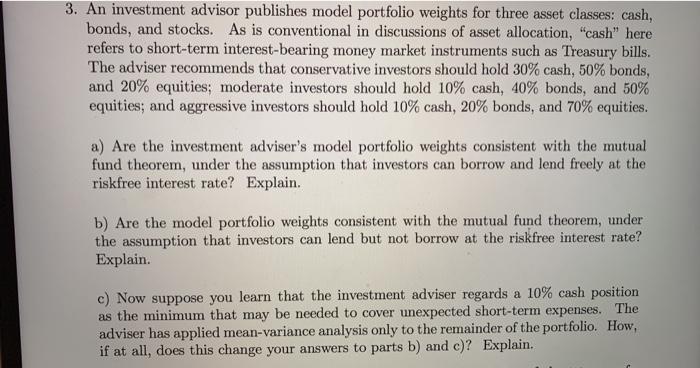

3. An investment advisor publishes model portfolio weights for three asset classes: cash, bonds, and stocks. As is conventional in discussions of asset allocation, "cash" here refers to short-term interest-bearing money market instruments such as Treasury bills. The adviser recommends that conservative investors should hold 30% cash, 50% bonds, and 20% equities: moderate investors should hold 10% cash, 40% bonds, and 50% equities, and aggressive investors should hold 10% cash, 20% bonds, and 70% equities. a) Are the investment adviser's model portfolio weights consistent with the mutual fund theorem, under the assumption that investors can borrow and lend freely at the riskfree interest rate? Explain. b) Are the model portfolio weights consistent with the mutual fund theorem, under the assumption that investors can lend but not borrow at the riskfree interest rate? Explain. c) Now suppose you learn that the investment adviser regards a 10% cash position as the minimum that may be needed to cover unexpected short-term expenses. The adviser has applied mean-variance analysis only to the remainder of the portfolio. How, if at all, does this change your answers to parts b) and c)? Explain. 3. An investment advisor publishes model portfolio weights for three asset classes: cash, bonds, and stocks. As is conventional in discussions of asset allocation, "cash" here refers to short-term interest-bearing money market instruments such as Treasury bills. The adviser recommends that conservative investors should hold 30% cash, 50% bonds, and 20% equities: moderate investors should hold 10% cash, 40% bonds, and 50% equities, and aggressive investors should hold 10% cash, 20% bonds, and 70% equities. a) Are the investment adviser's model portfolio weights consistent with the mutual fund theorem, under the assumption that investors can borrow and lend freely at the riskfree interest rate? Explain. b) Are the model portfolio weights consistent with the mutual fund theorem, under the assumption that investors can lend but not borrow at the riskfree interest rate? Explain. c) Now suppose you learn that the investment adviser regards a 10% cash position as the minimum that may be needed to cover unexpected short-term expenses. The adviser has applied mean-variance analysis only to the remainder of the portfolio. How, if at all, does this change your answers to parts b) and c)? Explain