Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Chris Johnson has observed Kayangan Industries Berhad and Hartalega Holding Berhad share on the Bursa Malaysia Derivatives market. He is interested to invest

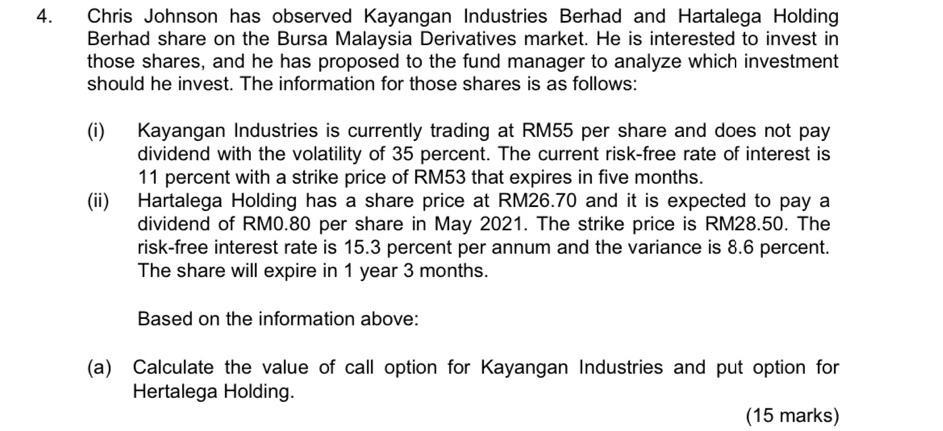

4. Chris Johnson has observed Kayangan Industries Berhad and Hartalega Holding Berhad share on the Bursa Malaysia Derivatives market. He is interested to invest in those shares, and he has proposed to the fund manager to analyze which investment should he invest. The information for those shares is as follows: (i) Kayangan Industries is currently trading at RM55 per share and does not pay dividend with the volatility of 35 percent. The current risk-free rate of interest is 11 percent with a strike price of RM53 that expires in five months. (ii) Hartalega Holding has a share price at RM26.70 and it is expected to pay a dividend of RM0.80 per share in May 2021. The strike price is RM28.50. The risk-free interest rate is 15.3 percent per annum and the variance is 8.6 percent. The share will expire in 1 year 3 months. Based on the information above: (a) Calculate the value of call option for Kayangan Industries and put option for Hertalega Holding. (15 marks)

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of the call option for Kayangan Industries and the put option for Hartalega H...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started