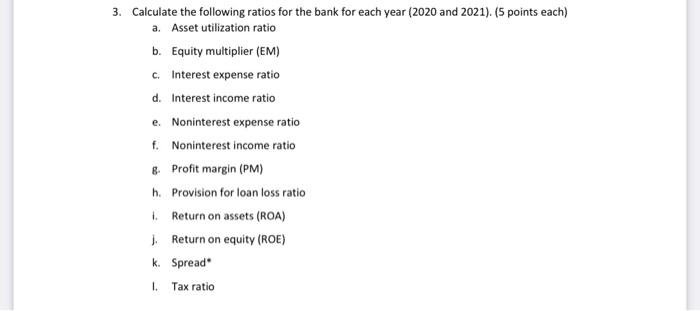

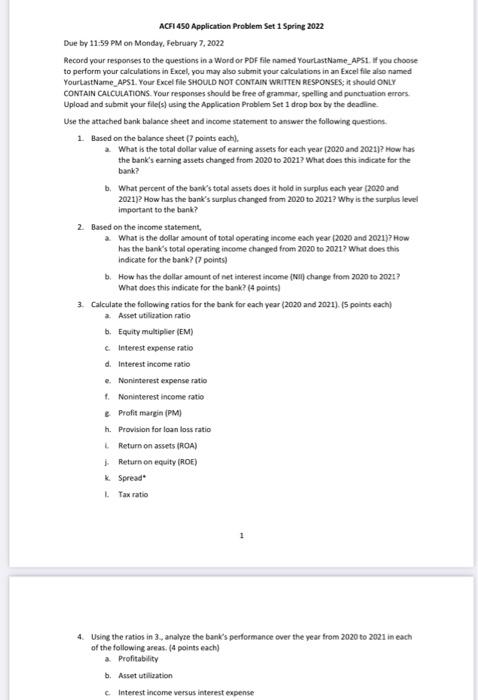

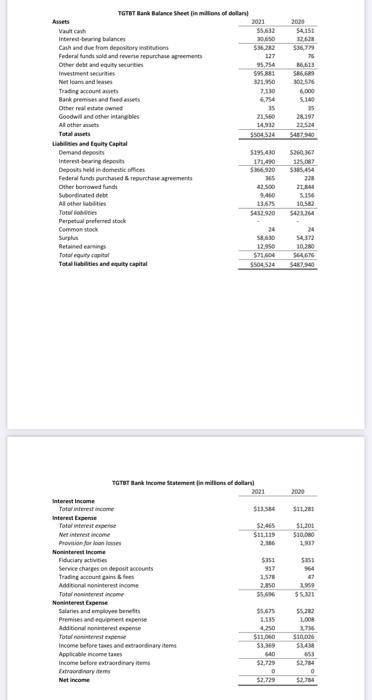

3. Calculate the following ratios for the bank for each year (2020 and 2021). (5 points each) a. Asset utilization ratio b. Equity multiplier (EM) c. Interest expense ratio d. Interest income ratio e. Noninterest expense ratio f. Noninterest income ratio & Profit margin (PM) h. Provision for loan loss ratio Return on assets (ROA) Return on equity (ROE) k. Spread I. Tax ratio ACFI 450 Application Problem Set 1 Spring 2022 Due by 11:59 PM on Monday, February 7, 2022 Record your responses to the questions in a Word or PDF file named YourtastName_APSL. If you choose to perform your calculations in Excel, you may also submit your calculations in an Excel file also named YourLastName APS1. Your Excel file SHOULD NOT CONTAIN WRITTEN RESPONSES, it should ONLY CONTAIN CALCULATIONS. Your responses should be free of grammar, spelling and punctuation errors Upload and submit your file(s) using the Application Problem Set 1 drop box by the deadline Use the attached bank balance sheet and income statement to answer the following questions 1. Based on the balance sheet (7 points each). What is the total dollar value of earning assets for each year (2020 and 20211? How has the bank's earning assets changed from 2020 to 2021? What does this indicate for the bank? b. What percent of the bank's total assets does it hold in surplus each year (2020 and 20212 How has the bank's surplus changed from 2020 to 2021? Why is the surplus level important to the bank? 2 Based on the income statement, a What is the dollar amount of total operating income each year 2020 and 2021)? How has the bank's total operating income changed from 2020 to 2021? What does this indicate for the bank? 7 points) b. How has the dollar amount of net interest income (NH) change from 2020 to 2021? What does this indicate for the bank? (4 points) 3. Calculate the following ratios for the bank for each year (2020 and 2021). (5 points each) a Asset utilisation ratio 6. Equity multiplier (EM) Interest expense ratio d. Interest income ratio e. Noninterest expense ratio 1. Noninterest income ratio B Profit margin (PM) h. Provision for loan loss ratio Return on assets (ROA) Return on equity (ROE) Spread L Tax ratio 1 4. Using the ratios in 3, analyze the bank's performance over the year from 2020 to 2021 in each of the following areas. (4 points each) a Profitability b. Asset utilisation Interest income versus interest expense 2000 54151 20 76 36611 585,69 2576 6.000 5.14 22.5.14 548790 TGTT Bank Balance Sheet in millions of dollars Assets 2031 Vault 55.633 Interest-beng balances 050 Cash and due from depository in Federal unde sold and new purchase agreements 127 Other dutt and equity secure 954 Investment securities $95.881 Nelle $21.950 Trading 7.110 Bank premises and resets Other real estate owned 35 Goodwill and other intangles 21.560 Al other 4. Tatial eart $50430 Liabilities and Equity Capital Demand deposits $295.430 Interest being deuts 171.450 Depois held in domestic offices SMA20 Federal funds purchased repurchase agreement Other borrowed and 500 Subordinated debt AD All other abilities 13.6 Toto foties $452.920 Perpetual preferred stock Common stock 24 Surplus 58.630 Retained earnings 12.950 Totalcowy $71.600 Total abilities and equity capital $504534 $260,367 135.0 $385.454 21 15 10:50 5:1 24 54.33 10:20 SAN 2000 $11.201 $1.201 $10,000 41 TGTT Bank Income Statement in millions of dollar 2021 Interest income Total interest income Interestepene Total interest expense Met interest income $11.19 Pretion for too lose Noninterest Income Fiduciary activities Service charges on deposit accounts 957 Trading accountants 1.578 Additionat noneterest income 2.50 Total noninterest income Noninterest Expense Salaries and employees 55.625 Premises and expense 1.135 Additional interesente 250 Totul expense $11.000 Income before taxes diary 53, Applicable income 40 Income before extraordinary $2.729 Extraordinary Net Income $2,729 $5.21 55.202 100 M $10.000 653 0 0 $2,54 3. Calculate the following ratios for the bank for each year (2020 and 2021). (5 points each) a. Asset utilization ratio b. Equity multiplier (EM) c. Interest expense ratio d. Interest income ratio e. Noninterest expense ratio f. Noninterest income ratio & Profit margin (PM) h. Provision for loan loss ratio Return on assets (ROA) Return on equity (ROE) k. Spread I. Tax ratio ACFI 450 Application Problem Set 1 Spring 2022 Due by 11:59 PM on Monday, February 7, 2022 Record your responses to the questions in a Word or PDF file named YourtastName_APSL. If you choose to perform your calculations in Excel, you may also submit your calculations in an Excel file also named YourLastName APS1. Your Excel file SHOULD NOT CONTAIN WRITTEN RESPONSES, it should ONLY CONTAIN CALCULATIONS. Your responses should be free of grammar, spelling and punctuation errors Upload and submit your file(s) using the Application Problem Set 1 drop box by the deadline Use the attached bank balance sheet and income statement to answer the following questions 1. Based on the balance sheet (7 points each). What is the total dollar value of earning assets for each year (2020 and 20211? How has the bank's earning assets changed from 2020 to 2021? What does this indicate for the bank? b. What percent of the bank's total assets does it hold in surplus each year (2020 and 20212 How has the bank's surplus changed from 2020 to 2021? Why is the surplus level important to the bank? 2 Based on the income statement, a What is the dollar amount of total operating income each year 2020 and 2021)? How has the bank's total operating income changed from 2020 to 2021? What does this indicate for the bank? 7 points) b. How has the dollar amount of net interest income (NH) change from 2020 to 2021? What does this indicate for the bank? (4 points) 3. Calculate the following ratios for the bank for each year (2020 and 2021). (5 points each) a Asset utilisation ratio 6. Equity multiplier (EM) Interest expense ratio d. Interest income ratio e. Noninterest expense ratio 1. Noninterest income ratio B Profit margin (PM) h. Provision for loan loss ratio Return on assets (ROA) Return on equity (ROE) Spread L Tax ratio 1 4. Using the ratios in 3, analyze the bank's performance over the year from 2020 to 2021 in each of the following areas. (4 points each) a Profitability b. Asset utilisation Interest income versus interest expense 2000 54151 20 76 36611 585,69 2576 6.000 5.14 22.5.14 548790 TGTT Bank Balance Sheet in millions of dollars Assets 2031 Vault 55.633 Interest-beng balances 050 Cash and due from depository in Federal unde sold and new purchase agreements 127 Other dutt and equity secure 954 Investment securities $95.881 Nelle $21.950 Trading 7.110 Bank premises and resets Other real estate owned 35 Goodwill and other intangles 21.560 Al other 4. Tatial eart $50430 Liabilities and Equity Capital Demand deposits $295.430 Interest being deuts 171.450 Depois held in domestic offices SMA20 Federal funds purchased repurchase agreement Other borrowed and 500 Subordinated debt AD All other abilities 13.6 Toto foties $452.920 Perpetual preferred stock Common stock 24 Surplus 58.630 Retained earnings 12.950 Totalcowy $71.600 Total abilities and equity capital $504534 $260,367 135.0 $385.454 21 15 10:50 5:1 24 54.33 10:20 SAN 2000 $11.201 $1.201 $10,000 41 TGTT Bank Income Statement in millions of dollar 2021 Interest income Total interest income Interestepene Total interest expense Met interest income $11.19 Pretion for too lose Noninterest Income Fiduciary activities Service charges on deposit accounts 957 Trading accountants 1.578 Additionat noneterest income 2.50 Total noninterest income Noninterest Expense Salaries and employees 55.625 Premises and expense 1.135 Additional interesente 250 Totul expense $11.000 Income before taxes diary 53, Applicable income 40 Income before extraordinary $2.729 Extraordinary Net Income $2,729 $5.21 55.202 100 M $10.000 653 0 0 $2,54