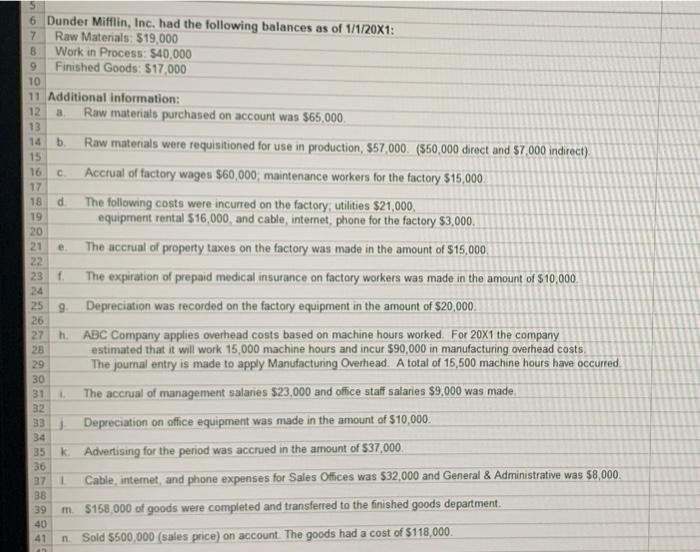

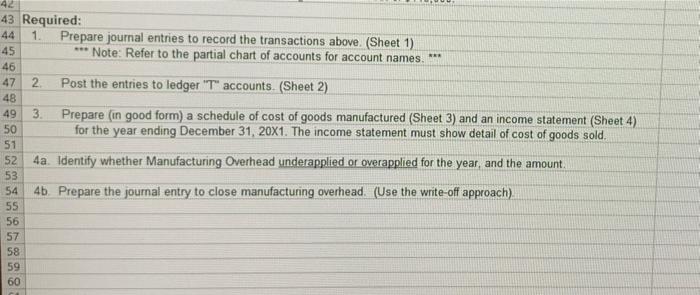

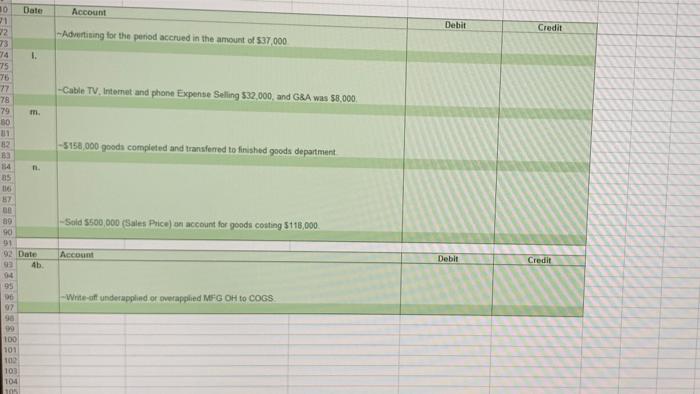

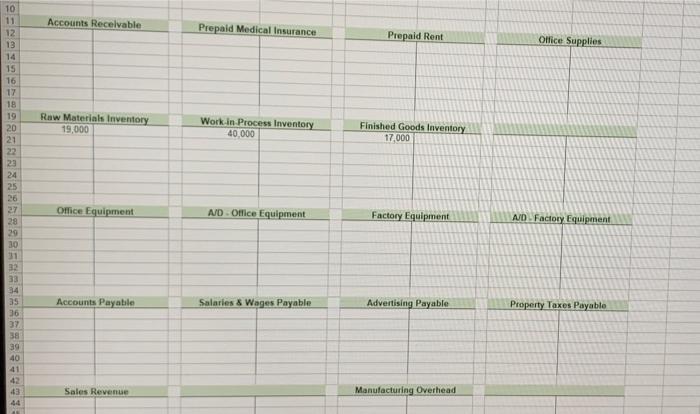

3 C 16 17 18 d e 5 6 Dunder Mifflin, Inc. had the following balances as of 1/1/20X1: 7 Raw Materials: $19,000 8 Work in Process: $40.000 9 Finished Goods: $17.000 10 11 Additional information: 12 Raw materials purchased on account was $65,000 13 14 b Raw materials were requisitioned for use in production, $57.000 (550,000 direct and $7.000 indirect). 15 Accrual of factory wages $60,000, maintenance workers for the factory S15,000 The following costs were incurred on the factory, utilities $21,000, 19 equipment rental $16,000, and cable, internet, phone for the factory $3,000. 20 21 The accrual of property taxes on the factory was made in the amount of $15,000 22 f The expiration of prepaid medical insurance on factory workers was made in the amount of $10,000 Depreciation was recorded on the factory equipment in the amount of $20,000 26 27 ABC Company applies overhead costs based on machine hours worked For 20x1 the company estimated that it will work 15,000 machine hours and incur $90,000 in manufacturing overhead costs The journal entry is made to apply Manufacturing Overhead. A total of 15,500 machine hours have occurred The accrual of management salaries $23,000 and office staff salaries $9,000 was made 32 Depreciation on office equipment was made in the amount of $10,000 k Advertising for the period was accrued in the amount of $37,000. Cable, internet, and phone expenses for Sales Offices was $32,000 and General & Administrative was $8,000. m. $158,000 of goods were completed and transferred to the finished goods department. Sold $500,000 (sales price) on account. The goods had a cost of $118,000 23 24 25 9 h 28 29 30 31 33 1 35 36 37 BB 39 40 41 n RRR 43 Required: 44 1. Prepare journal entries to record the transactions above. (Sheet 1) 45 *** Note: Refer to the partial chart of accounts for account names. 46 47 2 Post the entries to ledger "T" accounts. (Sheet 2) 48 49 3. Prepare (in good form) a schedule of cost of goods manufactured (Sheet 3) and an income statement (Sheet 4) 50 for the year ending December 31, 20X1. The income statement must show detail of cost of goods sold. 51 52 4a. Identify whether Manufacturing Overhead underapplied or overapplied for the year, and the amount 53 54 4b. Prepare the journal entry to close manufacturing overhead. (Use the write-off approach) 55 56 57 58 59 60 Date Account Debit Credit Advertising for the period accrued in the amount of 537 000 1. 10 21 22 73 74 75 75 77 78 79 30 11 62 Ba 14 -Cable TV, Internet and phone Expense Selling $32.000 and G&A was 58,000 m. -5158,000 goods completed and transferred to finished goods department Sold 5500,000 (Sales Price) on account for good costing 118,000 80 90 91 92 Date 4b 04 Account Debit Credit -White-off underapplind or overapplied MFG OH to COGS 06 92 98 100 101 102 100 104 105 Accounts Receivable Prepaid Medical Insurance Prepaid Rent Office Supplies 10 11 12 13 14 15 16 17 18 19 20 21 Raw Materials Inventory 19,000 Work in Process Inventory 40.000 Finished Goods Inventory 17,000 Office Equipment A/D - Office Equipment Factory Equipment AJD Factory Equipment 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 Accounts Payable Salaries & Wages Payable Advertising Payable Property Taxes Payable Sales Revenue Manufacturing Overhead 48 49 50 51 52 53 54 Cost of Goods Sold 55 56 57 58 59 60 61 62 63 Selling Expenses 64 65 Cable, Internet and Phone 66 67 60 Advertising Expense Office Staff Salaries Expense Depreciation: Office Equipment 70 71 72 73 General and Administrative Expenses: 74 75 Cable, Internet and Phone Management Salaries Expense 78 77 78 79 80 81 82 Dunder Mifflin, Inc. Schedule of Cost of Goods Manufactured For the Year Ending December 31, 20X1 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 46 47 48 49 50 51 52 10 ) Be sure to present details of cost of goods sold use textbook exhibts as a guide for formatting 11 2) Be sure to present details of individual expenses that make up seling general and ministrative expenses 15 Income Statement 16 For the Year Ending December 31, 20X1 17 18 19 20 21 22 23 04 25 27 20 30 31 32 34 35 36 37 30 39 40 41 42 43 44 45 46 47