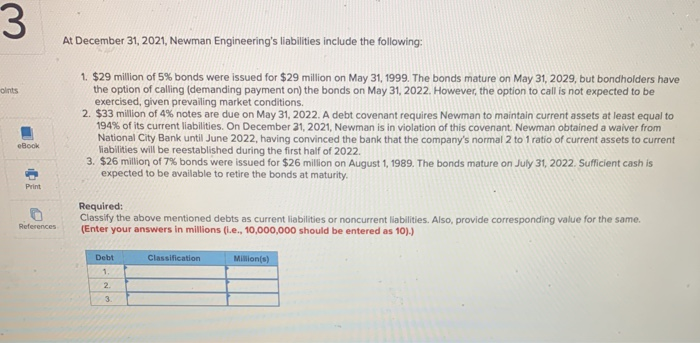

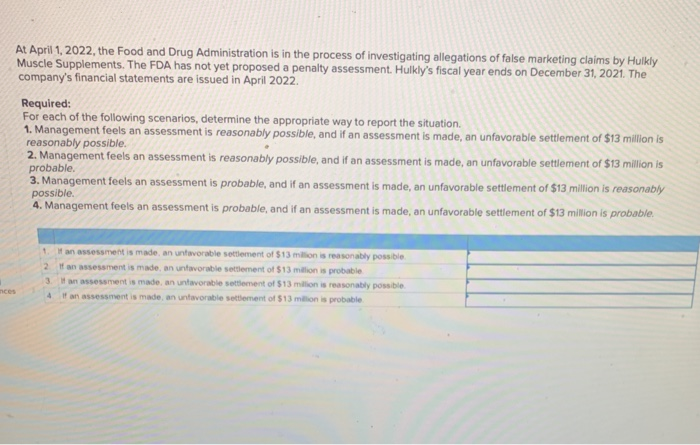

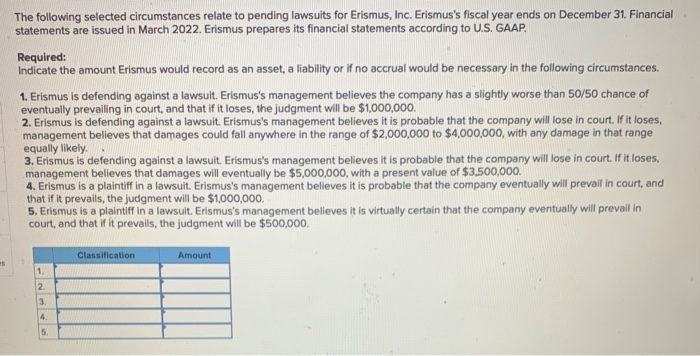

3 At December 31, 2021, Newman Engineering's liabilities include the following: onts 1. $29 million of 5% bonds were issued for $29 million on May 31, 1999. The bonds mature on May 31, 2029, but bondholders have the option of calling (demanding payment on the bonds on May 31, 2022. However, the option to call is not expected to be exercised, given prevailing market conditions. 2. $33 million of 4% notes are due on May 31, 2022. A debt covenant requires Newman to maintain current assets at least equal to 194% of its current liabilities. On December 31, 2021, Newman is in violation of this covenant. Newman obtained a waiver from National City Bank until June 2022, having convinced the bank that the company's normal 2 to 1 ratio of current assets to current liabilities will be reestablished during the first half of 2022 3. $26 million of 7% bonds were issued for $26 million on August 1, 1989. The bonds mature on July 31, 2022. Sufficient cash is expected to be available to retire the bonds at maturity. eBook Print Required: Classify the above mentioned debts as current liabilities or noncurrent liabilities. Also, provide corresponding value for the same. (Enter your answers in millions (.e., 10,000,000 should be entered as 10).) References Debt Classification Million(s) 1. 2 3 At April 1, 2022, the Food and Drug Administration is in the process of investigating allegations of false marketing claims by Hulkly Muscle Supplements. The FDA has not yet proposed a penalty assessment. Hulkly's fiscal year ends on December 31, 2021. The company's financial statements are issued in April 2022. Required: For each of the following scenarios, determine the appropriate way to report the situation. 1. Management feels an assessment is reasonably possible, and if an assessment is made, an unfavorable settlement of $13 million is reasonably possible. 2. Management feels an assessment is reasonably possible, and if an assessment is made, an unfavorable settlement of $13 million is probable 3. Management feels an assessment is probable, and if an assessment is made, an unfavorable settlement of $13 million is reasonably possible. 4. Management feels an assessment is probable, and if an assessment is made, an unfavorable settlement of $13 million is probable. 1 an assessment is made an unfavorable settlement of $13 million is reasonably possible 2 If an assessment is made an unfavorable settlement of $13 million is probable 3. Wassessment is made an unfavorable settlement of $13 million is reasonably possible 4 it an assessment is made an unfavorable settlement of $13 million is probable inces The following selected circumstances relate to pending lawsuits for Erismus, Inc. Erismus's fiscal year ends on December 31. Financial statements are issued in March 2022. Erismus prepares its financial statements according to U.S. GAAP. Required: Indicate the amount Erismus would record as an asset, a liability or if no accrual would be necessary in the following circumstances. 1. Erismus is defending against a lawsuit. Erismus's management believes the company has a slightly worse than 50/50 chance of eventually prevailing in court, and that if it loses, the judgment will be $1,000,000, 2. Erismus is defending against a lawsuit. Erismus's management believes it is probable that the company will lose in court. If it loses, management believes that damages could fall anywhere in the range of $2,000,000 to $4,000,000, with any damage in that range equally likely 3. Erismus is defending against a lawsuit. Erismus's management believes it is probable that the company will lose in court. If it loses, management believes that damages will eventually be $5,000,000, with a present value of $3,500,000 4. Erismus is a plaintiff in a lawsuit. Erismus's management believes it is probable that the company eventually will prevail in court, and that if it prevails, the judgment will be $1,000,000 5. Erismus is a plaintiff in a lawsuit. Erismus's management believes it is virtually certain that the company eventually will prevail in court, and that if it prevails, the judgment will be $500,000. Classification Amount 5 1. 2 3 4 5