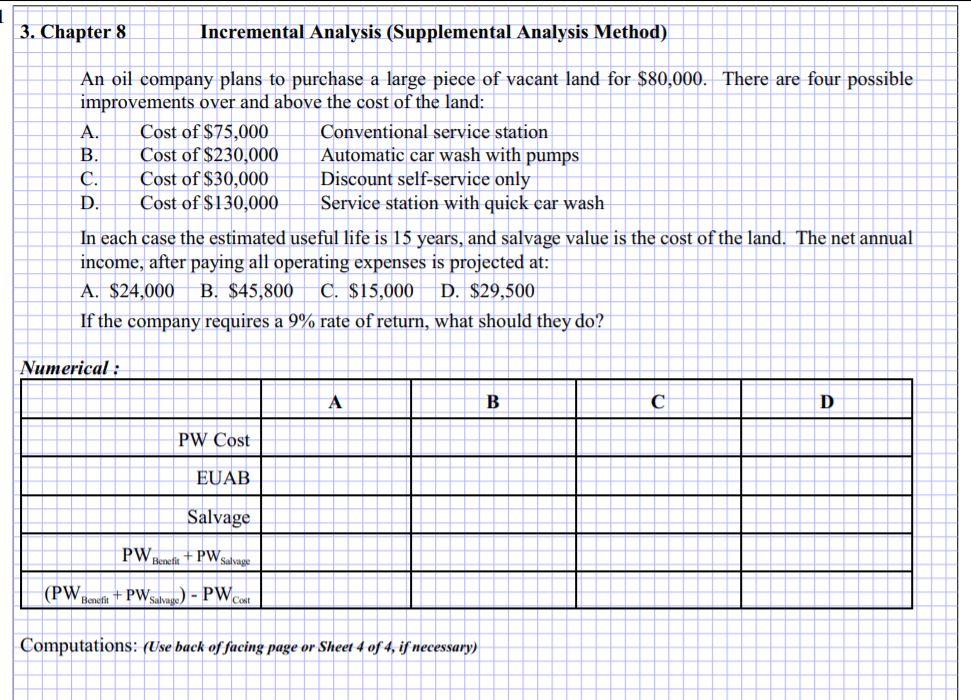

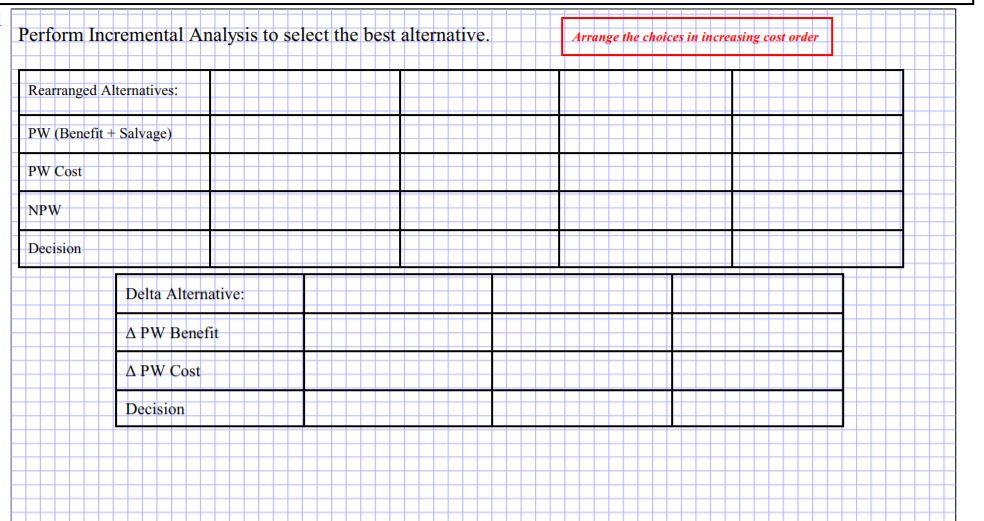

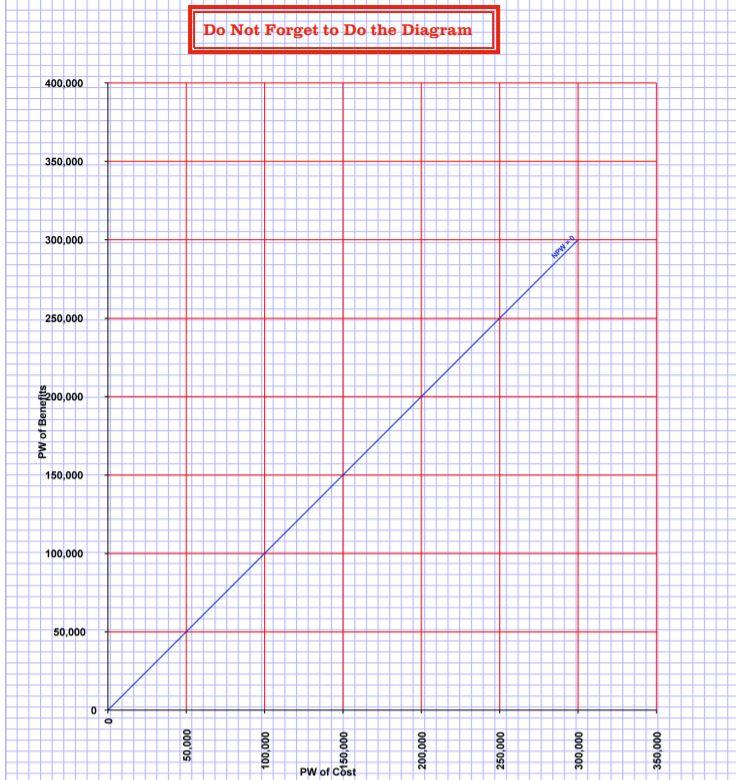

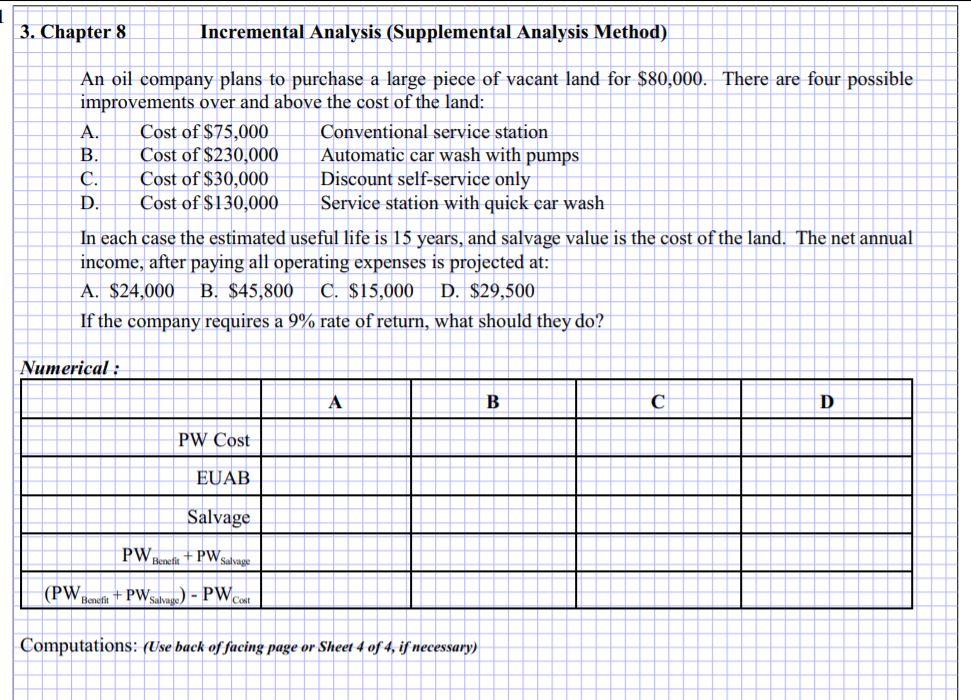

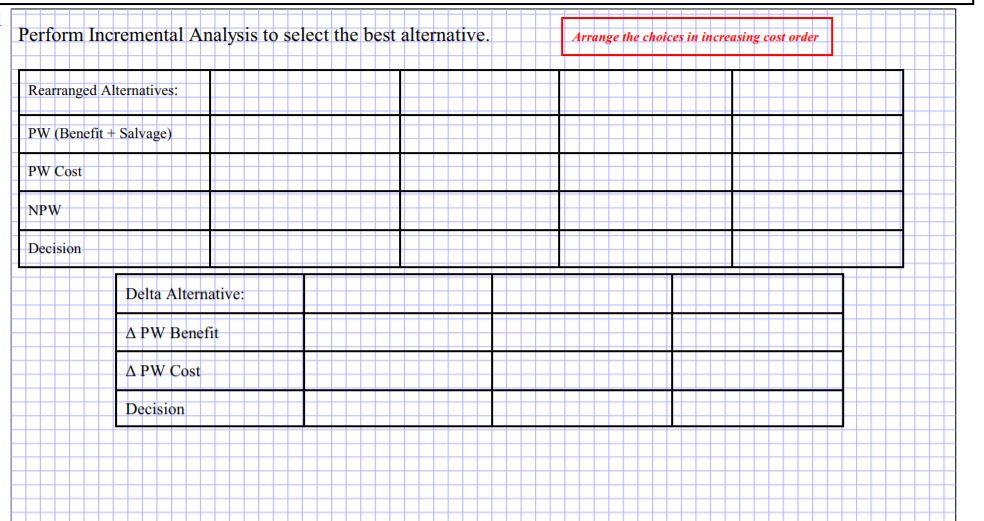

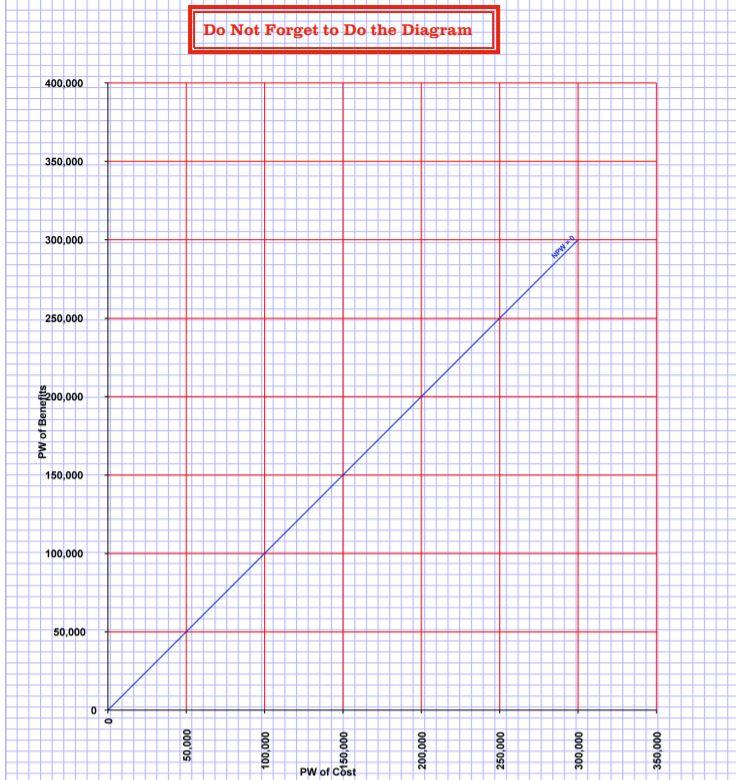

3. Chapter 8 Incremental Analysis (Supplemental Analysis Method) An oil company plans to purchase a large piece of vacant land for $80,000. There are four possible improvements over and above the cost of the land: A. Cost of $75,000 Conventional service station B. Cost of $230,000 Automatic car wash with pumps C. Cost of $30,000 Discount self-service only D. Cost of $130,000 Service station with quick car wash In each case the estimated useful life is 15 years, and salvage value is the cost of the land. The net annual income, after paying all operating expenses is projected at: A. $24,000 B. $45,800 C. $15,000 D. $29,500 If the company requires a 9% rate of return, what should they do? Numerical : A B C D PW Cost EUAB Salvage PW Benetic + PW salvage (PW Benefit PW salvage) - PW.COM Computations: (Use back of facing page or Sheet 4 of 4, if necessary) Perform Incremental Analysis to select the best alternative. Arrange the choices in increasing cost order Rearranged Alternatives: PW (Benefit + Salvage) PW Cost NPW Decision Delta Alternative: A PW Benefit APW Cost Decision Do Not Forget to Do the Diagram 400.000 400.000 350,00 350,000 300,000 300,000 NPWO 250,000 2000,000 PW of Benefits 150,000 100,000 50,000 0 0 50,000 g PW of Cost 3. Chapter 8 Incremental Analysis (Supplemental Analysis Method) An oil company plans to purchase a large piece of vacant land for $80,000. There are four possible improvements over and above the cost of the land: A. Cost of $75,000 Conventional service station B. Cost of $230,000 Automatic car wash with pumps C. Cost of $30,000 Discount self-service only D. Cost of $130,000 Service station with quick car wash In each case the estimated useful life is 15 years, and salvage value is the cost of the land. The net annual income, after paying all operating expenses is projected at: A. $24,000 B. $45,800 C. $15,000 D. $29,500 If the company requires a 9% rate of return, what should they do? Numerical : A B C D PW Cost EUAB Salvage PW Benetic + PW salvage (PW Benefit PW salvage) - PW.COM Computations: (Use back of facing page or Sheet 4 of 4, if necessary) Perform Incremental Analysis to select the best alternative. Arrange the choices in increasing cost order Rearranged Alternatives: PW (Benefit + Salvage) PW Cost NPW Decision Delta Alternative: A PW Benefit APW Cost Decision Do Not Forget to Do the Diagram 400.000 400.000 350,00 350,000 300,000 300,000 NPWO 250,000 2000,000 PW of Benefits 150,000 100,000 50,000 0 0 50,000 g PW of Cost