Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C company and B company signed a lease contract to purchase an airplane, B1 model. Both have signed a 20-year non-cancellable contract. There are

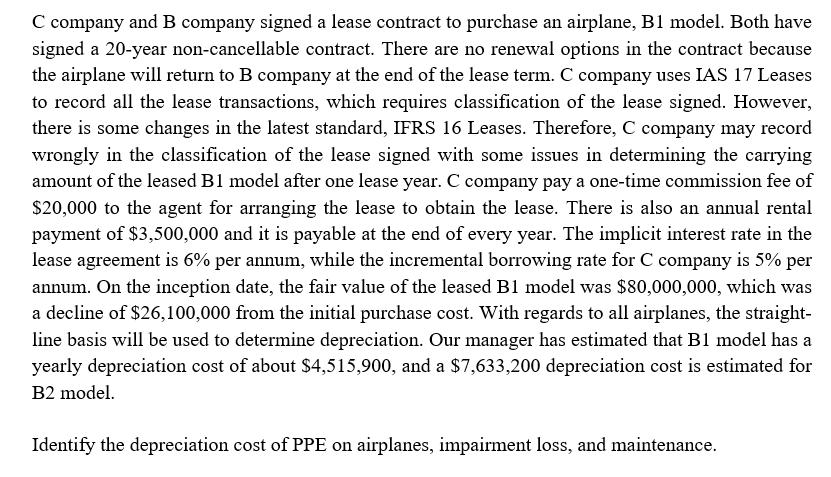

C company and B company signed a lease contract to purchase an airplane, B1 model. Both have signed a 20-year non-cancellable contract. There are no renewal options in the contract because the airplane will return to B company at the end of the lease term. C company uses IAS 17 Leases to record all the lease transactions, which requires classification of the lease signed. However, there is some changes in the latest standard, IFRS 16 Leases. Therefore, C company may record wrongly in the classification of the lease signed with some issues in determining the carrying amount of the leased B1 model after one lease year. C company pay a one-time commission fee of $20,000 to the agent for arranging the lease to obtain the lease. There is also an annual rental payment of $3,500,000 and it is payable at the end of every year. The implicit interest rate in the lease agreement is 6% per annum, while the incremental borrowing rate for C company is 5% per annum. On the inception date, the fair value of the leased B1 model was $80,000,000, which was a decline of $26,100,000 from the initial purchase cost. With regards to all airplanes, the straight- line basis will be used to determine depreciation. Our manager has estimated that B1 model has a yearly depreciation cost of about $4,515,900, and a $7,633,200 depreciation cost is estimated for B2 model. Identify the depreciation cost of PPE on airplanes, impairment loss, and maintenance.

Step by Step Solution

★★★★★

3.31 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

Assuming that C organisation classifies the rent as a finance rent the depreciation value of PPE on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started