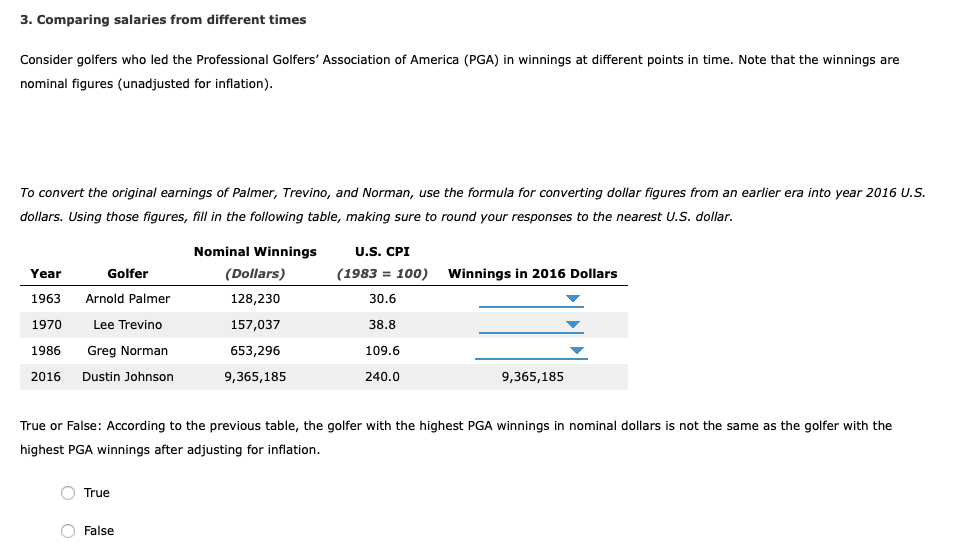

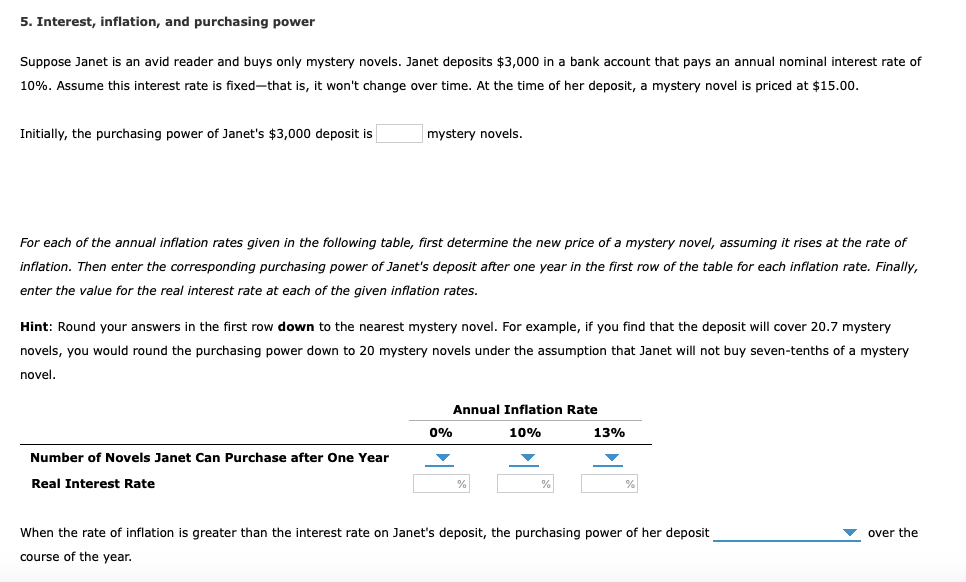

3. Comparing salaries from different times Consider golfers who led the Professional Golfers' Association of America (PGA) in winnings at different points in time. Note that the winnings are nominal figures (unadjusted for inflation). To convert the original earnings of Palmer, Trevino, and Norman, use the formula for converting dollar figures from an earlier era into year 2016 U.S. dollars. Using those figures, fill in the following table, making sure to round your responses to the nearest U.S. dollar. Nominal Winnings U.S. CPI Year Golfer ( Dollars) (1983 = 100) Winnings in 2016 Dollars 1963 Arnold Palmer 128,230 30.6 1970 Lee Trevino 157,037 38.8 1986 Greg Norman 653,296 109.6 2016 Dustin Johnson 9,365,185 240.0 9,365,185 True or False: According to the previous table, the golfer with the highest PGA winnings in nominal dollars is not the same as the golfer with the highest PGA winnings after adjusting for inflation. True False5. Interest, inflation, and purchasing power Suppose Janet is an avid reader and buys only mystery novels. Janet deposits $3,000 in a bank account that pays an annual nominal interest rate of 10%. Assume this interest rate is fixed-that is, it won't change over time. At the time of her deposit, a mystery novel is priced at $15.00. Initially, the purchasing power of Janet's $3,000 deposit is mystery novels. For each of the annual inflation rates given in the following table, first determine the new price of a mystery novel, assuming it rises at the rate of inflation. Then enter the corresponding purchasing power of Janet's deposit after one year in the first row of the table for each inflation rate. Finally, enter the value for the real interest rate at each of the given inflation rates. Hint: Round your answers in the first row down to the nearest mystery novel. For example, if you find that the deposit will cover 20.7 mystery novels, you would round the purchasing power down to 20 mystery novels under the assumption that Janet will not buy seven-tenths of a mystery novel. Annual Inflation Rate 0% 10% 13% Number of Novels Janet Can Purchase after One Year Real Interest Rate % % % When the rate of inflation is greater than the interest rate on Janet's deposit, the purchasing power of her deposit over the course of the year