Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(3) Assuming you are a local Atlanta business owner. You have the money in your marketing budget to either sponsor the Atlanta Braves or Atlanta

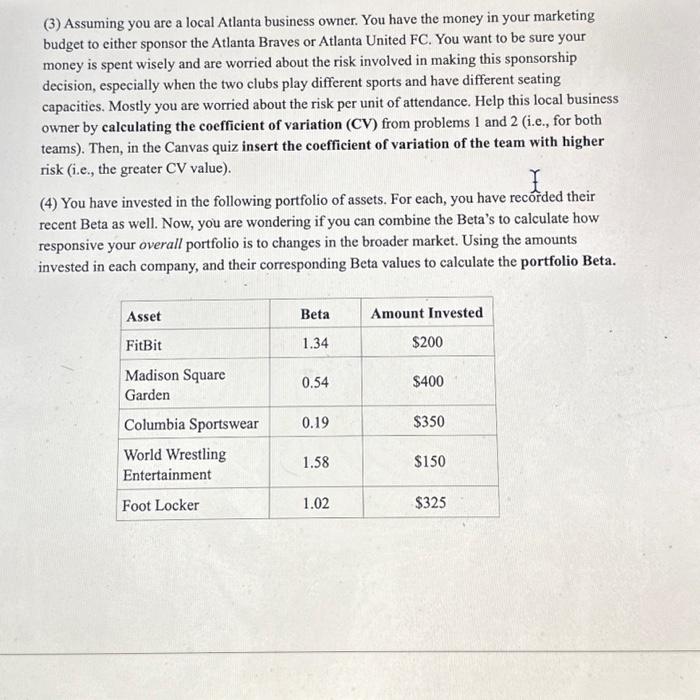

(3) Assuming you are a local Atlanta business owner. You have the money in your marketing budget to either sponsor the Atlanta Braves or Atlanta United FC. You want to be sure your money is spent wisely and are worried about the risk involved in making this sponsorship decision, especially when the two clubs play different sports and have different seating capacities. Mostly you are worried about the risk per unit of attendance. Help this local business owner by calculating the coefficient of variation (CV) from problems 1 and 2 (i.e., for both teams). Then, in the Canvas quiz insert the coefficient of variation of the team with higher risk (i.e., the greater CV value). X (4) You have invested in the following portfolio of assets. For each, you have recorded their recent Beta as well. Now, you are wondering if you can combine the Beta's to calculate how responsive your overall portfolio is to changes in the broader market. Using the amounts invested in each company, and their corresponding Beta values to calculate the portfolio Beta. Asset FitBit Madison Square Garden Columbia Sportswear World Wrestling Entertainment Foot Locker Beta 1.34 0.54 0.19 1.58 1.02 Amount Invested $200 $400 $350 $150 $325

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started