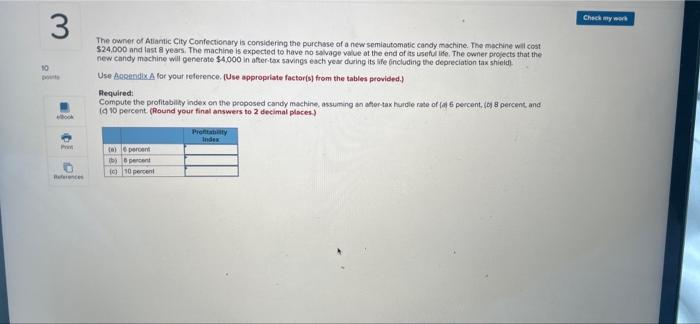

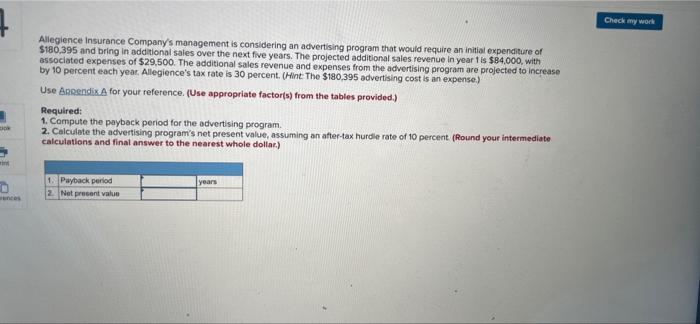

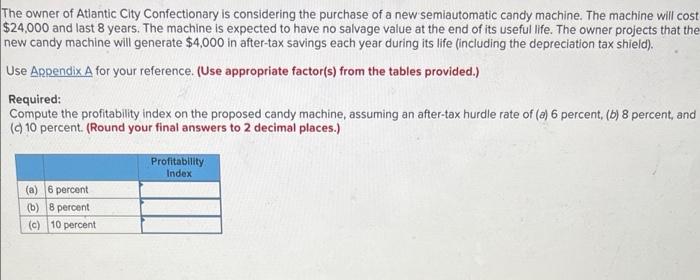

3 Chew 534000 The town of free cm you herriate for the the . 46 demy Check my work 3 10 The owner of Atlantic City Confectionary is considering the purchase of a new semiautomatic candy machine. The machine will cost $24.000 and last years. The machine is expected to have no salvage value at the end of its useful life. The owner projects that the new candy machine will generate $4.000 in after tax savings each year during its life including the depreciation tax shield Use Boondis.A for your reference. (Use appropriate factor(s) from the tables provided) Required: Compute the profitability index on the proposed candy machine suming enter to hurdle rate of fat percent. (6) 8 percent and ( 10 percent (Round your final answers to 2 decimal places) . Pretty Index al percent percent 10. 10 percent Biences 7 Check my work Allegience Insurance Company's management is considering an advertising program that would require an initial expenditure of $180,395 and bring in additional sales over the next five years. The projected additional sales revenue in year is $84.000, with associated expenses of $29.500. The additional sales revenue and expenses from the advertising program are projected to increase by 10 percent each year. Allegiance's tax rate is 30 percent. (Hint: The $180,395 advertising cost is an expense) Use Anvendix A for your reference (Use appropriate factor(s) from the tables provided) Required: 1. Compute the payback period for the advertising program 2. Calculate the advertising program's net present value, assuming an after-tax hurdle rate of 10 percent (Round your intermediate calculations and final answer to the nearest whole dollar) 1. Pwyback period 2. Net present value years The owner of Atlantic City Confectionary is considering the purchase of a new semiautomatic candy machine. The machine will cost $24,000 and last 8 years. The machine is expected to have no salvage value at the end of its useful life. The owner projects that the new candy machine will generate $4,000 in after-tax savings each year during its life (including the depreciation tax shield). Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: Compute the profitability index on the proposed candy machine, assuming an after-tax hurdle rate of (a) 6 percent, (b) 8 percent, and (10 percent. (Round your final answers to 2 decimal places.) Profitability Index (a) 6 percent (b) 8 percent (c) 10 percent