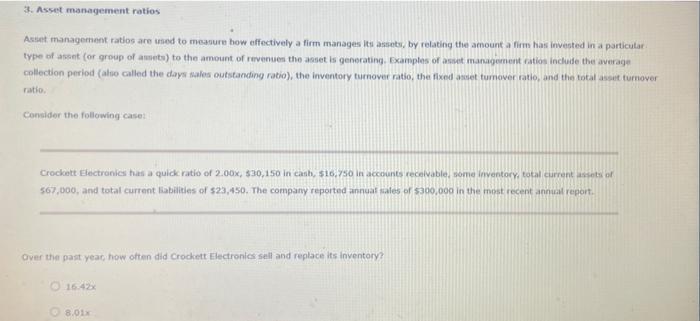

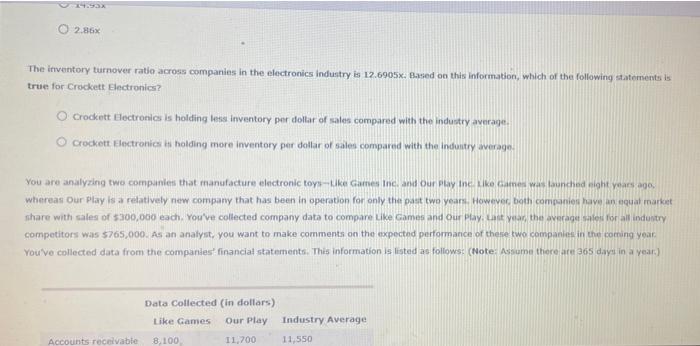

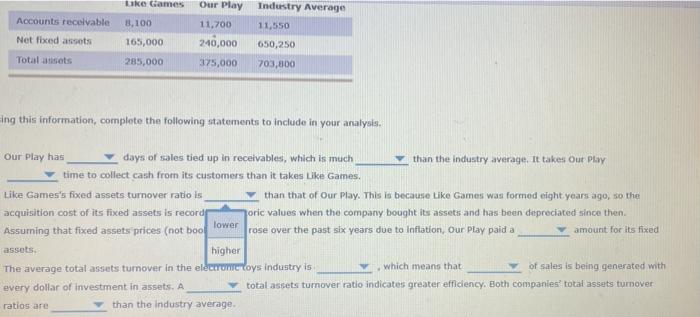

3. Asset management ratios Asset management ratios are used to measure how effectively a firm manages its assets, by relating the amount afim has invested in a particular type of sent (or group of a) to the amount of revenuen the asset is generating Examples of asset management ratios include the average collection period (also called the day sales outstanding ratio), the inventory turnover ratio, the fixed amet tumover ratio, and the total set turnover ratio Consider the following case Crockett Electronics has a quick ratio of 2.00%, 530,150 in cash, $16.750 in accounts recevable, some Inventory, total current of 567,000, and total current liabilities of $23,450. The company reported annual sales of $300,000 in the most recent annual report Over the past year how often did Crockett Electronics sell and replace its inventory? 16:42 8.012 2.86 The inventory turnover ratio across companies in the electronics Industry is 12.6905x. Based on this information, which of the following statement is true for Crockett Electronics? Crockett Electronics is holding less inventory per dollar of sales compared with the industry average. Crockett Electronics is holding more inventory per dollar of sales compared with the industry average You are analyzing two companies that manufacture electronic toys-Uke Games Inc. and our playine. Like came was launched eight years ago whereas Our Play is a relatively new company that has been in operation for only the past two years. However both companies have an equal market share with sales of $300,000 each. You've collected company data to compare Like Games and our play. Last year, the average sales for all industry competitors was 5765,000. As an analyst, you want to make comments on the expected performance of these two companies in the coming year You've collected data from the companies financial statements. This information is listed as follows: (Note: Assume there are 365 days in a year) Data Collected (in dollars) Like Games Our Play 8.100 I1.700 Industry Average Accounts receivable 11,550 Our Play Like Games 3,100 Accounts recevable 11,700 Net fixed assets Industry Average 11,550 050,250 703,300 240,000 Total assets 165,000 285,000 375,000 ing this information, complete the following statements to include in your analysis. Our Play has days of sales tied up in receivables, which is much than the industry average. It takes Our Play time to collect cash from its customers than it takes Like Games. Like Games's fixed assets turnover ratio is than that of Our Play. This is because Like Games was formed eight years ago, so the acquisition cost of its fixed assets is record oric values when the company bought its assets and has been depreciated since then. lower Assuming that fixed assets prices (not bool rose over the past six years due to Inflation, Our Play paid a amount for its fixed assets. higher The average total assets turnover in the electronic loys industry is which means that of sales is being generated with every dollar of investment in assets. A total assets turnover ratio indicates greater efficiency. Both companies' total assets turnover ratios are than the industry average