Answered step by step

Verified Expert Solution

Question

1 Approved Answer

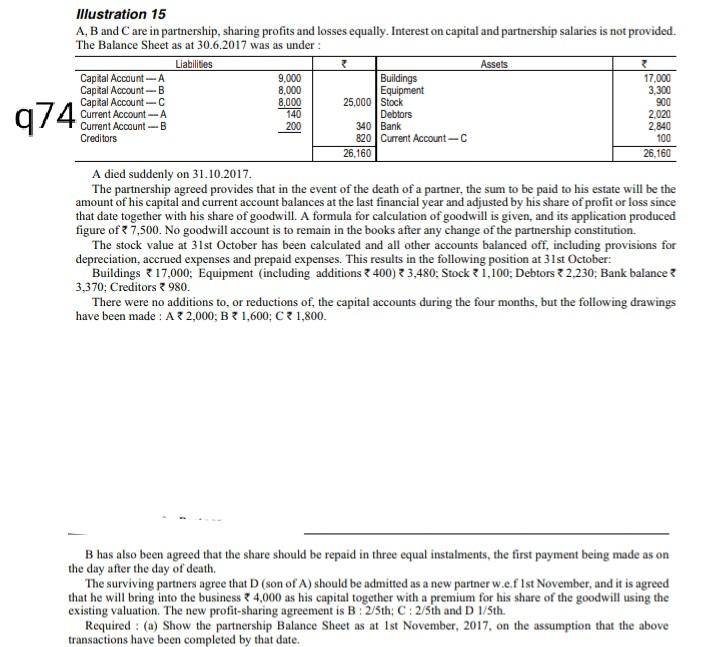

3 C 8.000 8,000 140 900 2.020 974 Illustration 15 A, B and Care in partnership, sharing profits and losses equally. Interest on capital and

3 C 8.000 8,000 140 900 2.020 974 Illustration 15 A, B and Care in partnership, sharing profits and losses equally. Interest on capital and partnership salaries is not provided. The Balance Sheet as at 30.6.2017 was as under: Liabilities Assets Capital Account - A 9,000 Buildings 17.000 Capital Account - B Equipment 3,300 Capital Account 25,000 Stock Current Account --A Debtors Current Account-B 200 340 Bank 2,840 Creditors 820 Current Account-C 100 26,160 26.160 A died suddenly on 31.10.2017. The partnership agreed provides that in the event of the death of a partner, the sum to be paid to his estate will be the amount of his capital and current account balances at the last financial year and adjusted by his share of profit or loss since that date together with his share of goodwill. A formula for calculation of goodwill is given, and its application produced figure of 7,500. No goodwill account is to remain in the books after any change of the partnership constitution. The stock value at 31st October has been calculated and all other accounts balanced off, including provisions for depreciation, accrued expenses and prepaid expenses. This results in the following position at 31st October Buildings 17,000; Equipment (including additions 2 400) 73,480: Stock? 1,100: Debtors ?2.230; Bank balance ? 3,370; Creditors 2 980. There were no additions to, or reductions of the capital accounts during the four months, but the following drawings have been made: A2,000; B2 1,600; C 1,800. B has also been agreed that the share should be repaid in three equal instalments, the first payment being made as on the day after the day of death, The surviving partners agree that D (son of A) should be admitted as a new partner w.e.f Ist November, and it is agreed that he will bring into the business 4,000 as his capital together with a premium for his share of the goodwill using the existing valuation. The new profit-sharing agreement is B : 2/5th: C: 2/5th and D 1/5th. Required: (a) Show the partnership Balance Sheet as at 1st November, 2017, on the assumption that the above transactions have been completed by that date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started