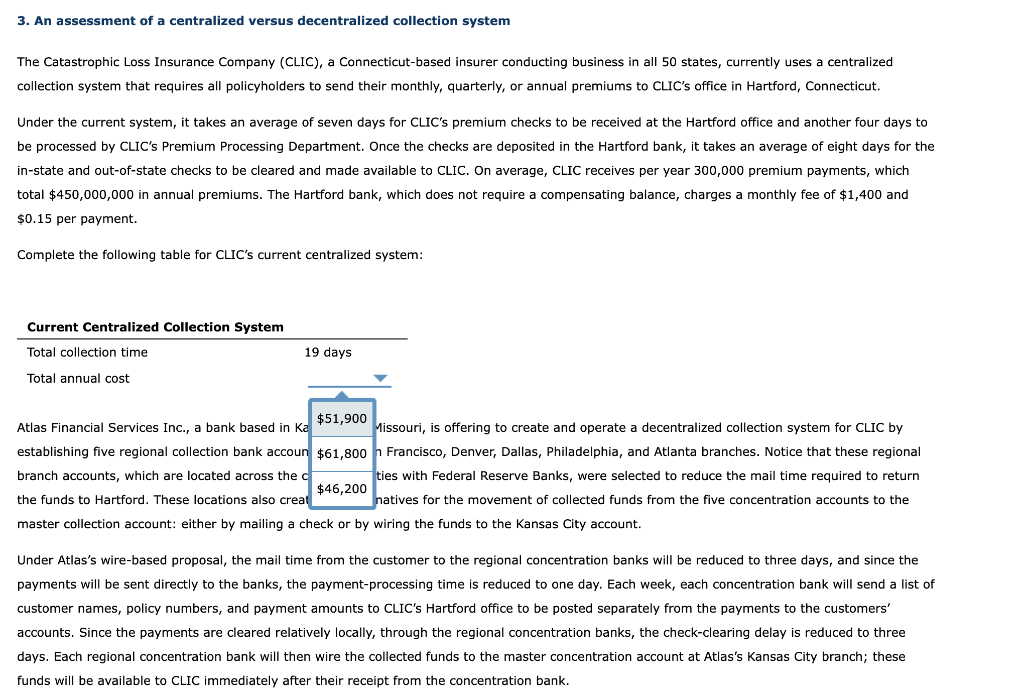

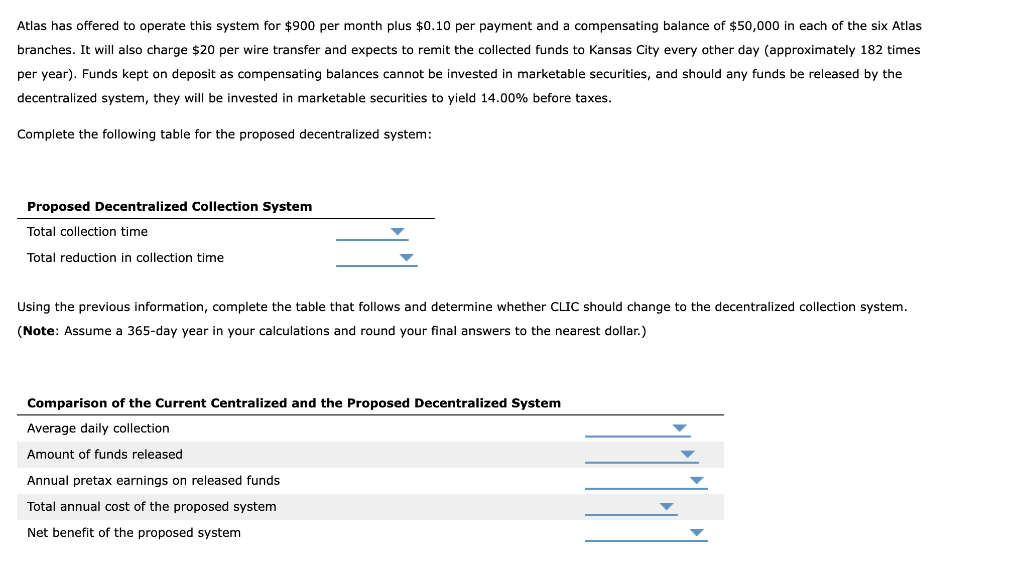

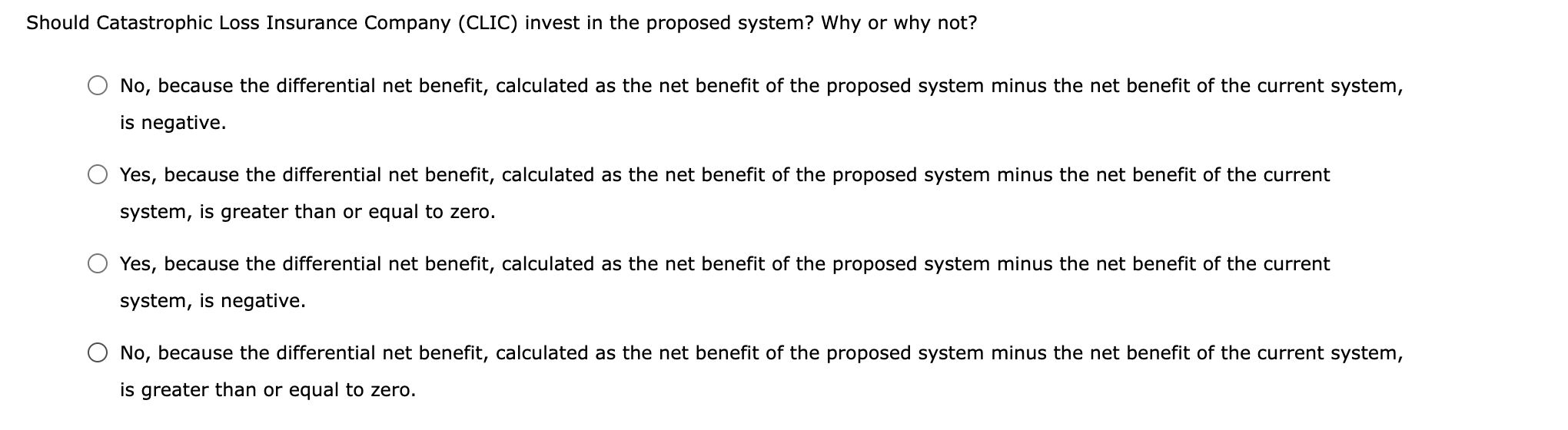

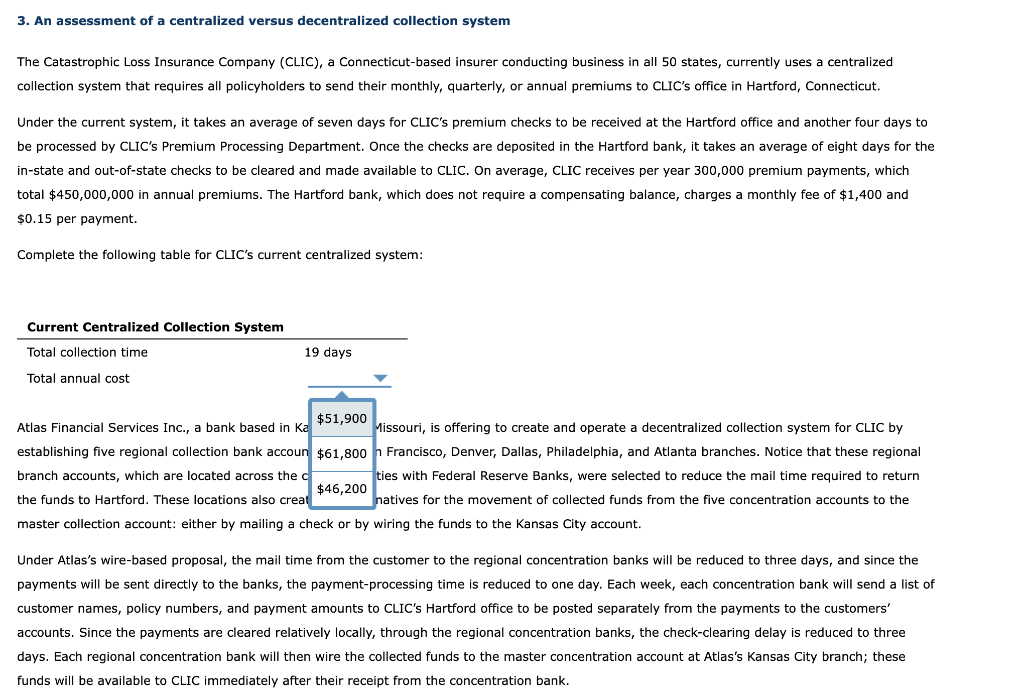

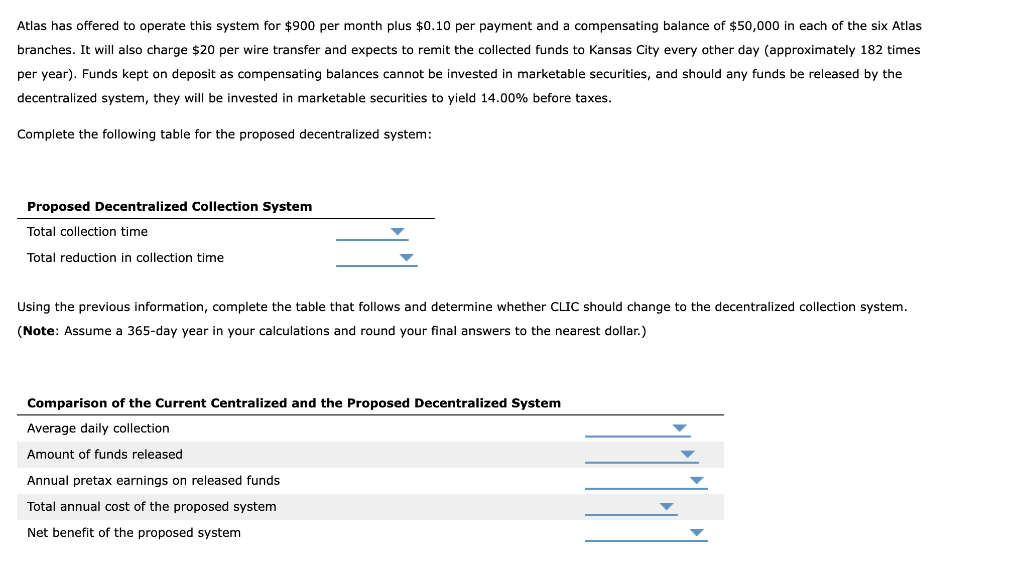

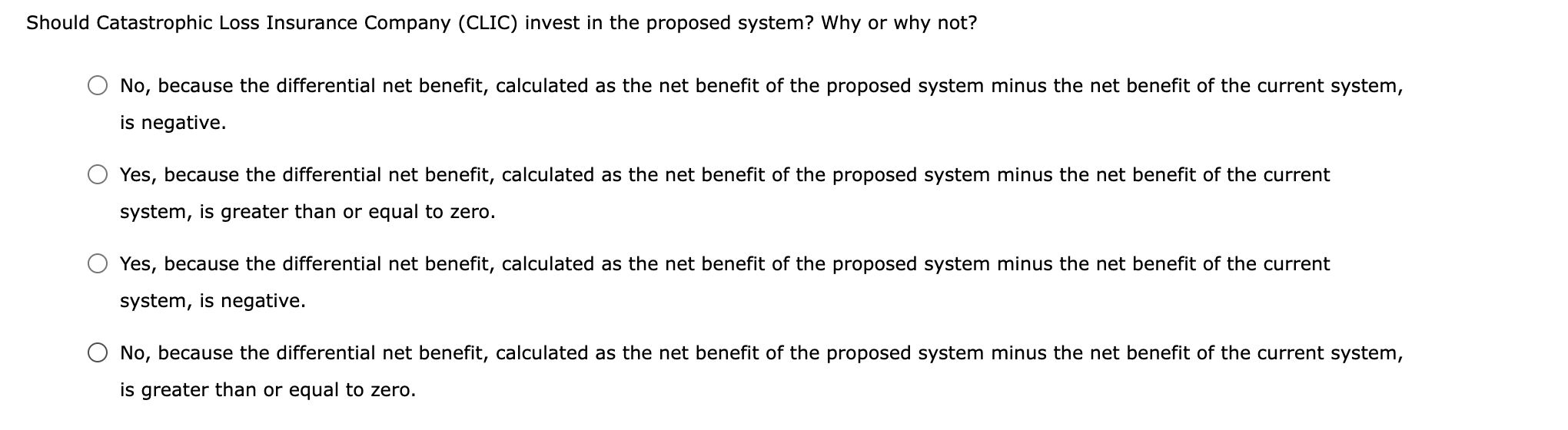

3. An assessment of a centralized versus decentralized collection system The Catastrophic Loss Insurance Company (CLIC), a Connecticut-based insurer conducting business in all 50 states, currently uses a centralized collection system that requires all policyholders to send their monthly, quarterly, or annual premiums to CLIC's office in Hartford, Connecticut. Under the current system, it takes an average of seven days for CLIC's premium checks to be received at the Hartford office and another four days to be processed by CLIC's Premium Processing Department. Once the checks are deposited in the Hartford bank, it takes an average of eight days for the in-state and out-of-state checks to be cleared and made available to CLIC. On average, CLIC receives per year 300,000 premium payments, which total $450,000,000 in annual premiums. The Hartford bank, which does not require a compensating balance, charges a monthly fee of $1,400 and $0.15 per payment. Complete the following table for CLIC's current centralized system: Current Centralized Collection System Total collection time 19 days Total annual cost $51,900 Atlas Financial Services Inc., a bank based in ka Missouri, is offering to create and operate a decentralized collection system for CLIC by establishing five regional collection bank accoun $61,800 h Francisco, Denver, Dallas, Philadelphia, and Atlanta branches. Notice that these regional branch accounts, which are located across the ci ties with Federal Reserve Banks, were selected to reduce the mail time required to return $46,200 the funds to Hartford. These locations also creat natives for the movement of collected funds from the five concentration accounts to the master collection account: either by mailing a check or by wiring the funds to the Kansas City account. Under Atlas's wire-based proposal, the mail time from the customer to the regional concentration banks will be reduced to three days, and since the payments will be sent directly to the banks, the payment-processing time is reduced to one day. Each week, each concentration bank will send a list of customer names, policy numbers, and payment amounts to CLIC's Hartford office to be posted separately from the payments to the customers' accounts. Since the payments are cleared relatively locally, through the regional concentration banks, the check-clearing delay is reduced to three days. Each regional concentration bank will then wire the collected funds to the master concentration account at Atlas's Kansas City branch; these funds will be available to CLIC immediately after their receipt from the concentration bank. Atlas has offered to operate this system for $900 per month plus $0.10 per payment and a compensating balance of $50,000 in each of the six Atlas branches. It will also charge $20 per wire transfer and expects to remit the collected funds to Kansas City every other day (approximately 182 times per year). Funds kept on deposit as compensating balances cannot be invested in marketable securities, and should any funds be released by the decentralized system, they will be invested in marketable securities to yield 14.00% before taxes. Complete the following table for the proposed decentralized system: Proposed Decentralized Collection System Total collection time Total reduction in collection time Using the previous information, complete the table that follows and determine whether CLIC should change to the decentralized collection system. (Note: Assume a 365-day year in your calculations and round your final answers to the nearest dollar.) Comparison of the Current Centralized and the Proposed Decentralized System Average daily collection Amount of funds released Annual pretax earnings on released funds Total annual cost of the proposed system Net benefit of the proposed system Should Catastrophic Loss Insurance Company (CLIC) invest in the proposed system? Why or why not? No, because the differential net benefit, calculated as the net benefit of the proposed system minus the net benefit of the current system, is negative. Yes, because the differential net benefit, calculated as the net benefit of the proposed system minus the net benefit of the current system, is greater than or equal to zero. Yes, because the differential net benefit, calculated as the net benefit of the proposed system minus the net benefit of the current system, is negative. No, because the differential net benefit, calculated as the net benefit of the proposed system minus the net benefit of the current system, is greater than or equal to zero. 3. An assessment of a centralized versus decentralized collection system The Catastrophic Loss Insurance Company (CLIC), a Connecticut-based insurer conducting business in all 50 states, currently uses a centralized collection system that requires all policyholders to send their monthly, quarterly, or annual premiums to CLIC's office in Hartford, Connecticut. Under the current system, it takes an average of seven days for CLIC's premium checks to be received at the Hartford office and another four days to be processed by CLIC's Premium Processing Department. Once the checks are deposited in the Hartford bank, it takes an average of eight days for the in-state and out-of-state checks to be cleared and made available to CLIC. On average, CLIC receives per year 300,000 premium payments, which total $450,000,000 in annual premiums. The Hartford bank, which does not require a compensating balance, charges a monthly fee of $1,400 and $0.15 per payment. Complete the following table for CLIC's current centralized system: Current Centralized Collection System Total collection time 19 days Total annual cost $51,900 Atlas Financial Services Inc., a bank based in ka Missouri, is offering to create and operate a decentralized collection system for CLIC by establishing five regional collection bank accoun $61,800 h Francisco, Denver, Dallas, Philadelphia, and Atlanta branches. Notice that these regional branch accounts, which are located across the ci ties with Federal Reserve Banks, were selected to reduce the mail time required to return $46,200 the funds to Hartford. These locations also creat natives for the movement of collected funds from the five concentration accounts to the master collection account: either by mailing a check or by wiring the funds to the Kansas City account. Under Atlas's wire-based proposal, the mail time from the customer to the regional concentration banks will be reduced to three days, and since the payments will be sent directly to the banks, the payment-processing time is reduced to one day. Each week, each concentration bank will send a list of customer names, policy numbers, and payment amounts to CLIC's Hartford office to be posted separately from the payments to the customers' accounts. Since the payments are cleared relatively locally, through the regional concentration banks, the check-clearing delay is reduced to three days. Each regional concentration bank will then wire the collected funds to the master concentration account at Atlas's Kansas City branch; these funds will be available to CLIC immediately after their receipt from the concentration bank. Atlas has offered to operate this system for $900 per month plus $0.10 per payment and a compensating balance of $50,000 in each of the six Atlas branches. It will also charge $20 per wire transfer and expects to remit the collected funds to Kansas City every other day (approximately 182 times per year). Funds kept on deposit as compensating balances cannot be invested in marketable securities, and should any funds be released by the decentralized system, they will be invested in marketable securities to yield 14.00% before taxes. Complete the following table for the proposed decentralized system: Proposed Decentralized Collection System Total collection time Total reduction in collection time Using the previous information, complete the table that follows and determine whether CLIC should change to the decentralized collection system. (Note: Assume a 365-day year in your calculations and round your final answers to the nearest dollar.) Comparison of the Current Centralized and the Proposed Decentralized System Average daily collection Amount of funds released Annual pretax earnings on released funds Total annual cost of the proposed system Net benefit of the proposed system Should Catastrophic Loss Insurance Company (CLIC) invest in the proposed system? Why or why not? No, because the differential net benefit, calculated as the net benefit of the proposed system minus the net benefit of the current system, is negative. Yes, because the differential net benefit, calculated as the net benefit of the proposed system minus the net benefit of the current system, is greater than or equal to zero. Yes, because the differential net benefit, calculated as the net benefit of the proposed system minus the net benefit of the current system, is negative. No, because the differential net benefit, calculated as the net benefit of the proposed system minus the net benefit of the current system, is greater than or equal to zero