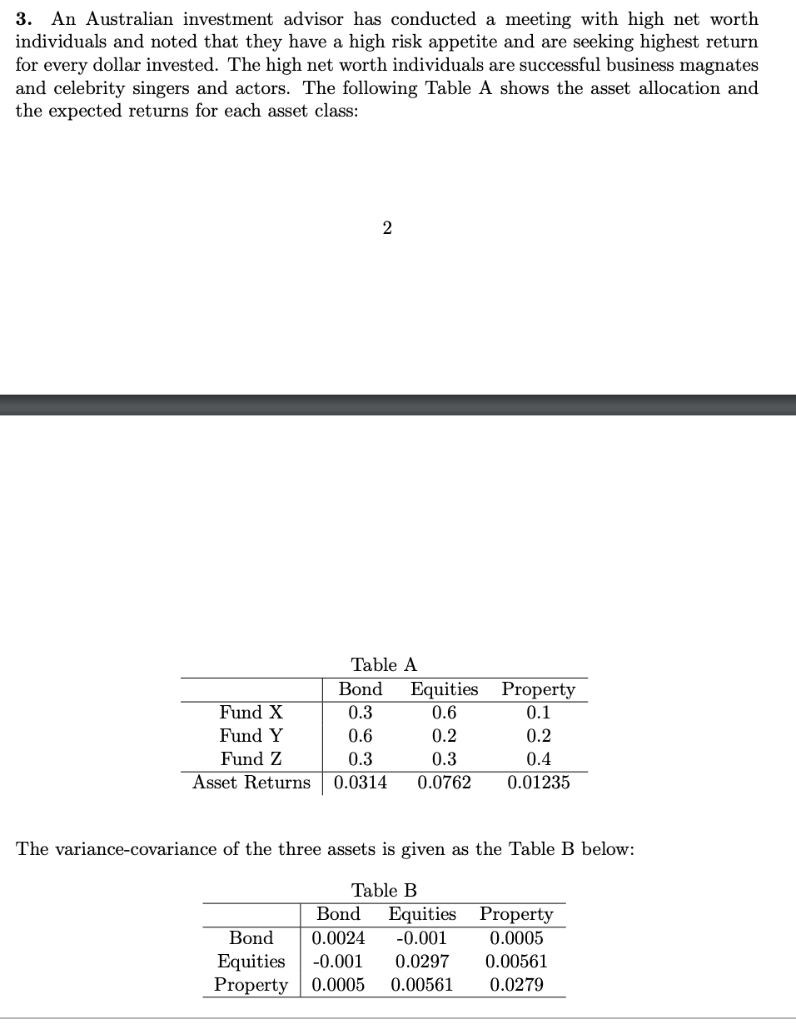

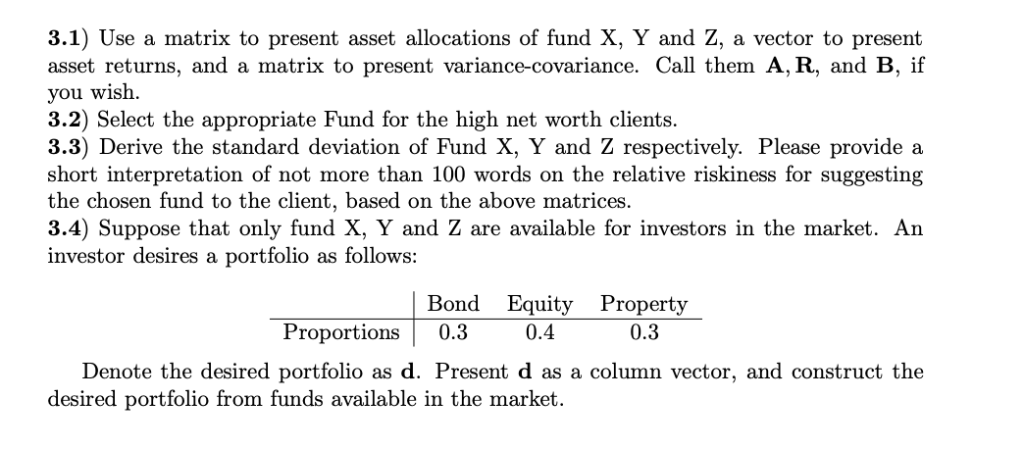

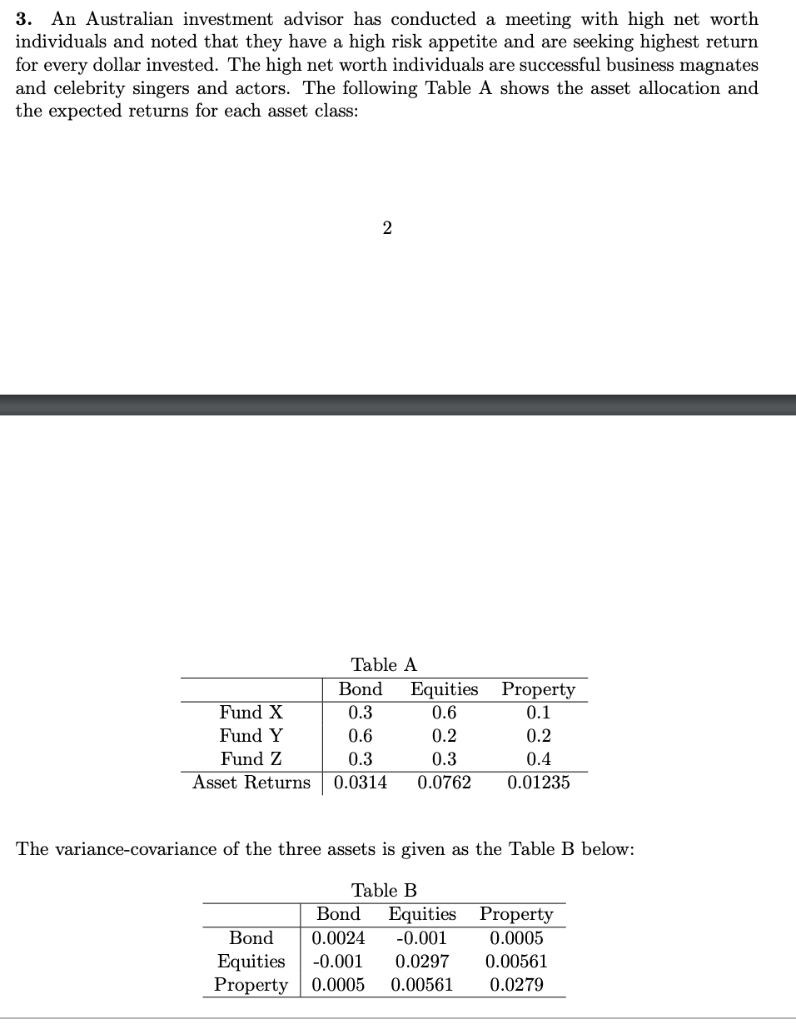

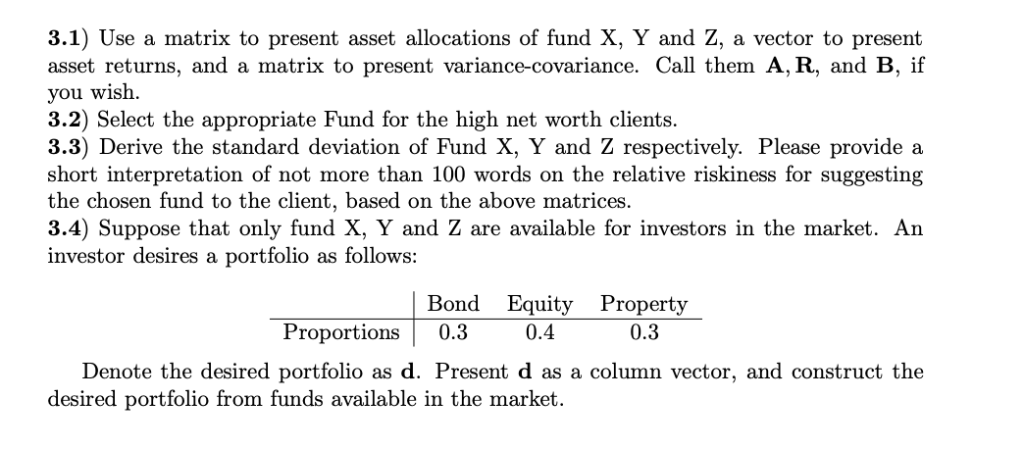

3. An Australian investment advisor has conducted a meeting with high net worth individuals and noted that they have a high risk appetite and are seeking highest return for every dollar invested. The high net worth individuals are successful business magnates and celebrity singers and actors. The following Table A shows the asset allocation and the expected returns for each asset class: 2 Table A Bond Equities Property Fund X 0.3 0.6 0.1 Fund Y 0.6 0.2 0.2 Fund Z 0.4 0.3 0.3 Asset Returns 0.0314 0.0762 0.01235 The variance-covariance of the three assets is given as the Table B below: Table B Bond Equities Property 0.0005 Bond 0.0024 -0.001 Equities Property -0.001 0.0297 0.00561 0.00561 0.0005 0.0279 3.1) Use a matrix to present asset allocations of fund X, Y and Z, asset returns, and a matrix to present variance-covariance. Call them A, R, and B, if a vector to present you wish 3.2) Select the appropriate Fund for the high net worth clients. 3.3) Derive the standard deviation of Fund X, Y and Z respectively. Please provide short interpretation of not more than 100 words on the relative riskiness for suggesting the chosen fund to the client, based on the above matrices. 3.4) Suppose that only fund X, Y and Z are available for investors in the market. An investor desires a portfolio as follows: a Bond Equity Property Proportions 0.3 0.4 0.3 Denote the desired portfolio as d. Present d as a column vector, and construct the desired portfolio from funds available in the market. 3. An Australian investment advisor has conducted a meeting with high net worth individuals and noted that they have a high risk appetite and are seeking highest return for every dollar invested. The high net worth individuals are successful business magnates and celebrity singers and actors. The following Table A shows the asset allocation and the expected returns for each asset class: 2 Table A Bond Equities Property Fund X 0.3 0.6 0.1 Fund Y 0.6 0.2 0.2 Fund Z 0.4 0.3 0.3 Asset Returns 0.0314 0.0762 0.01235 The variance-covariance of the three assets is given as the Table B below: Table B Bond Equities Property 0.0005 Bond 0.0024 -0.001 Equities Property -0.001 0.0297 0.00561 0.00561 0.0005 0.0279 3.1) Use a matrix to present asset allocations of fund X, Y and Z, asset returns, and a matrix to present variance-covariance. Call them A, R, and B, if a vector to present you wish 3.2) Select the appropriate Fund for the high net worth clients. 3.3) Derive the standard deviation of Fund X, Y and Z respectively. Please provide short interpretation of not more than 100 words on the relative riskiness for suggesting the chosen fund to the client, based on the above matrices. 3.4) Suppose that only fund X, Y and Z are available for investors in the market. An investor desires a portfolio as follows: a Bond Equity Property Proportions 0.3 0.4 0.3 Denote the desired portfolio as d. Present d as a column vector, and construct the desired portfolio from funds available in the market