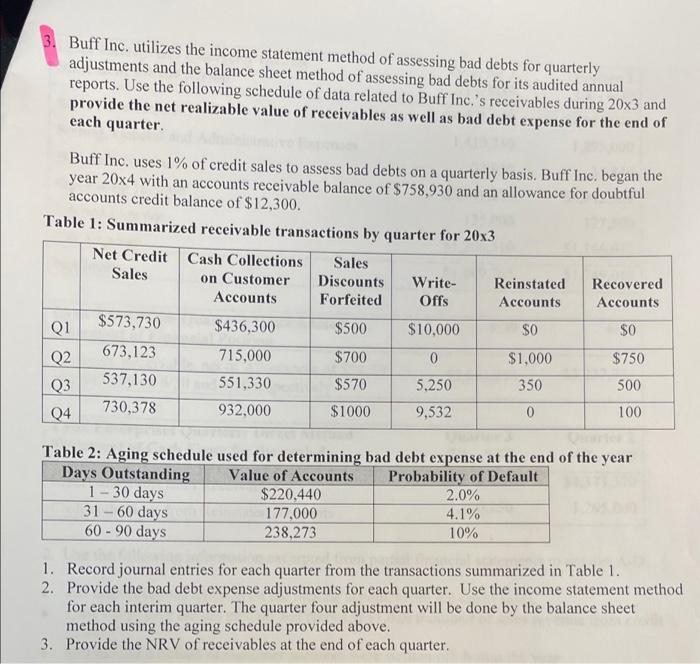

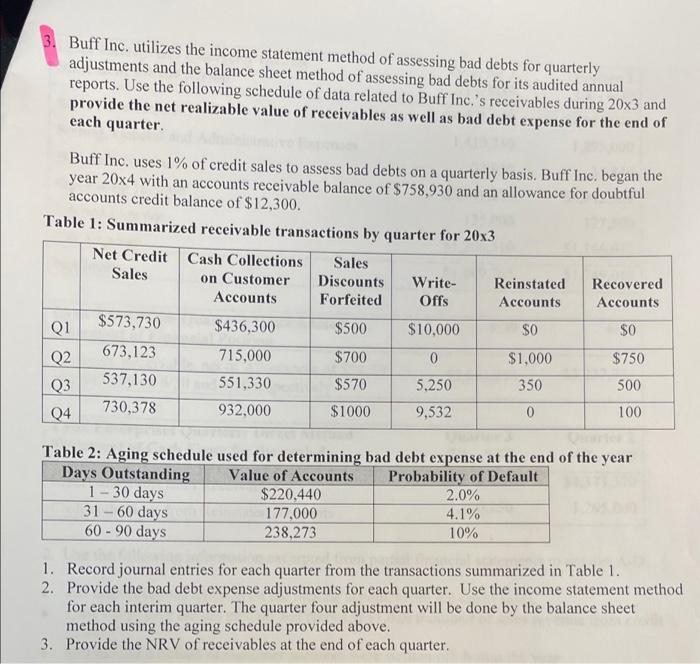

3. Buff Inc. utilizes the income statement method of assessing bad debts for quarterly adjustments and the balance sheet method of assessing bad debts for its audited annual reports. Use the following schedule of data related to Buff Inc.'s receivables during 20x3 and provide the net realizable value of receivables as well as bad debt expense for the end of each quarter Buff Inc. uses 1% of credit sales to assess bad debts on a quarterly basis. Buff Inc. began the year 20x4 with an accounts receivable balance of $758,930 and an allowance for doubtful accounts credit balance of $12,300. Table 1: Summarized receivable transactions by quarter for 20x3 Net Credit Cash Collections Sales Sales on Customer Discounts Write- Reinstated Recovered Accounts Forfeited Offs Accounts Accounts Q1 $573,730 $436,300 $500 $10,000 SO $0 Q2 673,123 715,000 $700 0 $1,000 $750 537,130 551,330 $570 5.250 350 500 730,378 04 932,000 $1000 9,532 0 100 Q3 Table 2: Aging schedule used for determining bad debt expense at the end of the year Days Outstanding Value of Accounts Probability of Default 1 - 30 days $220,440 2.0% 31 -60 days 177,000 4.1% 60 - 90 days 238,273 10% 1. Record journal entries for each quarter from the transactions summarized in Table 1. 2. Provide the bad debt expense adjustments for each quarter. Use the income statement method for each interim quarter. The quarter four adjustment will be done by the balance sheet method using the aging schedule provided above. 3. Provide the NRV of receivables at the end of each quarter. 3. Buff Inc. utilizes the income statement method of assessing bad debts for quarterly adjustments and the balance sheet method of assessing bad debts for its audited annual reports. Use the following schedule of data related to Buff Inc.'s receivables during 20x3 and provide the net realizable value of receivables as well as bad debt expense for the end of each quarter Buff Inc. uses 1% of credit sales to assess bad debts on a quarterly basis. Buff Inc. began the year 20x4 with an accounts receivable balance of $758,930 and an allowance for doubtful accounts credit balance of $12,300. Table 1: Summarized receivable transactions by quarter for 20x3 Net Credit Cash Collections Sales Sales on Customer Discounts Write- Reinstated Recovered Accounts Forfeited Offs Accounts Accounts Q1 $573,730 $436,300 $500 $10,000 SO $0 Q2 673,123 715,000 $700 0 $1,000 $750 537,130 551,330 $570 5.250 350 500 730,378 04 932,000 $1000 9,532 0 100 Q3 Table 2: Aging schedule used for determining bad debt expense at the end of the year Days Outstanding Value of Accounts Probability of Default 1 - 30 days $220,440 2.0% 31 -60 days 177,000 4.1% 60 - 90 days 238,273 10% 1. Record journal entries for each quarter from the transactions summarized in Table 1. 2. Provide the bad debt expense adjustments for each quarter. Use the income statement method for each interim quarter. The quarter four adjustment will be done by the balance sheet method using the aging schedule provided above. 3. Provide the NRV of receivables at the end of each quarter