Answered step by step

Verified Expert Solution

Question

1 Approved Answer

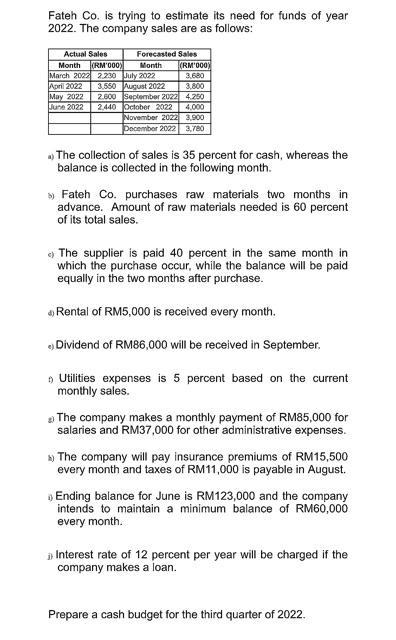

Fateh Co. is trying to estimate its need for funds of year 2022. The company sales are as follows: Actual Sales Forecasted Sales Month

Fateh Co. is trying to estimate its need for funds of year 2022. The company sales are as follows: Actual Sales Forecasted Sales Month (RM'000) Month March 2022 2.230 July 2022 August 2022 September 2022 October 2022 November 2022 3,900 December 2022 3,780 April 2022 May 2022 June 2022 2.440 3,550 2.600 (RM'000) 3,680 3,800 4.250 4,000 The collection of sales is 35 percent for cash, whereas the balance is collected in the following month. >Fateh Co. purchases raw materials two months in advance. Amount of raw materials needed is 60 percent of its total sales. The supplier is paid 40 percent in the same month in which the purchase occur, while the balance will be paid equally in the two months after purchase. Rental of RM5,000 is received every month. e) Dividend of RM86,000 will be received in September. >Utilities expenses is 5 percent based on the current monthly sales. The company makes a monthly payment of RM85,000 for salaries and RM37,000 for other administrative expenses. The company will pay insurance premiums of RM15,500 every month and taxes of RM11,000 is payable in August. Ending balance for June is RM123,000 and the company intends to maintain a minimum balance of RM60,000 every month. Interest rate of 12 percent per year will be charged if the company makes a loan. Prepare a cash budget for the third quarter of 2022.

Step by Step Solution

★★★★★

3.59 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Fateh Co Cash Budget for the Third Quarter of 2022 July 2022 Cash Inflows Cash Sales RM3680 035 RM12...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started