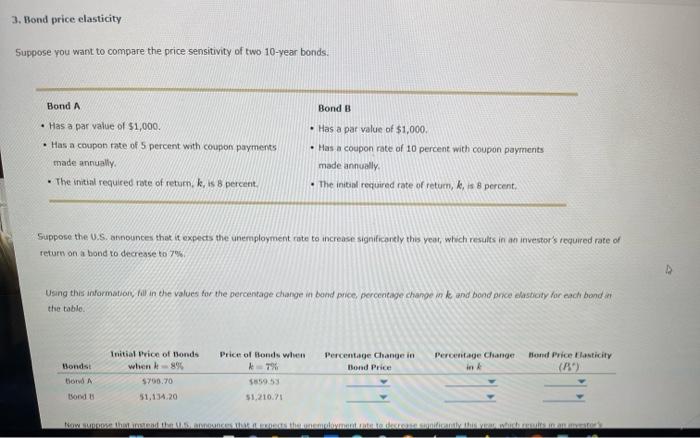

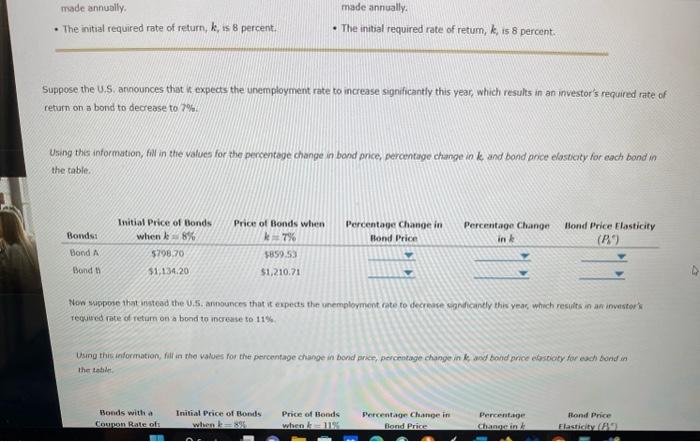

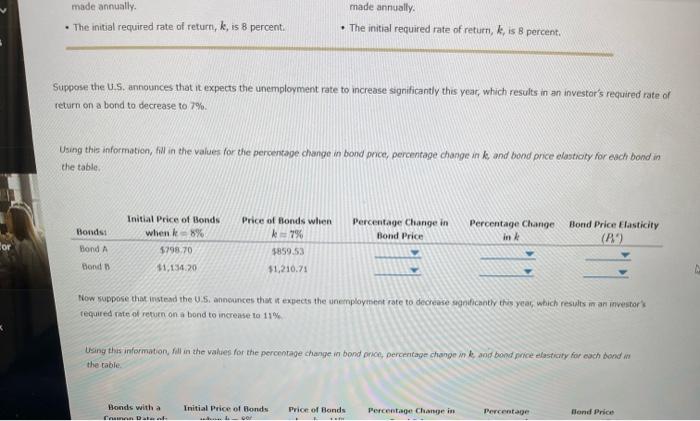

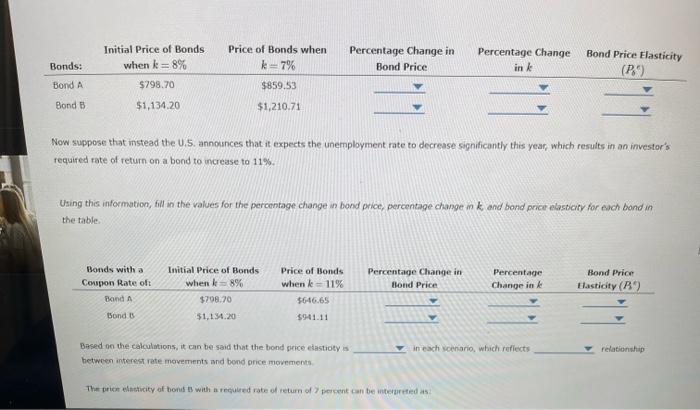

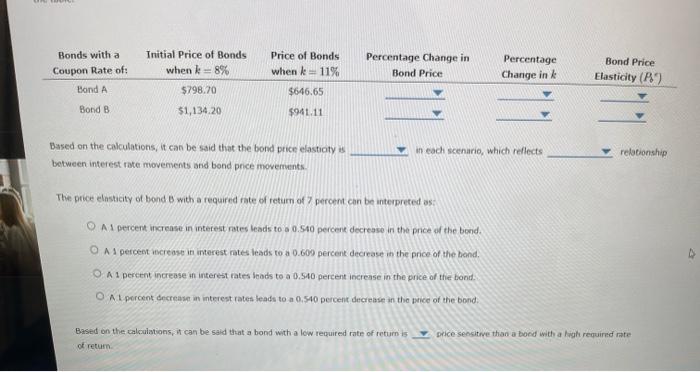

3. Bond price elasticity Suppose you want to compare the price sensitivity of two 10 -year bonds: Suppose the U.S. atynounces that it expects the unernployment rate to increase significantly this year, which results in an investor's tequired rate of return on a bond to decrease to 7%. Using this information, fill in the values for the percentage change in bond price percencage change in k and bopd ance elasbicty for each bond in the table. Suppose the U.S. announces that k expects the unemployment rate to increase significantly this year, which results in an investor's required rate of return on a bond to decrease to 7% i. Using this information, fil in the values for the percentoge change in bond price, percentage change in k and bond phice elastioty for each band in the cabie. requised rate of retarn on a bond to incrense to 11% Vang thit information, fill in the values for the percentage change in bond price, percentage change in ke and bond puce etsicioty for euch bund in the tabie. uppose the U.S. announces that it expects the unemployment rate to increase significantly this yeac, which results in an investor's required rate of eturn on a bond to decrease to 7%. Using this information, fil in the values for the percentage change in bond pnce, percentage change in k, and bond phce elastioty for each bond in the table. Now suppose thac insted the U.S: anneunces that in expects the unemployenent rate to decrease agnificanty this yeat, which results in an investork required rate of return on a bond to increase to 11% Using ths information, fill in the values for the percentage change in bond onics, percentage chenge in d, snd bond parce elastiaty for euch dond in the table. Now suppose that instead the U,5. announces that it expects the unemployment rate to decrease significantly this year, which results in an investor's requited rate of return on a bond to increase to 11% Using this information, fill in the values for the percentage change in bond price, percentage chamge mh k and bond price elasticit for eact band in the table. Based on the ealculations, it can be said that the bond price edastioty is between interest rate movements and bond orice movements. The price eiasticity af bons B with a reguled rate of return of 7 percent can be intearetied as based on the calculations, it can be said that the bond price elastioty is in each scenario, which reflects retationshis between interest rate movements and bond price movements. The price elastacity of bond is with a required rate of return of 7 percent can be interpreted as: A 1 percent increase in interest rates leads to a 0.540 percent decrease in the price of the bond. A 1 percent ifcrease in interest rates leads to a 0.609 percent deciease in the price of the bond. A I peceent increase in interest rates leads to a 0.540. percent increase in the price of thie bond. A t percent decrease in interest rates leads to a 0,540 percent decrease in the price of the bond. Based on the calculstions, it can be said that a bond with a low required rate of return is of return