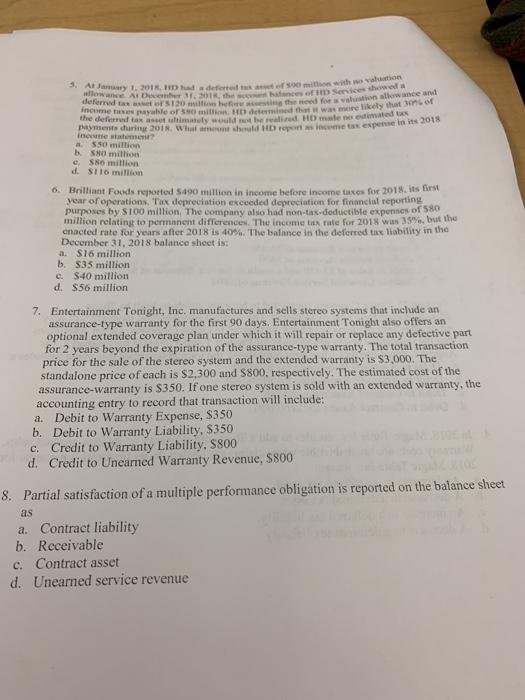

3. At January 1, 2018, HD had a deferred tax asset of 590 million with no valuation allowance. At December 31, 2018, the account balances of HD Services showed a deferred tax asset ofS120 million befre assessing the need for a valuation allowance and income taxes payable of 580 million. HD determined that it was more likely that 30% of the deferred tax asset ultimately would not be realized. HD made no estimmated tat payments during 2018. What amount should HED report as income tax espense in its 2018 income statement? $50 million b. S80 million c. $86 million d. S116 million a. 6. Brilliant Foods reported $490 million in income before income taxes for 2018, its first year of operations. Tax depreciation exceeded depreciation for financial reporting purposes by S100 million. The company also had non-tax-deductible expenses of S80 million relating to permanent differences. The income tax rate for 2018 was 35%, but the enacted rate for years after 2018 is 40 %. The balance in the deferred tax liability in the December 31, 2018 balance sheet is: a. S16 million b. $35 million c. $40 million d. $56 million 7. Entertainment Tonight, Inc. manufactures and sells stereo systems that include an assurance-type warranty for the first 90 days. Entertainment Tonight also offers an optional extended coverage plan under which it will repair or replace any defective part for 2 years beyond the expiration of the assurance-type warranty. The total transaction. price for the sale of the stereo system and the extended warranty is $3,000. The standalone price of each is $2,300 and $800, respectively. The estimated cost of the assurance-warranty is $350.. If one stereo system is sold with an extended warranty, the accounting entry to record that transaction will include: a. Debit to Warranty Expense, $350 b. Debit to Warranty Liability, $350 Credit to Warranty Liability, $800 d. Credit to Unearned Warranty Revenue, $800 . 210 Partial satisfaction of a multiple performance obligation is reported on the balance sheet 8. as Contract liability a. b. Receivable c. Contract asset d. Unearned service revenue