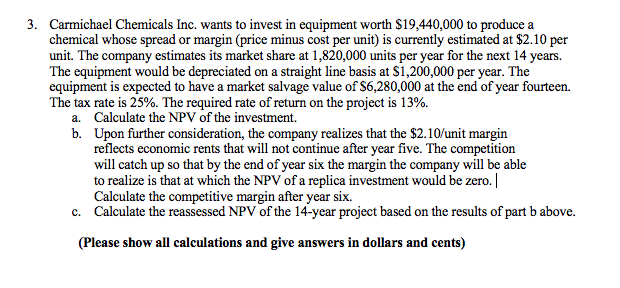

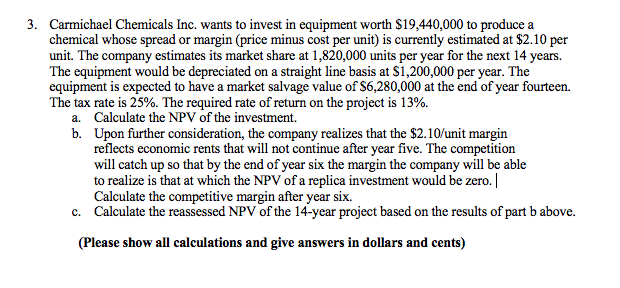

3. Carmichael Chemicals Inc. wants to invest in equipment worth $19,440,000 to produce a chemical whose spread or margin (price minus cost per unit) is currently estimated at $2.10 per unit. The company estimates its market share at 1,820,000 units per year for the next 14 years. The equipment would be depreciated on a straight line basis at $1,200,000 per year. The equipment is expected to have a market salvage value of $6,280,000 at the end of year fourteen. The tax rate is 25%. The required rate of return on the project is 13%. a. Calculate the NPV of the investment. b. Upon further consideration, the company realizes that the $2.10/unit margin reflects economic rents that will not continue after year five. The competition will catch up so that by the end of year six the margin the company will be able to realize is that at which the NPV of a replica investment would be zero. Calculate the competitive margin after year six. c. Calculate the reassessed NPV of the 14-year project based on the results of part b above. (Please show all calculations and give answers in dollars and cents) 3. Carmichael Chemicals Inc. wants to invest in equipment worth $19,440,000 to produce a chemical whose spread or margin (price minus cost per unit) is currently estimated at $2.10 per unit. The company estimates its market share at 1,820,000 units per year for the next 14 years. The equipment would be depreciated on a straight line basis at $1,200,000 per year. The equipment is expected to have a market salvage value of $6,280,000 at the end of year fourteen. The tax rate is 25%. The required rate of return on the project is 13%. a. Calculate the NPV of the investment. b. Upon further consideration, the company realizes that the $2.10/unit margin reflects economic rents that will not continue after year five. The competition will catch up so that by the end of year six the margin the company will be able to realize is that at which the NPV of a replica investment would be zero. Calculate the competitive margin after year six. c. Calculate the reassessed NPV of the 14-year project based on the results of part b above. (Please show all calculations and give answers in dollars and cents)