Answered step by step

Verified Expert Solution

Question

1 Approved Answer

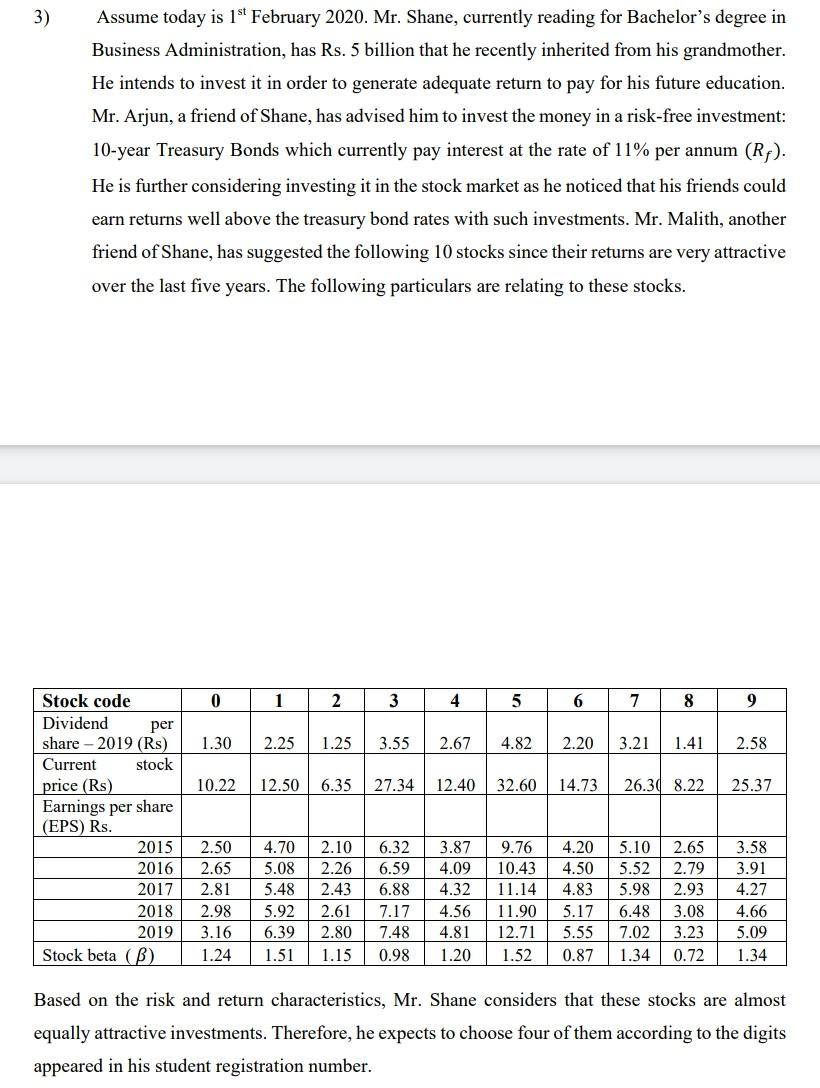

3) Assume today is 1st February 2020. Mr. Shane, currently reading for Bachelor's degree in Business Administration, has Rs. 5 billion that he recently inherited

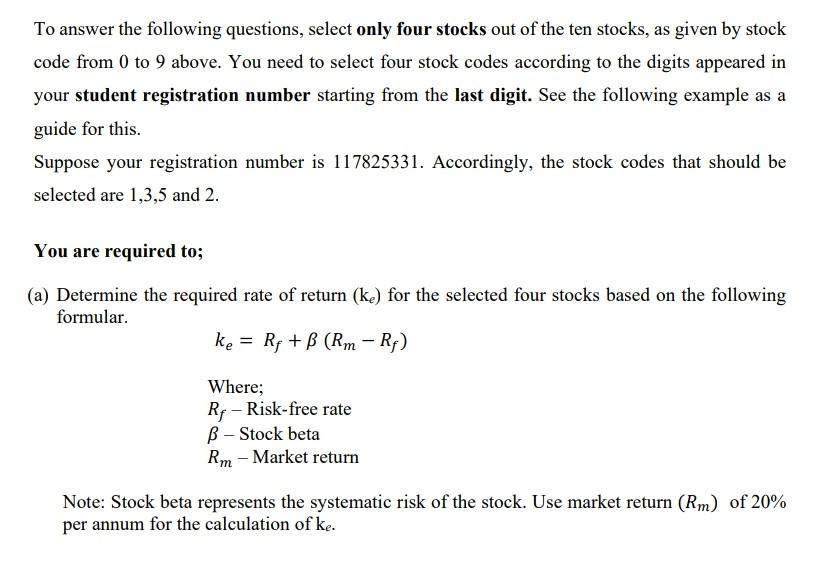

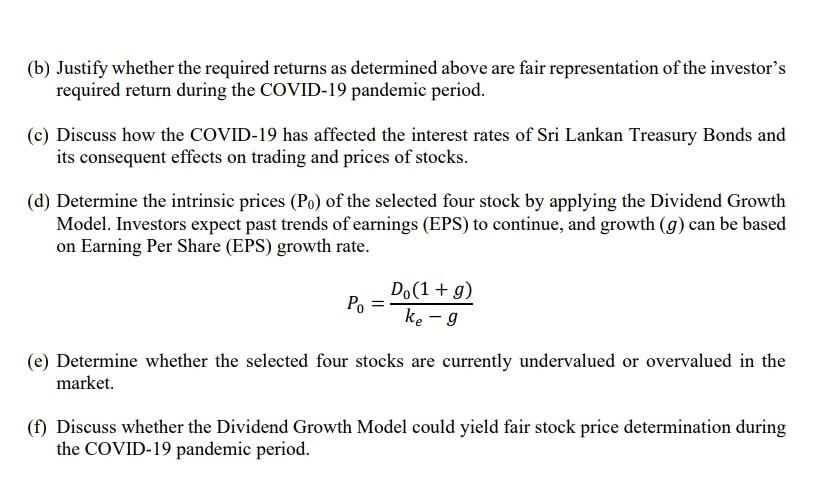

3) Assume today is 1st February 2020. Mr. Shane, currently reading for Bachelor's degree in Business Administration, has Rs. 5 billion that he recently inherited from his grandmother. He intends to invest it in order to generate adequate return to pay for his future education. Mr. Arjun, a friend of Shane, has advised him to invest the money in a risk-free investment: 10-year Treasury Bonds which currently pay interest at the rate of 11% per annum (RF). He is further considering investing it in the stock market as he noticed that his friends could earn returns well above the treasury bond rates with such investments. Mr. Malith, another friend of Shane, has suggested the following 10 stocks since their returns are very attractive over the last five years. The following particulars are relating to these stocks. 0 1 3 4 5 6 7 8 9 1.30 2.25 1.25 3.55 2.67 4.82 2.20 3.21 1.41 2.58 10.22 12.50 6.35 27.34 12.40 32.60 14.73 26.30 8.22 25.37 Stock code Dividend per share-2019 (RS) Current stock price (Rs) Earnings per share (EPS) Rs. 2015 2016 2017 2018 2019 Stock beta (B) 4.20 4.50 3.58 3.91 4.83 4.27 2.50 2.65 2.81 2.98 3.16 1.24 4.70 5.08 5.48 5.92 6.39 1.51 2.10 2.26 2.43 2.61 2.80 1.15 6.32 6.59 6.88 7.17 7.48 0.98 3.87 4.09 4.32 4.56 4.81 1.20 9.76 10.43 11.14 11.90 12.71 1.52 5.10 5.52 5.98 6.48 7.02 1.34 2.65 2.79 2.93 3.08 3.23 0.72 5.17 5.55 0.87 4.66 5.09 1.34 Based on the risk and return characteristics, Mr. Shane considers that these stocks are almost equally attractive investments. Therefore, he expects to choose four of them according to the digits appeared in his student registration number. To answer the following questions, select only four stocks out of the ten stocks, as given by stock code from 0 to 9 above. You need to select four stock codes according to the digits appeared in your student registration number starting from the last digit. See the following example as a guide for this. Suppose your registration number is 117825331. Accordingly, the stock codes that should be selected are 1,3,5 and 2. You are required to; (a) Determine the required rate of return (ke) for the selected four stocks based on the following formular ke = Rs + B (Rm - Rr) Where; Rr-Risk-free rate B - Stock beta Rm - Market return Note: Stock beta represents the systematic risk of the stock. Use market return (Rm) of 20% per annum for the calculation of ke. (b) Justify whether the required returns as determined above are fair representation of the investor's required return during the COVID-19 pandemic period. (c) Discuss how the COVID-19 has affected the interest rates of Sri Lankan Treasury Bonds and its consequent effects on trading and prices of stocks. (d) Determine the intrinsic prices (Po) of the selected four stock by applying the Dividend Growth Model. Investors expect past trends of earnings (EPS) to continue, and growth (g) can be based on Earning Per Share (EPS) growth rate. D.(1 + g) P. = ke - 9 (e) Determine whether the selected four stocks are currently undervalued or overvalued in the market. (f) Discuss whether the Dividend Growth Model could yield fair stock price determination during the COVID-19 pandemic period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started