Question

3. Before the acquisition of AFB, the market value of MBSB and AFB were RM250 million and RM15 million respectively. The offer from MBSB

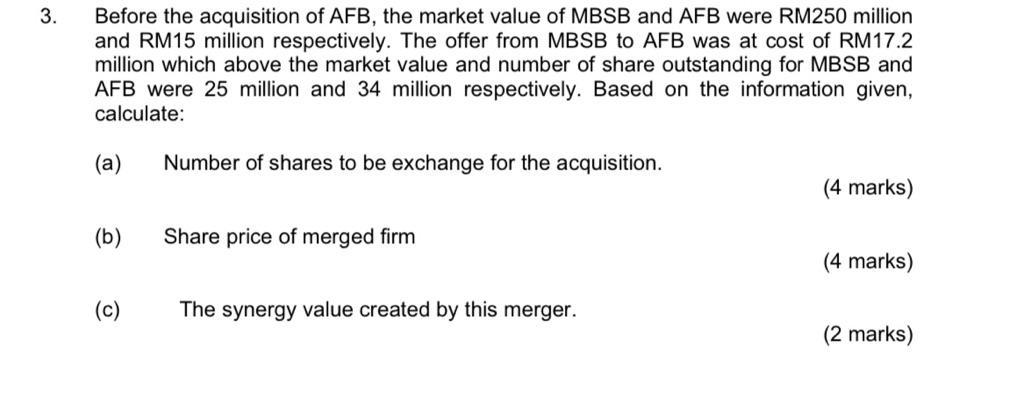

3. Before the acquisition of AFB, the market value of MBSB and AFB were RM250 million and RM15 million respectively. The offer from MBSB to AFB was at cost of RM17.2 million which above the market value and number of share outstanding for MBSB and AFB were 25 million and 34 million respectively. Based on the information given, calculate: (a) (b) (c) Number of shares to be exchange for the acquisition. Share price of merged firm The synergy value created by this merger. (4 marks) (4 marks) (2 marks)

Step by Step Solution

3.43 Rating (137 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the number of shares to be exchanged for the acquisition we need to determine the exc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Accounting

Authors: Kim Langfield Smith, Helen Thorne, David Alan Smith, Ronald W. Hilton

7th Edition

978-1760421144, 1760421146

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App