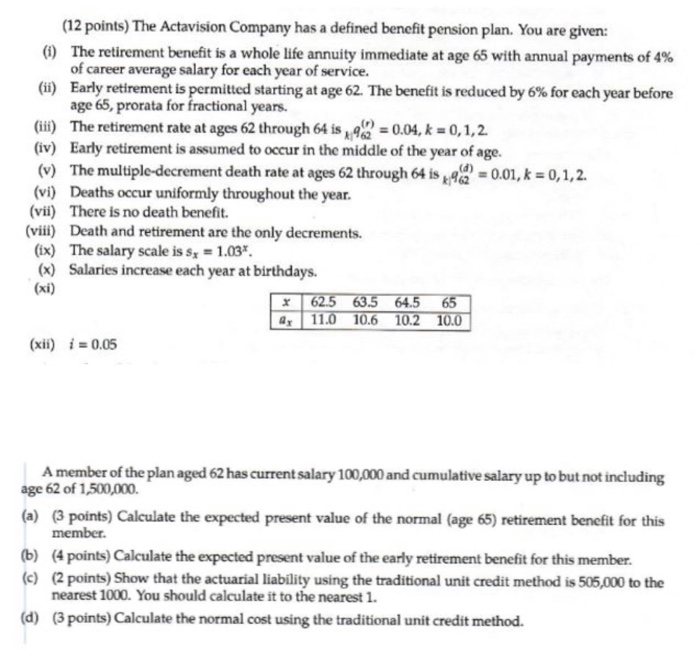

3. ACTUARIAL LTAM QUESTION (12 points) The Actavision Company has a defined benefit pension plan. You are given: (1) The retirement benefit is a whole

3. ACTUARIAL LTAM QUESTION

(12 points) The Actavision Company has a defined benefit pension plan. You are given: (1) The retirement benefit is a whole life annuity immediate at age 65 with annual payments of 4% of career average salary for each year of service. (ii) Early retirement is permitted starting at age 62. The benefit is reduced by 6% for each year before age 65, prorata for fractional years. (iii) The retirement rate at ages 62 through 64 is 92 = 0.04, k = 0,1,2. (iv) Early retirement is assumed to occur in the middle of the year of age. (v) The multiple-decrement death rate at ages 62 through 64 is kq = 0.01, k = 0,1,2. (vi) Deaths occur uniformly throughout the year. (vii) There is no death benefit. (viii) Death and retirement are the only decrements. (ix) The salary scale is sx = 1.03* (x) Salaries increase each year at birthdays. (xi) x 62.5 63.5 64.5 65 Qy 11.0 10.6 10.2 10.0 (xii) i = 0.05 A member of the plan aged 62 has current salary 100,000 and cumulative salary up to but not including age 62 of 1,500,000 (a) (3 points) Calculate the expected present value of the normal (age 65) retirement benefit for this member. (b) (4 points) Calculate the expected present value of the early retirement benefit for this member. (c) (2 points) Show that the actuarial liability using the traditional unit credit method is 505,000 to the nearest 1000. You should calculate it to the nearest 1. (d) (3 points) Calculate the normal cost using the traditional unit credit method. (12 points) The Actavision Company has a defined benefit pension plan. You are given: (1) The retirement benefit is a whole life annuity immediate at age 65 with annual payments of 4% of career average salary for each year of service. (ii) Early retirement is permitted starting at age 62. The benefit is reduced by 6% for each year before age 65, prorata for fractional years. (iii) The retirement rate at ages 62 through 64 is 92 = 0.04, k = 0,1,2. (iv) Early retirement is assumed to occur in the middle of the year of age. (v) The multiple-decrement death rate at ages 62 through 64 is kq = 0.01, k = 0,1,2. (vi) Deaths occur uniformly throughout the year. (vii) There is no death benefit. (viii) Death and retirement are the only decrements. (ix) The salary scale is sx = 1.03* (x) Salaries increase each year at birthdays. (xi) x 62.5 63.5 64.5 65 Qy 11.0 10.6 10.2 10.0 (xii) i = 0.05 A member of the plan aged 62 has current salary 100,000 and cumulative salary up to but not including age 62 of 1,500,000 (a) (3 points) Calculate the expected present value of the normal (age 65) retirement benefit for this member. (b) (4 points) Calculate the expected present value of the early retirement benefit for this member. (c) (2 points) Show that the actuarial liability using the traditional unit credit method is 505,000 to the nearest 1000. You should calculate it to the nearest 1. (d) (3 points) Calculate the normal cost using the traditional unit credit method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started