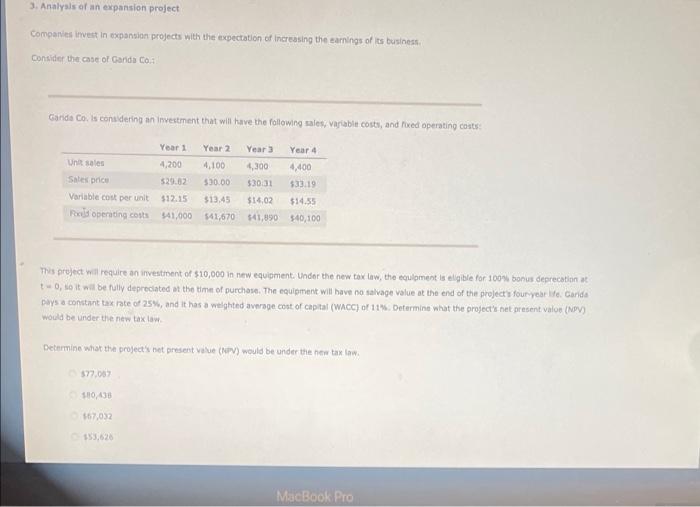

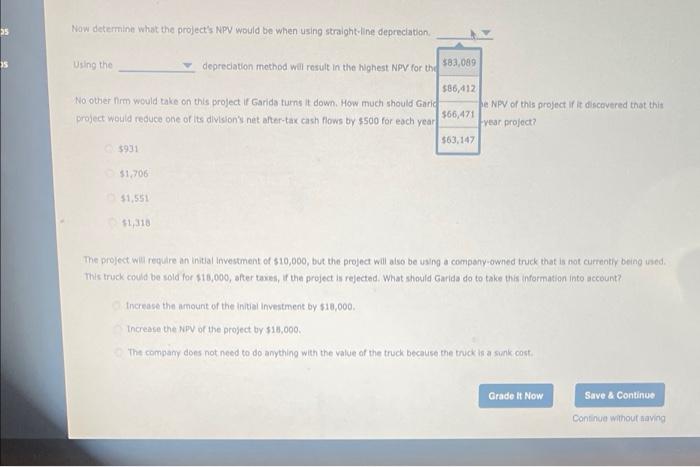

3. Analysis of an expansion project Companies invest in expansion projects with the expectation of increasing the earnings of its business. Consider the case of Garida Co.: Garida Co. is considering an investment that will have the following sales, variable costs, and fixed operating costs: Year 3 Unit sales Year 1 4,200 $29.82 Year 2 4,100 4,300 $30.00 Sales price $30.31 Variable cost per unit $12.15 $13,45 $14,02 Roxeld operating costs $41,000 $41,670 $41,890 This project will require an investment of $10,000 in new equipment. Under the new tax law, the equipment is eligible for 100% bonus deprecation at t-0, so it will be fully depreciated at the time of purchase. The equipment will have no salvage value at the end of the project's four-year life. Garida pays a constant tax rate of 25%, and it has a weighted average cost of capital (WACC) of 11%. Determine what the project's net present value (NPV) would be under the new tax law. Year 4 4,400 $33.19 $14.55 $40,100 Determine what the project's net present value (NPV) would be under the new tax law. $77,087 180,438 $67,032 $53,626 MacBook Pro Now determine what the project's NPV would be when using straight-line depreciation. Using the No other firm would take on this project if Garida turns it down. How much should Garid project would reduce one of its division's net after-tax cash flows by $500 for each year $931 depreciation method will result in the highest NPV for the $1,706 $1,551 $1,318 $83,089 $86,412 $66,471 $63,147 be NPV of this project if it discovered that this year project? The project will require an initial investment of $10,000, but the project will also be using a company-owned truck that is not currently being used. This truck could be sold for $18,000, after taxes, if the project is rejected. What should Garida do to take this information into account? Increase the amount of the initial Investment by $18,000. Increase the NPV of the project by $18,000. The company does not need to do anything with the value of the truck because the truck is a sunk cost. Grade It Now Save & Continue Continue without saving su dignich $931 $1,706 $1,551 $1,318 The project will require an initial investment of $10,000, but the project will also be using a company-owned truck that is not currently being used. This truck could be sold for $18,000, after taxes, if the project is rejected. What should Garida do to take this information into account? Increase the amount of the initial Investment by $18,000. Increase the NPV of the project by $18,000. The company does not need to do anything with the value of the truck because the truck is a sunk cost. Grade It Now Save & Continue Continue without saving