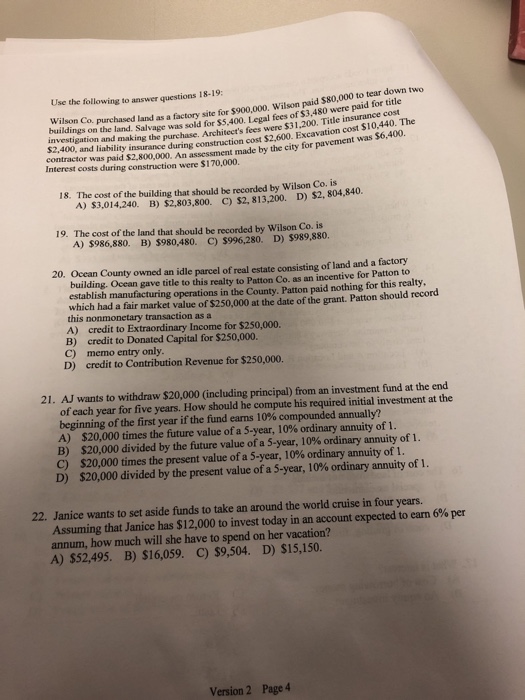

Use the following to answer questions 18-19 Wilson Co. son Co, purchased land as a factory site for $900,000. Wilson paid $80,000 to tear down two of $3.480 were paid for title buildings on the land. investigation and $2,400, and liability contractor was paid $2,800,000. An assessment made by the city tor Interest costs during construction were $170,000. making the purchase. Achitect's fees were $31,200. Title insurance cost pavement was $6,400. insurance during construction cost $2,600. Excavation cost $10,440. The The cost of the building that should be recorded by Wilson Co. is A) $3,014,240, 18. B) $2.803,800. C) $2.813,200. D) $2.804,840. 19. The cost of the land that should be recorded by Wilson Co. is A) $986,880. B) $980,480. C) $996,280. D) $989,880. 20. Ocean County owned an idle parcel of real estate consisting of land and a factory building. Ocean gave title to this realty to Patton Co. as an incentive for Patton to establish manufacturing operations in the County. Patton paid nothing for this realty, which had a fair market value of $250,000 at the date of the grant. Patton should record this nonmonetary transaction as a A) credit to Extraordinary Income for $250,000. credit to Donated Capital for $250,000. memo entry only credit to Contribution Revenue for $250,000. B) C) D) 21. AJ wants to withdraw $20,000 (including principal) from an investment fund at the end of each year for five years. How should he compute his required initial investment at the beginning of the first year if the fund earns 10% compounded annually? A) $20,000 times the future value ofa 5-year, 10% ordinary annuity of 1. B) $20,000 divided by the future value of a 5-year, 10% ordinary annuity of 1. C) $20,000 times the present value of a 5-year, 10% ordinary annuity of 1. D) $20,000 divided by the present value of a 5-year, 10% ordinary annuity of 1. 22. Janice wants to set aside funds to take an around the world cruise in four years. Assuming that Janice has $12,000 to invest today in an account expected to earn 6% per annum, how much will she have to spend on her vacation? ?) $52,495. B) $16,059. C) $9,504. D) $15,150. Version 2 Page 4