Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Beckett is a small investor who owns a portfolio currently consisting of equity investments in three assets, which he imaginatively refers to by

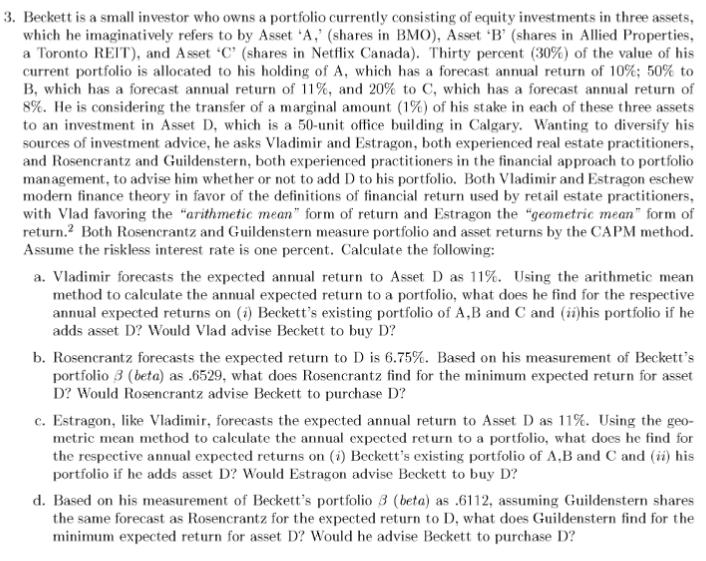

3. Beckett is a small investor who owns a portfolio currently consisting of equity investments in three assets, which he imaginatively refers to by Asset 'A,' (shares in BMO), Asset 'B' (shares in Allied Properties, a Toronto REIT), and Asset 'C' (shares in Netflix Canada). Thirty percent (30%) of the value of his current portfolio is allocated to his holding of A, which has a forecast annual return of 10%; 50% to B, which has a forecast annual return of 11%, and 20% to C, which has a forecast annual return of 8%. He is considering the transfer of a marginal amount (1%) of his stake in each of these three assets to an investment in Asset D, which is a 50-unit office building in Calgary. Wanting to diversify his sources of investment advice, he asks Vladimir and Estragon, both experienced real estate practitioners, and Rosencrantz and Guildenstern, both experienced practitioners in the financial approach to portfolio management, to advise him whether or not to add D to his portfolio. Both Vladimir and Estragon eschew modern finance theory in favor of the definitions of financial return used by retail estate practitioners, with Vlad favoring the "arithmetic mean" form of return and Estragon the "geometric mean" form of return. Both Rosencrantz and Guildenstern measure portfolio and asset returns by the CAPM method. Assume the riskless interest rate is one percent. Calculate the following: a. Vladimir forecasts the expected annual return to Asset D as 11%. Using the arithmetic mean method to calculate the annual expected return to a portfolio, what does he find for the respective annual expected returns on (i) Beckett's existing portfolio of A,B and C and (ii)his portfolio if he adds asset D? Would Vlad advise Beckett to buy D? b. Rosencrantz forecasts the expected return to D is 6.75%. Based on his measurement of Beckett's portfolio 3 (beta) as .6529, what does Rosencrantz find for the minimum expected return for asset D? Would Rosencrantz advise Beckett to purchase D? c. Estragon, like Vladimir, forecasts the expected annual return to Asset D as 11%. Using the geo- metric mean method to calculate the annual expected return to a portfolio, what does he find for the respective annual expected returns on (1) Beckett's existing portfolio of A,B and C and (ii) his portfolio if he adds asset D? Would Estragon advise Beckett to buy D? d. Based on his measurement of Beckett's portfolio 3 (beta) as .6112, assuming Guildenstern shares the same forecast as Rosencrantz for the expected return to D, what does Guildenstern find for the minimum expected return for asset D? Would he advise Beckett to purchase D?

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started