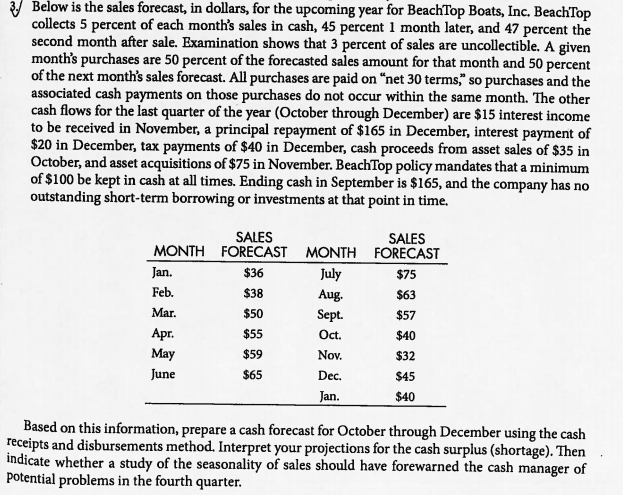

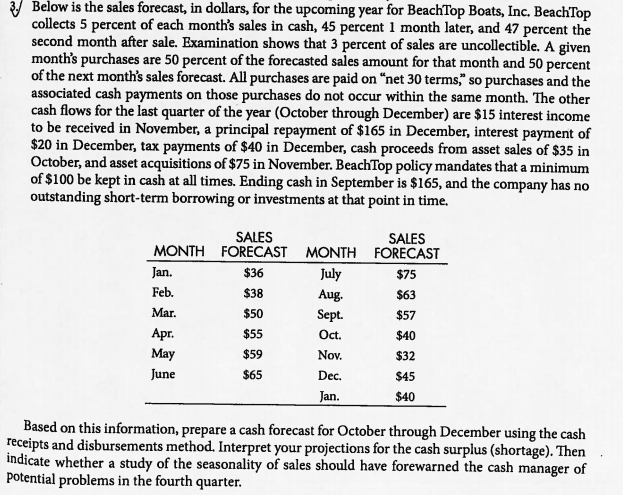

3. Below is the sales forecast, in dollars, for the upcoming year for BeachTop Boats, Inc. BeachTop collects 5 percent of each month's sales in cash, 45 percent 1 month later, and 47 percent the second month after sale. Examination shows that 3 percent of sales are uncollectible. A given month's purchases are 50 percent of the forecasted sales amount for that month and 50 percent of the next month's sales forecast. All purchases are paid on "net 30 terms," so purchases and the associated cash payments on those purchases do not occur within the same month. The other cash flows for the last quarter of the year (October through December) are $15 interest income to be received in November, a principal repayment of $165 in December, interest payment of $20 in December, tax payments of $40 in December, cash proceeds from asset sales of $35 in October, and asset acquisitions of $75 in November. BeachTop policy mandates that a minimum of $100 be kept in cash at all times. Ending cash in September is $165, and the company has no outstanding short-term borrowing or investments at that point in time. MONTH Jan. Feb. Mar. Apr. May June SALES FORECAST $36 $38 $50 $55 $59 $65 MONTH July Aug. Sept. Oct. Nov. Dec. Jan. SALES FORECAST $75 $63 $57 $40 $32 $45 $40 Based on this information, prepare a cash forecast for October through December using the cash receipts and disbursements method. Interpret your projections for the cash surplus (shortage). Then indicate whether a study of the seasonality of sales should have forewarned the cash manager of potential problems in the fourth quarter. 3. Below is the sales forecast, in dollars, for the upcoming year for BeachTop Boats, Inc. BeachTop collects 5 percent of each month's sales in cash, 45 percent 1 month later, and 47 percent the second month after sale. Examination shows that 3 percent of sales are uncollectible. A given month's purchases are 50 percent of the forecasted sales amount for that month and 50 percent of the next month's sales forecast. All purchases are paid on "net 30 terms," so purchases and the associated cash payments on those purchases do not occur within the same month. The other cash flows for the last quarter of the year (October through December) are $15 interest income to be received in November, a principal repayment of $165 in December, interest payment of $20 in December, tax payments of $40 in December, cash proceeds from asset sales of $35 in October, and asset acquisitions of $75 in November. BeachTop policy mandates that a minimum of $100 be kept in cash at all times. Ending cash in September is $165, and the company has no outstanding short-term borrowing or investments at that point in time. MONTH Jan. Feb. Mar. Apr. May June SALES FORECAST $36 $38 $50 $55 $59 $65 MONTH July Aug. Sept. Oct. Nov. Dec. Jan. SALES FORECAST $75 $63 $57 $40 $32 $45 $40 Based on this information, prepare a cash forecast for October through December using the cash receipts and disbursements method. Interpret your projections for the cash surplus (shortage). Then indicate whether a study of the seasonality of sales should have forewarned the cash manager of potential problems in the fourth quarter