Answered step by step

Verified Expert Solution

Question

1 Approved Answer

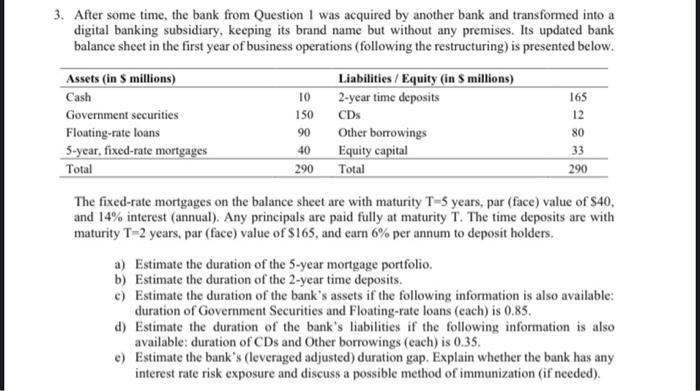

3. After some time, the bank from Question 1 was acquired by another bank and transformed into a digital banking subsidiary, keeping its brand

3. After some time, the bank from Question 1 was acquired by another bank and transformed into a digital banking subsidiary, keeping its brand name but without any premises. Its updated bank balance sheet in the first year of business operations (following the restructuring) is presented below. Assets (in 5 millions) Cash Government securities Floating-rate loans 5-year, fixed-rate mortgages Total 10 150 90 40 290 Liabilities/ Equity (in $ millions) 2-year time deposits CDs Other borrowings Equity capital Total 165 12 80 33 290 The fixed-rate mortgages on the balance sheet are with maturity T-5 years, par (face) value of $40, and 14% interest (annual). Any principals are paid fully at maturity T. The time deposits are with maturity T-2 years, par (face) value of $165, and earn 6% per annum to deposit holders. a) Estimate the duration of the 5-year mortgage portfolio. b) Estimate the duration of the 2-year time deposits. c) Estimate the duration of the bank's assets if the following information is also available: duration of Government Securities and Floating-rate loans (each) is 0.85. d) Estimate the duration of the bank's liabilities if the following information is also available: duration of CDs and Other borrowings (each) is 0.35. e) Estimate the bank's (leveraged adjusted) duration gap. Explain whether the bank has any interest rate risk exposure and discuss a possible method of immunization (if needed).

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a The duration of the 5year mortgage portfolio is 467 years Duration 1114 111421141 1114311411141 11...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started