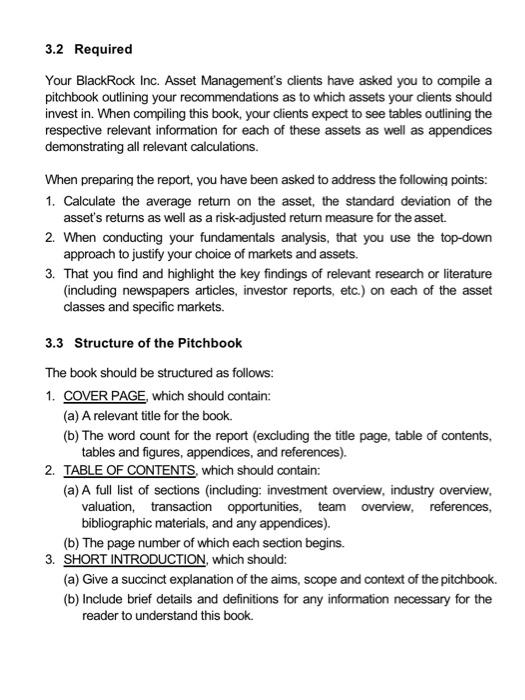

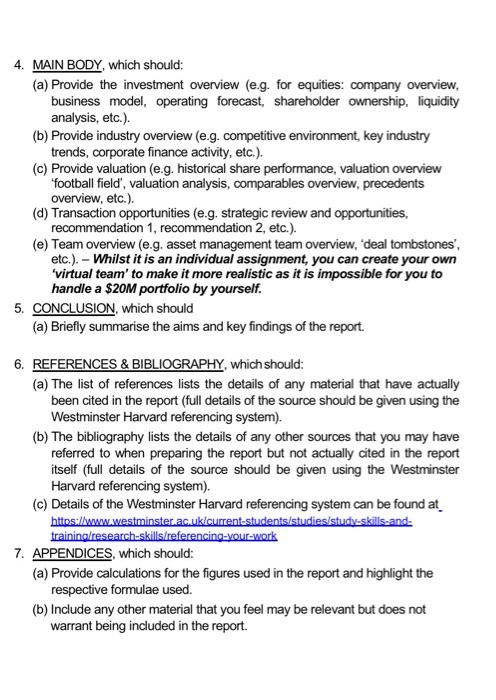

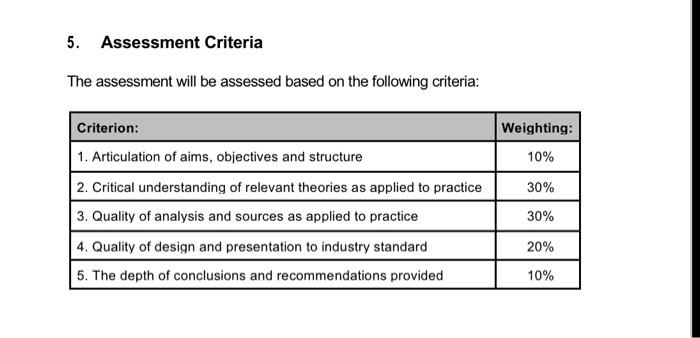

3. Case Study 3.1 BlackRock Inc. Asset Management You are the Managing Director of BlackRock Inc Asset Management team. You were in charge of a SSM fund pool. Your dients were pleased with the performance of their portfolios last time that they have decided to increase your fund pool from SSM to 520M. Given that BlackRock is the largest asset management firm based on its $9T AUM as of 31 March 2021 based on advratings), your clients have put significant must in your ability to manage their portfolios. They have instructed you to diversity their assets beyond global equities into other financial assets. Specifically, they want to see their portfolios of 10 assets comprising of global equities and other financial assets of your own choosing Furthermore, due to the scale of the investment your dients have asked you to construct a pictbook and present this more formally and professionally to them as your written proposals. Use the Bloomberg terminal (or other similar databases) to select and gather data for these assets. The following conditions apply 1. Your clients indicated that you are to invest all of the $20M fund in these assets and provide recommendations for the next 12 months. You can assume to use the same 12 month period as in the previous assessment 2 You should assume the same the risk atitude of your clients as before. They can roughly be divided into those who want to moimise motum for a given level or risk or minimise risk for a given level of retum 3. As the managing director and based on your world renowned reputation, you have the discretion to take a long and a short positions in these assets. For example, if you employ both a long and a short positions, then it is possible for your long position to go over $20M for as long as the total long and short positions is SZOM. It is advisable that you stick with the types of assets that you learned in this module, however, should you decide to choose specific financial assets not covered in this module you are free to do so provided that you understand the nature of how these assets operate and perform 4 Your clients also require you to provide rationale for the assets chosen in the investment For instance, if you decide to Investin TSLA stock, the rationale behind this decision (eg transparency, liquidity growth retums, etc.) You can also add Key Performance Indicators Ps) such as income statement balance sheet financial ratios, segment data credit ratings, camings estimate relative performance, share price performance, etc.) to your analysis. For other types of assets, you should think carefully about what types of KPIs are relevant to those asset types SINCEROW Couce 2021-23 5. In terms of historical trade data you should use andior analyse a minimum of 5 years' worth of data at a monthly frequency. Please include COVID 19 periods in your data selection and analysis. Bear in mind that some of the assets are UK andor EU asset types, you will also need to think about the Brexit implications in your decision 6. Hint: Keep in mind that while there is a lot information you will need to present in writing, you are essentially pitching your recommendations What does this mean? I means that your clients do not want to be bored with pages and pages of uninteresting facts hence try to design the presentation in a succinct. concise condensed for that is simple to look at but yet informative and elegant this sometimes means using al the space available in a creative way) Cosmetics is paramount for the assessment 3.2 Required Your BlackRock Inc. Asset Management's clients have asked you to compile a pitchbook outlining your recommendations as to which assets your clients should invest in. When compiling this book, your clients expect to see tables outlining the respective relevant information for each of these assets as well as appendices demonstrating all relevant calculations. When preparing the report, you have been asked to address the following points: 1. Calculate the average return on the asset, the standard deviation of the asset's returns as well as a risk-adjusted return measure for the asset. 2. When conducting your fundamentals analysis, that you use the top-down approach to justify your choice of markets and assets. 3. That you find and highlight the key findings of relevant research or literature (including newspapers articles, investor reports, etc.) on each of the asset classes and specific markets. 3.3 Structure of the Pitchbook The book should be structured as follows: 1. COVER PAGE, which should contain: (a) A relevant title for the book. (b) The word count for the report (excluding the title page, table of contents, tables and figures, appendices, and references). 2. TABLE OF CONTENTS, which should contain: (a) A full list of sections (including: investment overview, industry overview, valuation, transaction opportunities, team overview, references, bibliographic materials, and any appendices). (b) The page number of which each section begins. 3. SHORT INTRODUCTION, which should: (a) Give a succinct explanation of the aims, scope and context of the pitchbook. (b) Include brief details and definitions for any information necessary for the reader to understand this book. 4. MAIN BODY, which should (a) Provide the investment overview (e.g. for equities: company overview, business model, operating forecast, shareholder ownership, liquidity analysis, etc.). (b) Provide industry overview (e.g. competitive environment, key industry trends, corporate finance activity, etc.). (c) Provide valuation (e.g. historical share performance, valuation overview football field', valuation analysis, comparables overview, precedents overview, etc.). (d) Transaction opportunities (e.g. strategic review and opportunities, recommendation 1, recommendation 2, etc.). (e) Team overview (e.g. asset management team overview, 'deal tombstones, etc.). - Whilst it is an individual assignment, you can create your own 'virtual team' to make it more realistic as it is impossible for you to handle a $20M portfolio by yourself. 5. CONCLUSION, which should (a) Briefly summarise the aims and key findings of the report. 6. REFERENCES & BIBLIOGRAPHY, which should (a) The list of references lists the details of any material that have actually been cited in the report (full details of the source should be given using the Westminster Harvard referencing system). (b) The bibliography lists the details of any other sources that you may have referred to when preparing the report but not actually cited in the report itself (full details of the source should be given using the Westminster Harvard referencing system). (c) Details of the Westminster Harvard referencing system can be found at https://www.westminster.ac.uk/current-students/studies/study-skills-and- training/research-skills/referencing-your-work 7. APPENDICES, which should: (a) Provide calculations for the figures used in the report and highlight the respective formulae used. (b) Include any other material that you feel may be relevant but does not warrant being included in the report. 5. Assessment Criteria The assessment will be assessed based on the following criteria: Weighting: 10% 30% Criterion: 1. Articulation of aims, objectives and structure 2. Critical understanding of relevant theories as applied to practice 3. Quality of analysis and sources as applied to practice 4. Quality of design and presentation to industry standard 5. The depth of conclusions and recommendations provided 30% 20% 10% 3. Case Study 3.1 BlackRock Inc. Asset Management You are the Managing Director of BlackRock Inc Asset Management team. You were in charge of a SSM fund pool. Your dients were pleased with the performance of their portfolios last time that they have decided to increase your fund pool from SSM to 520M. Given that BlackRock is the largest asset management firm based on its $9T AUM as of 31 March 2021 based on advratings), your clients have put significant must in your ability to manage their portfolios. They have instructed you to diversity their assets beyond global equities into other financial assets. Specifically, they want to see their portfolios of 10 assets comprising of global equities and other financial assets of your own choosing Furthermore, due to the scale of the investment your dients have asked you to construct a pictbook and present this more formally and professionally to them as your written proposals. Use the Bloomberg terminal (or other similar databases) to select and gather data for these assets. The following conditions apply 1. Your clients indicated that you are to invest all of the $20M fund in these assets and provide recommendations for the next 12 months. You can assume to use the same 12 month period as in the previous assessment 2 You should assume the same the risk atitude of your clients as before. They can roughly be divided into those who want to moimise motum for a given level or risk or minimise risk for a given level of retum 3. As the managing director and based on your world renowned reputation, you have the discretion to take a long and a short positions in these assets. For example, if you employ both a long and a short positions, then it is possible for your long position to go over $20M for as long as the total long and short positions is SZOM. It is advisable that you stick with the types of assets that you learned in this module, however, should you decide to choose specific financial assets not covered in this module you are free to do so provided that you understand the nature of how these assets operate and perform 4 Your clients also require you to provide rationale for the assets chosen in the investment For instance, if you decide to Investin TSLA stock, the rationale behind this decision (eg transparency, liquidity growth retums, etc.) You can also add Key Performance Indicators Ps) such as income statement balance sheet financial ratios, segment data credit ratings, camings estimate relative performance, share price performance, etc.) to your analysis. For other types of assets, you should think carefully about what types of KPIs are relevant to those asset types SINCEROW Couce 2021-23 5. In terms of historical trade data you should use andior analyse a minimum of 5 years' worth of data at a monthly frequency. Please include COVID 19 periods in your data selection and analysis. Bear in mind that some of the assets are UK andor EU asset types, you will also need to think about the Brexit implications in your decision 6. Hint: Keep in mind that while there is a lot information you will need to present in writing, you are essentially pitching your recommendations What does this mean? I means that your clients do not want to be bored with pages and pages of uninteresting facts hence try to design the presentation in a succinct. concise condensed for that is simple to look at but yet informative and elegant this sometimes means using al the space available in a creative way) Cosmetics is paramount for the assessment 3.2 Required Your BlackRock Inc. Asset Management's clients have asked you to compile a pitchbook outlining your recommendations as to which assets your clients should invest in. When compiling this book, your clients expect to see tables outlining the respective relevant information for each of these assets as well as appendices demonstrating all relevant calculations. When preparing the report, you have been asked to address the following points: 1. Calculate the average return on the asset, the standard deviation of the asset's returns as well as a risk-adjusted return measure for the asset. 2. When conducting your fundamentals analysis, that you use the top-down approach to justify your choice of markets and assets. 3. That you find and highlight the key findings of relevant research or literature (including newspapers articles, investor reports, etc.) on each of the asset classes and specific markets. 3.3 Structure of the Pitchbook The book should be structured as follows: 1. COVER PAGE, which should contain: (a) A relevant title for the book. (b) The word count for the report (excluding the title page, table of contents, tables and figures, appendices, and references). 2. TABLE OF CONTENTS, which should contain: (a) A full list of sections (including: investment overview, industry overview, valuation, transaction opportunities, team overview, references, bibliographic materials, and any appendices). (b) The page number of which each section begins. 3. SHORT INTRODUCTION, which should: (a) Give a succinct explanation of the aims, scope and context of the pitchbook. (b) Include brief details and definitions for any information necessary for the reader to understand this book. 4. MAIN BODY, which should (a) Provide the investment overview (e.g. for equities: company overview, business model, operating forecast, shareholder ownership, liquidity analysis, etc.). (b) Provide industry overview (e.g. competitive environment, key industry trends, corporate finance activity, etc.). (c) Provide valuation (e.g. historical share performance, valuation overview football field', valuation analysis, comparables overview, precedents overview, etc.). (d) Transaction opportunities (e.g. strategic review and opportunities, recommendation 1, recommendation 2, etc.). (e) Team overview (e.g. asset management team overview, 'deal tombstones, etc.). - Whilst it is an individual assignment, you can create your own 'virtual team' to make it more realistic as it is impossible for you to handle a $20M portfolio by yourself. 5. CONCLUSION, which should (a) Briefly summarise the aims and key findings of the report. 6. REFERENCES & BIBLIOGRAPHY, which should (a) The list of references lists the details of any material that have actually been cited in the report (full details of the source should be given using the Westminster Harvard referencing system). (b) The bibliography lists the details of any other sources that you may have referred to when preparing the report but not actually cited in the report itself (full details of the source should be given using the Westminster Harvard referencing system). (c) Details of the Westminster Harvard referencing system can be found at https://www.westminster.ac.uk/current-students/studies/study-skills-and- training/research-skills/referencing-your-work 7. APPENDICES, which should: (a) Provide calculations for the figures used in the report and highlight the respective formulae used. (b) Include any other material that you feel may be relevant but does not warrant being included in the report. 5. Assessment Criteria The assessment will be assessed based on the following criteria: Weighting: 10% 30% Criterion: 1. Articulation of aims, objectives and structure 2. Critical understanding of relevant theories as applied to practice 3. Quality of analysis and sources as applied to practice 4. Quality of design and presentation to industry standard 5. The depth of conclusions and recommendations provided 30% 20% 10%