Answered step by step

Verified Expert Solution

Question

1 Approved Answer

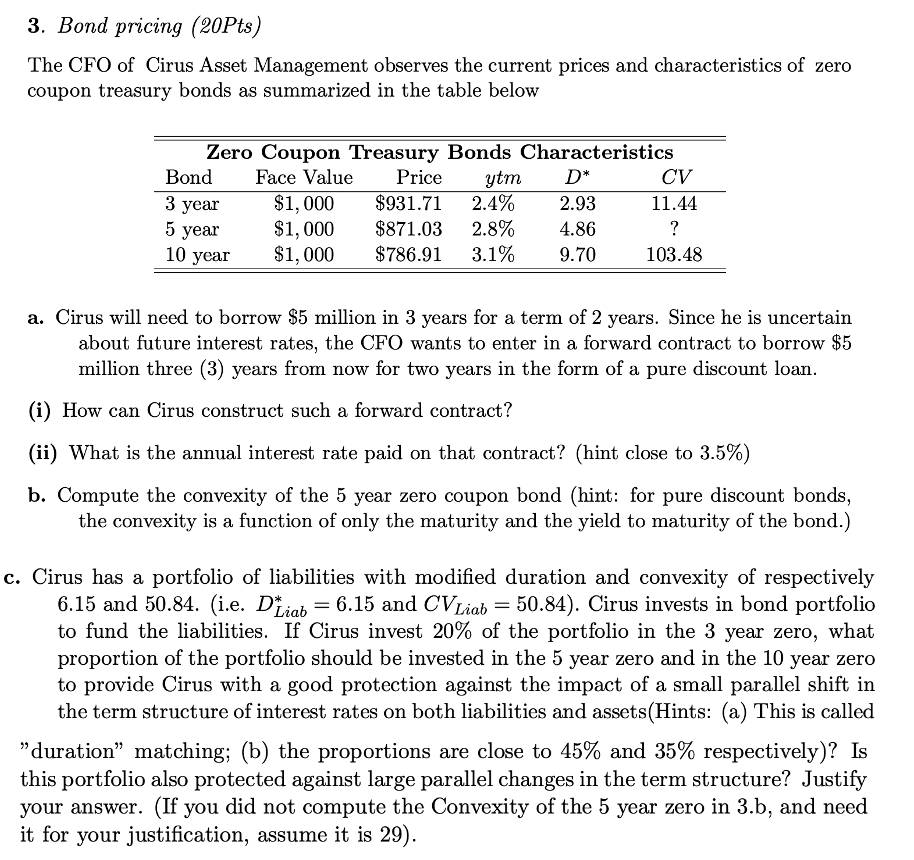

3. Bond pricing (20Pts) The CFO of Cirus Asset Management observes the current prices and characteristics of zero coupon treasury bonds as summarized in the

3. Bond pricing (20Pts) The CFO of Cirus Asset Management observes the current prices and characteristics of zero coupon treasury bonds as summarized in the table below Zero Coupon Treasury Bonds Characteristics Bond Face Value Price ytm D* CV $1,000 $931.71 2.4% 2.93 11.44 $1,000 $871.03 2.8% 4.86 ? $1,000 $786.91 3.1% 9.70 103.48 3 year 5 year 10 year a. Cirus will need to borrow $5 million in 3 years for a term of 2 years. Since he is uncertain about future interest rates, the CFO wants to enter in a forward contract to borrow $5 million three (3) years from now for two years in the form of a pure discount loan. (i) How can Cirus construct such a forward contract? (ii) What is the annual interest rate paid on that contract? (hint close to 3.5%) b. Compute the convexity of the 5 year zero coupon bond (hint: for pure discount bonds, the convexity is a function of only the maturity and the yield to maturity of the bond.) = c. Cirus has a portfolio of liabilities with modified duration and convexity of respectively 6.15 and 50.84. (i.e. Deiab = 6.15 and CV Liab = 50.84). Cirus invests in bond portfolio to fund the liabilities. If Cirus invest 20% of the portfolio in the 3 year zero, what proportion of the portfolio should be invested in the 5 year zero and in the 10 year zero to provide Cirus with a good protection against the impact of a small parallel shift in the term structure of interest rates on both liabilities and assets(Hints: (a) This is called "duration" matching; (b) the proportions are close to 45% and 35% respectively)? Is this portfolio also protected against large parallel changes in the term structure? Justify your answer. (If you did not compute the Convexity of the 5 year zero in 3.b, and need it for your justification, assume it is 29). 3. Bond pricing (20Pts) The CFO of Cirus Asset Management observes the current prices and characteristics of zero coupon treasury bonds as summarized in the table below Zero Coupon Treasury Bonds Characteristics Bond Face Value Price ytm D* CV $1,000 $931.71 2.4% 2.93 11.44 $1,000 $871.03 2.8% 4.86 ? $1,000 $786.91 3.1% 9.70 103.48 3 year 5 year 10 year a. Cirus will need to borrow $5 million in 3 years for a term of 2 years. Since he is uncertain about future interest rates, the CFO wants to enter in a forward contract to borrow $5 million three (3) years from now for two years in the form of a pure discount loan. (i) How can Cirus construct such a forward contract? (ii) What is the annual interest rate paid on that contract? (hint close to 3.5%) b. Compute the convexity of the 5 year zero coupon bond (hint: for pure discount bonds, the convexity is a function of only the maturity and the yield to maturity of the bond.) = c. Cirus has a portfolio of liabilities with modified duration and convexity of respectively 6.15 and 50.84. (i.e. Deiab = 6.15 and CV Liab = 50.84). Cirus invests in bond portfolio to fund the liabilities. If Cirus invest 20% of the portfolio in the 3 year zero, what proportion of the portfolio should be invested in the 5 year zero and in the 10 year zero to provide Cirus with a good protection against the impact of a small parallel shift in the term structure of interest rates on both liabilities and assets(Hints: (a) This is called "duration" matching; (b) the proportions are close to 45% and 35% respectively)? Is this portfolio also protected against large parallel changes in the term structure? Justify your answer. (If you did not compute the Convexity of the 5 year zero in 3.b, and need it for your justification, assume it is 29)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started