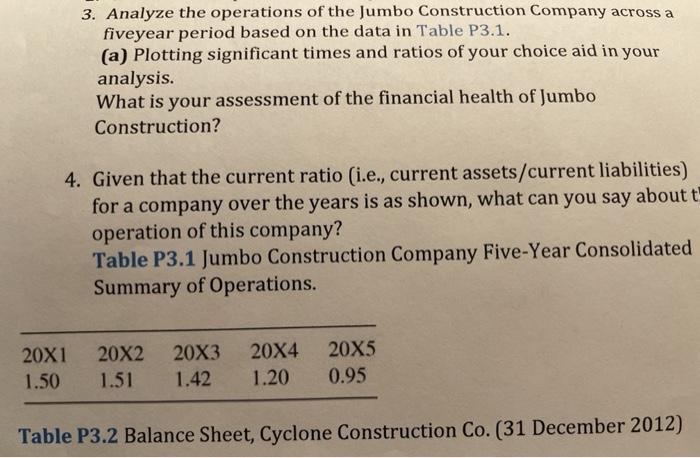

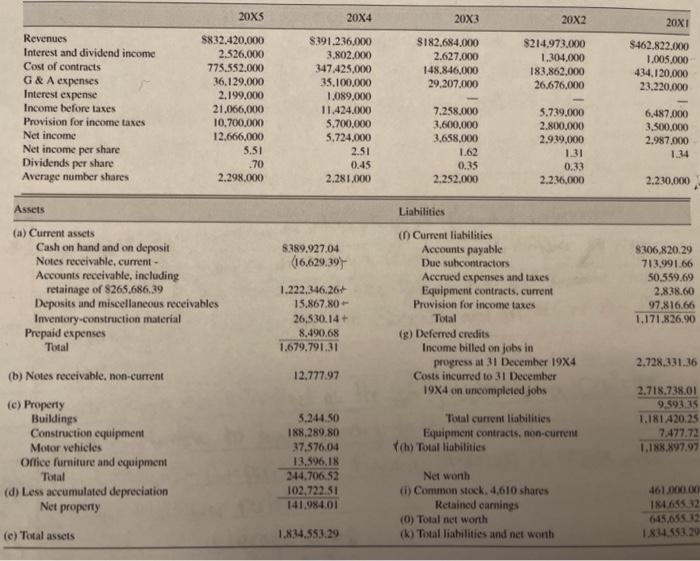

3. Analyze the operations of the Jumbo Construction Company across a fiveyear period based on the data in Table P3.1. (a) Plotting significant times and ratios of your choice aid in your analysis. What is your assessment of the financial health of Jumbo Construction? 4. Given that the current ratio (i.e., current assets/current liabilities) for a company over the years is as shown, what can you say about t operation of this company? Table P3.1 Jumbo Construction Company Five-Year Consolidated Summary of Operations. 20X1 1.50 20X2 1.51 20X3 1.42 20X4 1.20 20X5 0.95 Table P3.2 Balance Sheet, Cyclone Construction Co. (31 December 2012) 20X5 20X4 20X3 20X2 20X1 8182.684.000 2.627.000 148.846,000 29.207.000 $214.973.000 1.304.000 183.862,000 26,676,000 $462.822.000 1.005.000 434,120,000 23.220.000 Revenues Interest and dividend income Cost of contracts G&A expenses Interest expense Income before taxes Provision for income taxes Net income Net income per share Dividends per share Average number shares S832.420,000 2.526,000 775.552.000 36.129,000 2.199.000 21.066.000 10.700.000 12.666,000 5.51 .70 2.298,000 $391.236,000 3.802.000 347.425.000 35.100.000 1.089.000 11.424.000 5.700,000 5,724.000 2.51 0.45 2.281.000 7.258.000 3.600,000 3.658,000 1.62 0.35 2.252.000 5.739,000 2.800.000 2.939,000 1.31 0.33 2.236,000 6,487.000 3.500.000 2.987.000 1.34 2.230,000 Assets 8389.927.04 (16,629.39) (a) Current assets Cash on hand and on deposit Notes receivable, current Accounts receivable, including retainage of $265.686,39 Deposits and miscellaneous receivables Inventory-construction material Prepaid expenses Total 1.222,346.26+ 15.867.80 26,530,14 + 8.490,68 1.679.791.31 Liabilities Current liabilities Accounts payable Due subcontractors Accrued expenses and taxes Equipment contracts, current Provision for income taxes Total (g) Deferred credits Income billed on jobs in progress at 31 December 1984 Costs incurred to 31 December 1984 on uncompleted jobs S306,820.29 713.991.06 50.559.69 2.838.60 97,816,66 1.171.826,90 2.728.331.36 (b) Notes receivable, non-current 12.777.97 (c) Property Buildings Construction equipment Motor vehicles Office furniture and equipment Total (d) Less accumulated depreciation Total current liabilities Equipment contracts.non-cument ch) Total liabilities 2.718.738.01 9.593.15 1.181 A20.25 7.477.72 1.188.897.97 3.244.50 188,289.80 37.376.04 13.596.18 244.706.52 102,722.51 141.984.01 Net property Net worth 0) Common stock, 4,610 shares Retained carnings (0) Total net worth (k) Total liabilities and net worth 461.000.00 184.655.32 645,65612 1.844.553.29 (e) Total assets 1.834.553.29