Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. ACTUARIAL LTAM QUESTION 3. For a defined benefit pension plan you are given: (i) Accrual rate is 1.6%. The pension benefit is a monthly

3. ACTUARIAL LTAM QUESTION

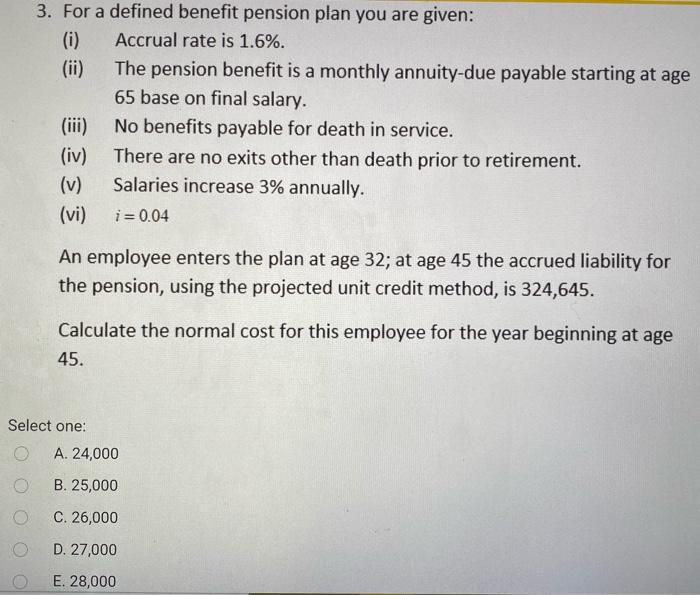

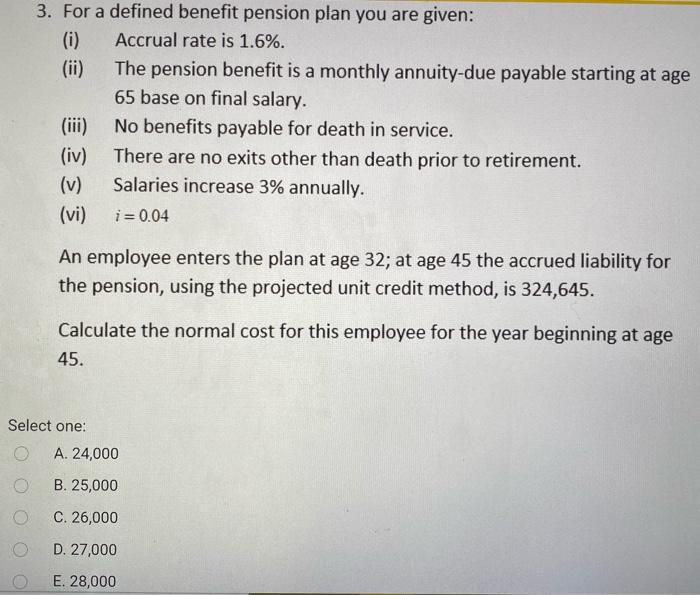

3. For a defined benefit pension plan you are given: (i) Accrual rate is 1.6%. The pension benefit is a monthly annuity-due payable starting at age 65 base on final salary. (iii) No benefits payable for death in service. (iv) There are no exits other than death prior to retirement. Salaries increase 3% annually. (vi) i= 0.04 An employee enters the plan at age 32; at age 45 the accrued liability for the pension, using the projected unit credit method, is 324,645. Calculate the normal cost for this employee for the year beginning at age 45. Select one: O A. 24,000 o B. 25,000 C. 26,000 o D. 27,000 E. 28,000 3. For a defined benefit pension plan you are given: (i) Accrual rate is 1.6%. The pension benefit is a monthly annuity-due payable starting at age 65 base on final salary. (iii) No benefits payable for death in service. (iv) There are no exits other than death prior to retirement. Salaries increase 3% annually. (vi) i= 0.04 An employee enters the plan at age 32; at age 45 the accrued liability for the pension, using the projected unit credit method, is 324,645. Calculate the normal cost for this employee for the year beginning at age 45. Select one: O A. 24,000 o B. 25,000 C. 26,000 o D. 27,000 E. 28,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started