Answered step by step

Verified Expert Solution

Question

1 Approved Answer

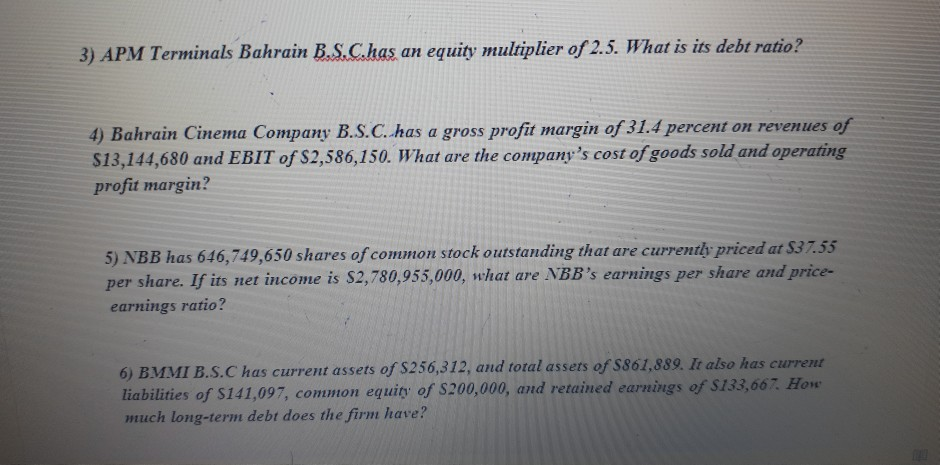

3) APM Terminals Bahrain B.S.C.has an equity multiplier of 2.5. What is its debt ratio? 4) Bahrain Cinema Company B.S.C. has a gross profit margin

3) APM Terminals Bahrain B.S.C.has an equity multiplier of 2.5. What is its debt ratio? 4) Bahrain Cinema Company B.S.C. has a gross profit margin of 31.4 percent on revenues of $13,144,680 and EBIT of $2,586,150. What are the company's cost of goods sold and operating profit margin? 5) NBB has 646,749,650 shares of common stock outstanding that are currently priced at $37.55 per share. If its net income is S2,780,955,000, what are NBB's earnings per share and price- earnings ratio? 6) BMMI B.S.C has current assets of S256,312, and total assets of 5861,889. It also has current liabilities of 141.097, common equity of S200,000, and retained earnings of S733,067. How much long-term debt does the firm have

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started