Question

3. Compute excess returns for the market, i.e. market risk premia, as R = Rm - Rrf, where Rm is the return on the

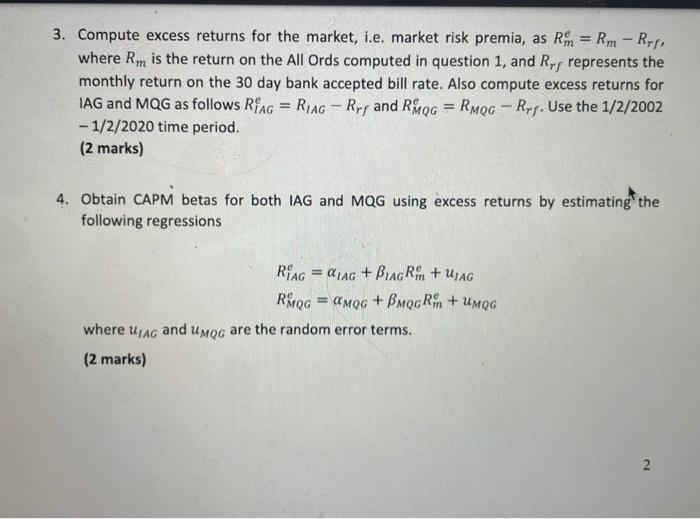

3. Compute excess returns for the market, i.e. market risk premia, as R = Rm - Rrf, where Rm is the return on the All Ords computed in question 1, and Rr represents the monthly return on the 30 day bank accepted bill rate. Also compute excess returns for IAG and MQG as follows RAG = RIAG-Rrf and RMQG = RMQG - Rr. Use the 1/2/2002 - 1/2/2020 time period. (2 marks) 4. Obtain CAPM betas for both IAG and MQG using excess returns by estimating the following regressions RIAGIAG+BIAGR + UIAG Rhc = amc + BuocR +uMoG = where UAG and UMQG are the random error terms. (2 marks) 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Computing Excess Returns Data Gathering Youll needhistorical monthly datafor the following All Ords Index Rm February 2002 to January 2020 30day Bank ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown

10th Edition

538482109, 1133711774, 538482389, 9780538482103, 9781133711773, 978-0538482387

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App