Answered step by step

Verified Expert Solution

Question

1 Approved Answer

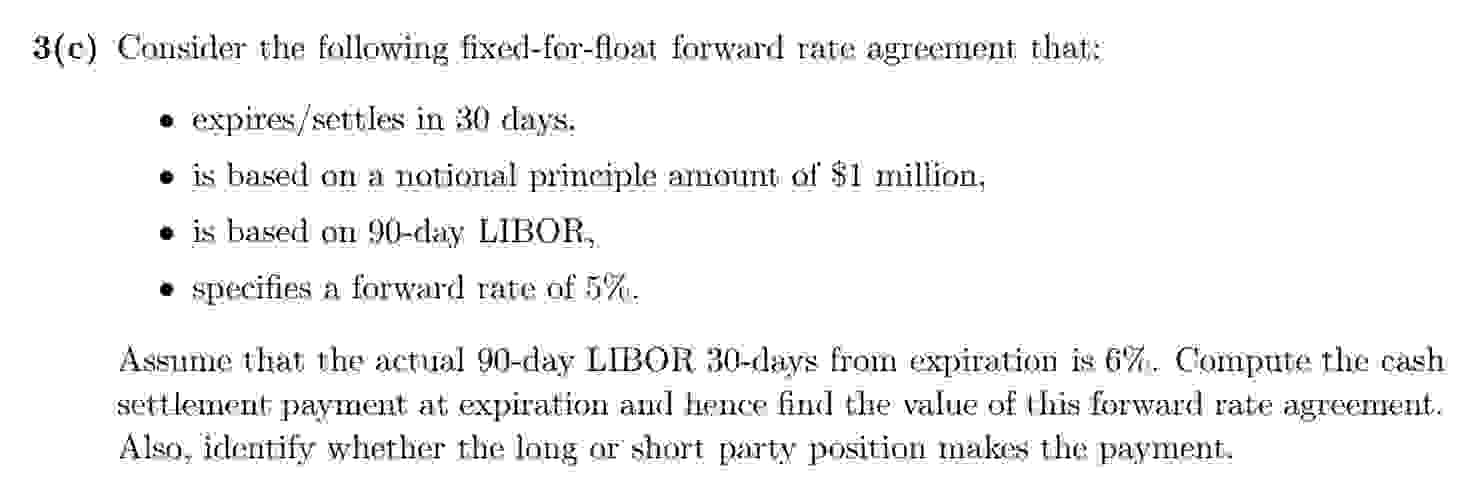

3 ( c ) Consider the following fixed - for - float forward rate agrement thatis expires / settles in 3 0 days: is based

c Consider the following fixedforfloat forward rate agrement thatis

expiressettles in days:

is based on a notional prineple amount of $ million,

is based on diay LIBOR.

specifies a forward rate of

Assume that the actual day LIBOR days from expiration is Compute the cash

settlement payment at expiration and hence find the value of this forward rate agreement.

Also, Identify whether the long or short party position makes the payment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started