Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3) Cass SA, a leading wind energy developer, is planning an acquisition of City BV, a cable company. Cass is offering City's shareholders 0.25

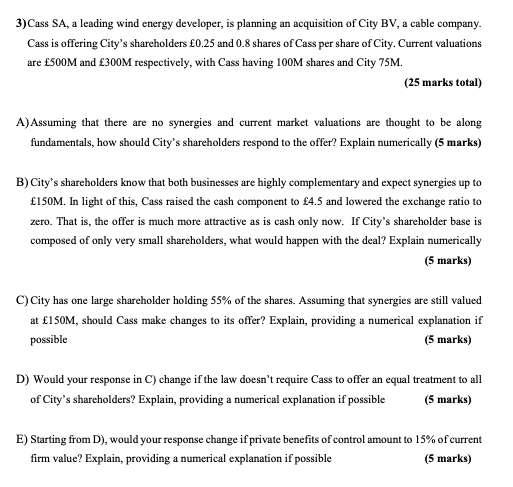

3) Cass SA, a leading wind energy developer, is planning an acquisition of City BV, a cable company. Cass is offering City's shareholders 0.25 and 0.8 shares of Cass per share of City. Current valuations are 500M and 300M respectively, with Cass having 100M shares and City 75M. (25 marks total) A) Assuming that there are no synergies and current market valuations are thought to be along fundamentals, how should City's shareholders respond to the offer? Explain numerically (5 marks) B) City's shareholders know that both businesses are highly complementary and expect synergies up to 150M. In light of this, Cass raised the cash component to 4.5 and lowered the exchange ratio to zero. That is, the offer is much more attractive as is cash only now. If City's shareholder base is composed of only very small shareholders, what would happen with the deal? Explain numerically (5 marks) C) City has one large shareholder holding 55% of the shares. Assuming that synergies are still valued at 150M, should Cass make changes to its offer? Explain, providing a numerical explanation if possible (5 marks) D) Would your response in C) change if the law doesn't require Cass to offer an equal treatment to all of City's shareholders? Explain, providing a numerical explanation if possible (5 marks) E) Starting from D), would your response change if private benefits of control amount to 15% of current firm value? Explain, providing a numerical explanation if possible (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Assuming no synergies and current market valuations are along fundamentals Citys shareholders should evaluate the offer based on the relative value they are receiving compared to their current inves...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started