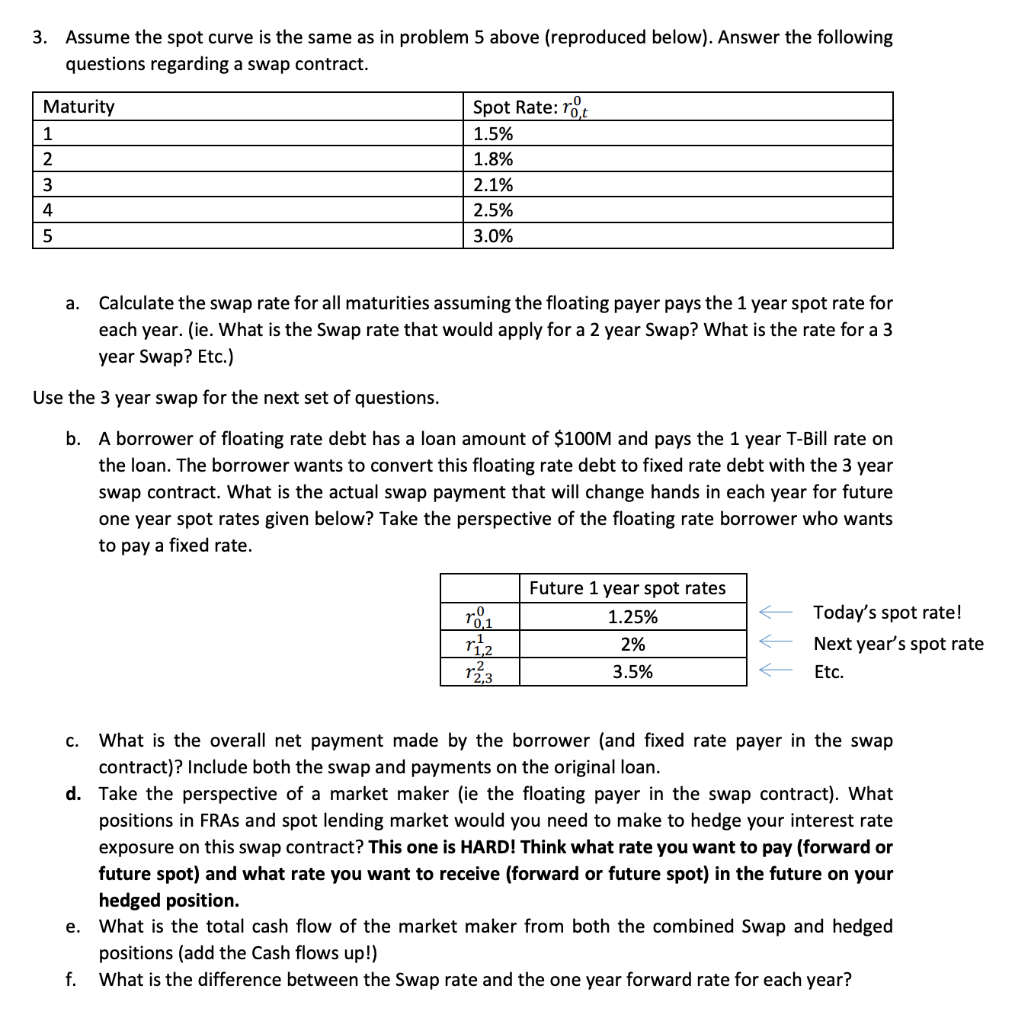

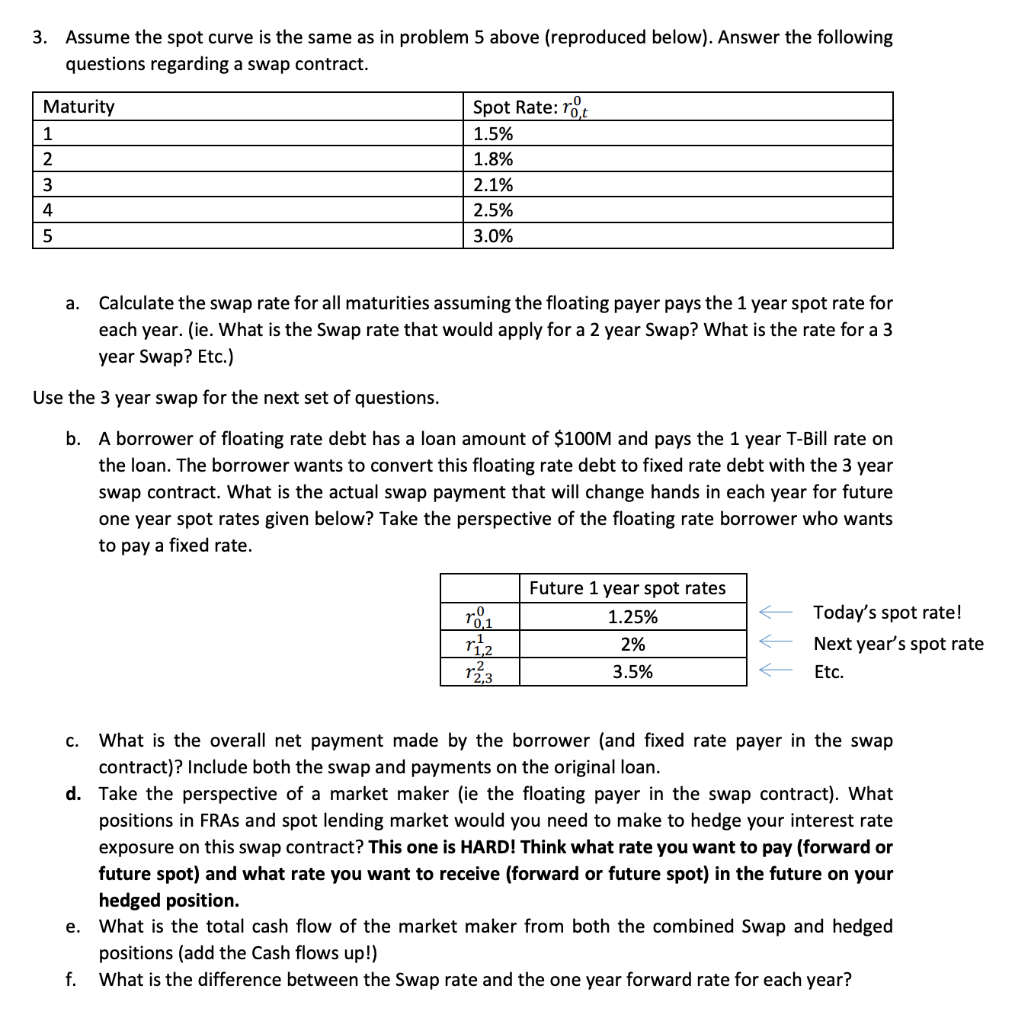

3. Assume the spot curve is the same as in problem 5 above (reproduced below). Answer the following questions regarding a swap contract. Maturity 1 2 3 Spot Rate: rot 1.5% 1.8% 2.1% 2.5% 3.0% 4 5 a. Calculate the swap rate for all maturities assuming the floating payer pays the 1 year spot rate for each year. (ie. What is the Swap rate that would apply for a 2 year Swap? What is the rate for a 3 year Swap? Etc.) Use the 3 year swap for the next set of questions. b. A borrower of floating rate debt has a loan amount of $100M and pays the 1 year T-Bill rate on the loan. The borrower wants to convert this floating rate debt to fixed rate debt with the 3 year swap contract. What is the actual swap payment that will change hands in each year for future one year spot rates given below? Take the perspective of the floating rate borrower who wants to pay a fixed rate. Future 1 year spot rates 1.25% - ria 12,3 2% 3.5% Today's spot rate! Next year's spot rate Etc. 2 C. What is the overall net payment made by the borrower (and fixed rate payer in the swap contract)? Include both the swap and payments on the original loan. d. Take the perspective of a market maker (ie the floating payer in the swap contract). What positions in FRAs and spot lending market would you need to make to hedge your interest rate exposure on this swap contract? This one is HARD! Think what rate you want to pay forward or future spa and what rate you want to receive (forwar future spot) in the future on your hedged position. e. What is the total cash flow of the market maker from both the combined Swap and hedged positions (add the Cash flows up!) f. What is the difference between the Swap rate and the one year forward rate for each year? 3. Assume the spot curve is the same as in problem 5 above (reproduced below). Answer the following questions regarding a swap contract. Maturity 1 2 3 Spot Rate: rot 1.5% 1.8% 2.1% 2.5% 3.0% 4 5 a. Calculate the swap rate for all maturities assuming the floating payer pays the 1 year spot rate for each year. (ie. What is the Swap rate that would apply for a 2 year Swap? What is the rate for a 3 year Swap? Etc.) Use the 3 year swap for the next set of questions. b. A borrower of floating rate debt has a loan amount of $100M and pays the 1 year T-Bill rate on the loan. The borrower wants to convert this floating rate debt to fixed rate debt with the 3 year swap contract. What is the actual swap payment that will change hands in each year for future one year spot rates given below? Take the perspective of the floating rate borrower who wants to pay a fixed rate. Future 1 year spot rates 1.25% - ria 12,3 2% 3.5% Today's spot rate! Next year's spot rate Etc. 2 C. What is the overall net payment made by the borrower (and fixed rate payer in the swap contract)? Include both the swap and payments on the original loan. d. Take the perspective of a market maker (ie the floating payer in the swap contract). What positions in FRAs and spot lending market would you need to make to hedge your interest rate exposure on this swap contract? This one is HARD! Think what rate you want to pay forward or future spa and what rate you want to receive (forwar future spot) in the future on your hedged position. e. What is the total cash flow of the market maker from both the combined Swap and hedged positions (add the Cash flows up!) f. What is the difference between the Swap rate and the one year forward rate for each year