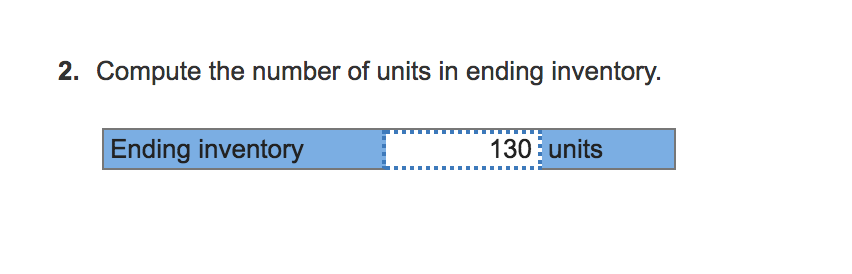

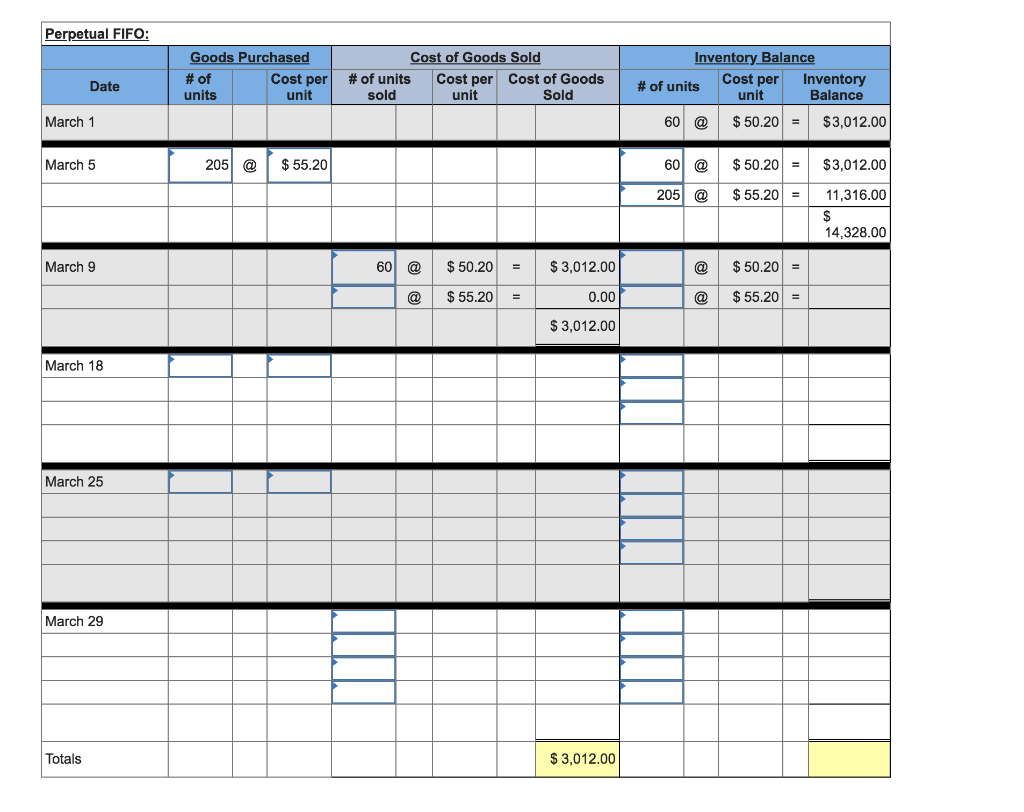

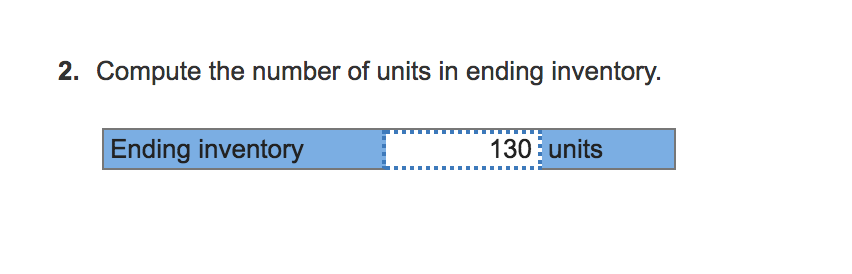

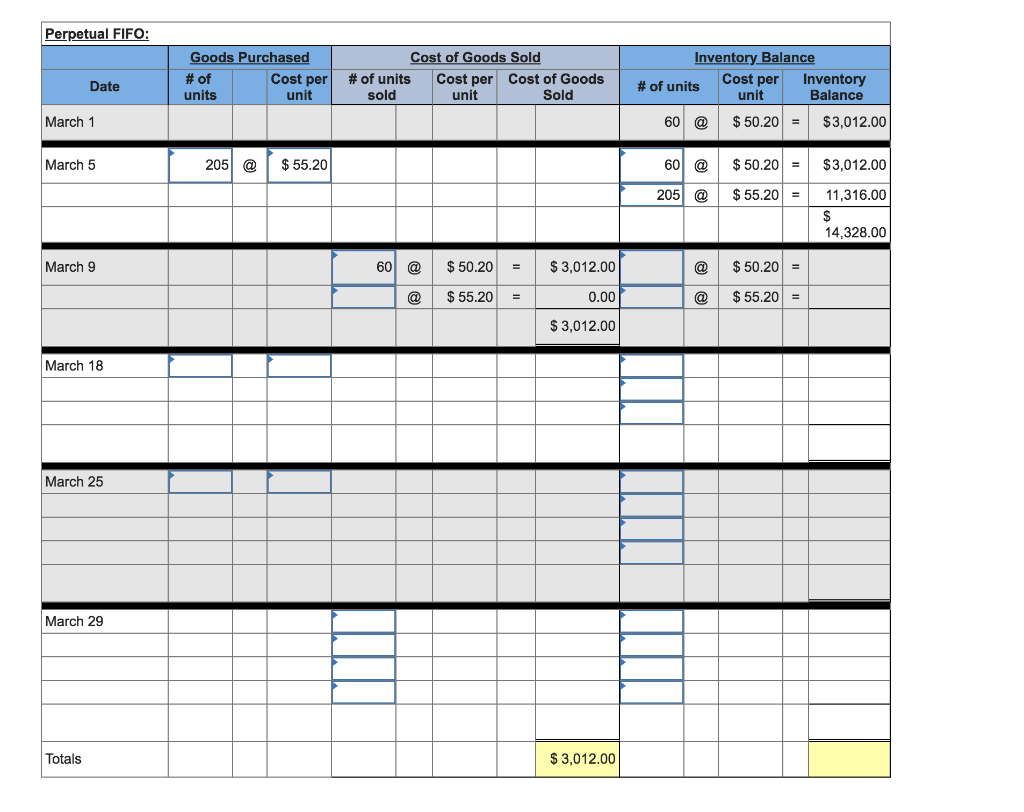

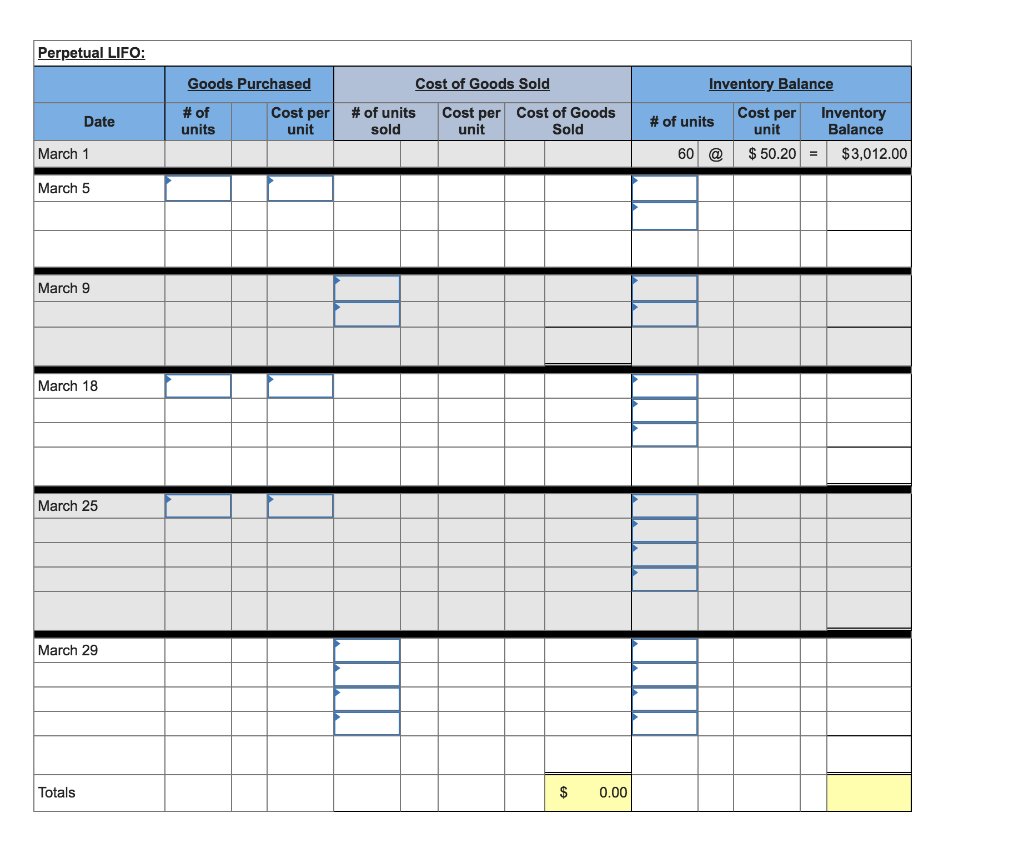

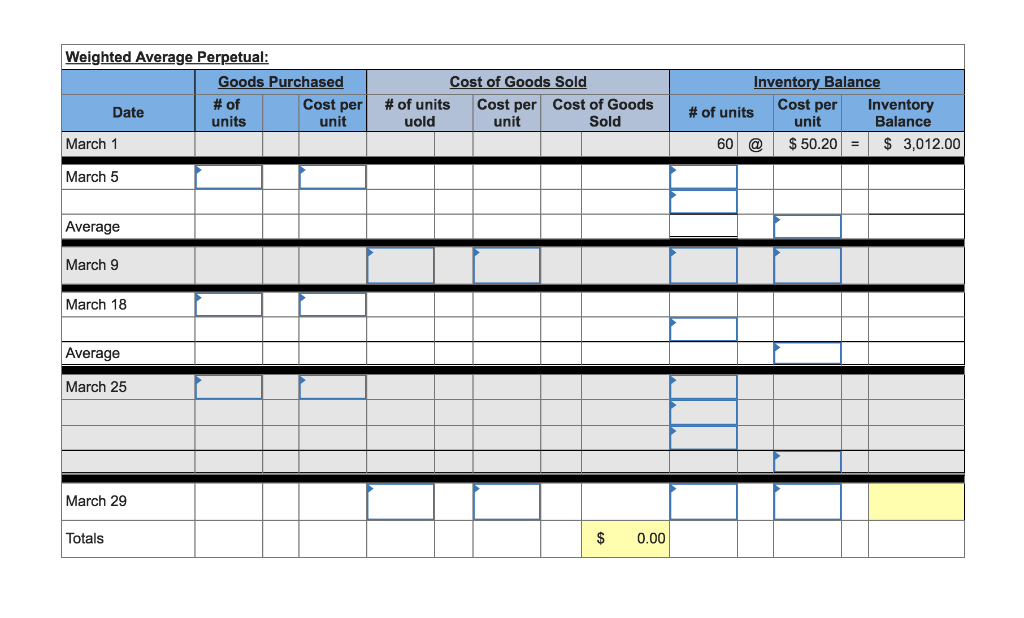

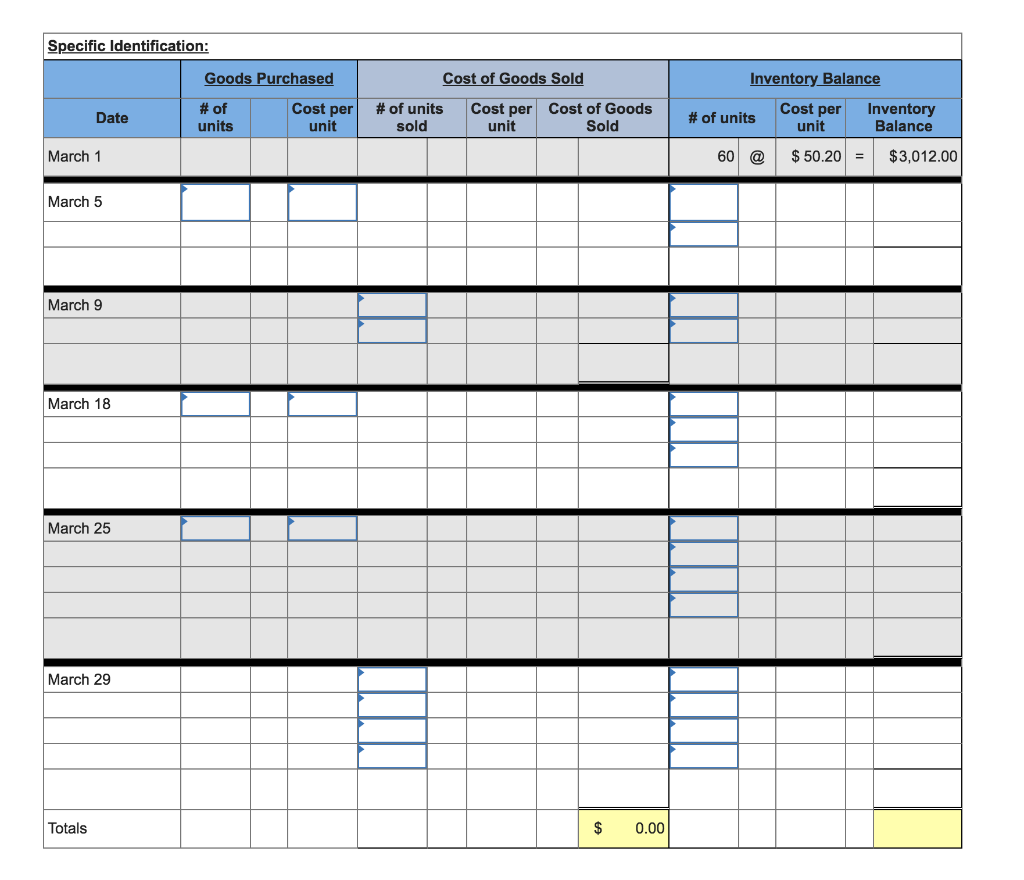

3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d)specific identification. For specific identification, the March 9 sale consisted of 45 units from beginning inventory and 175 units from the March 5 purchase; the March 29 sale consisted of 25 units from the March 18 purchase and 65 units from the March 25 purchase. (Round your average cost per unit to 2 decimal places.)

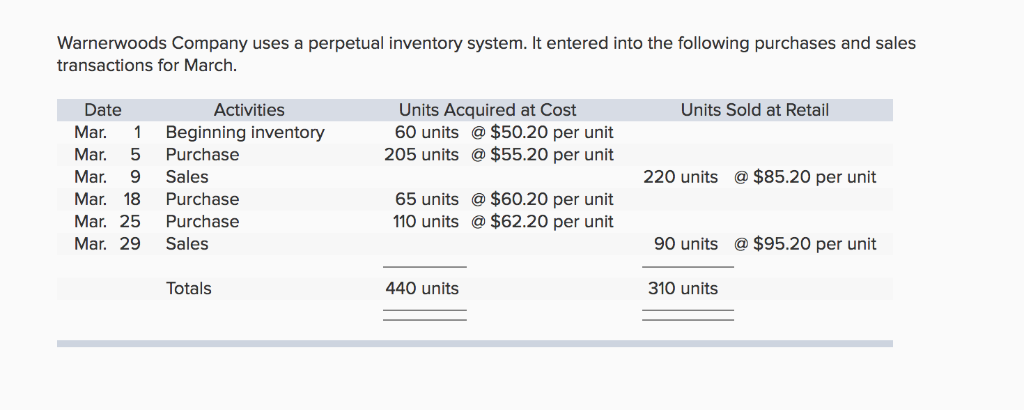

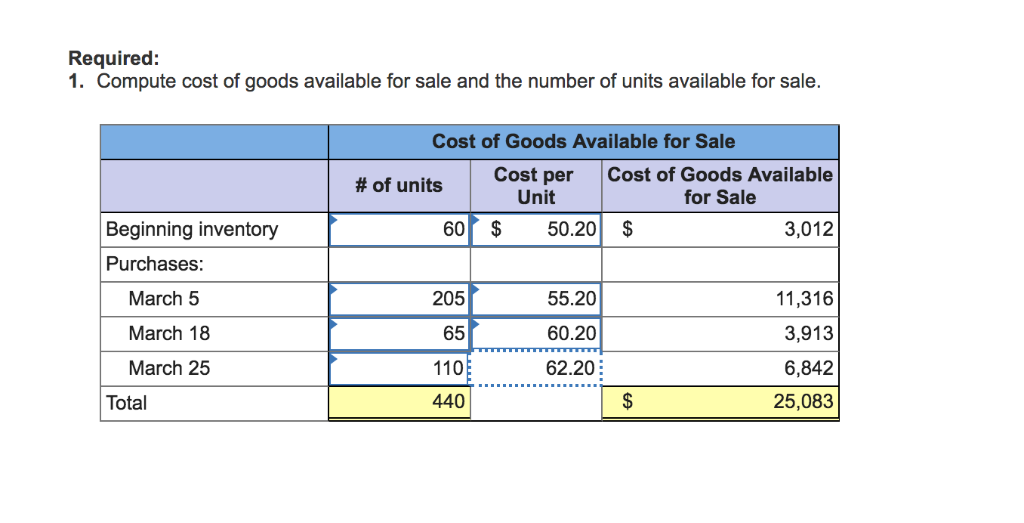

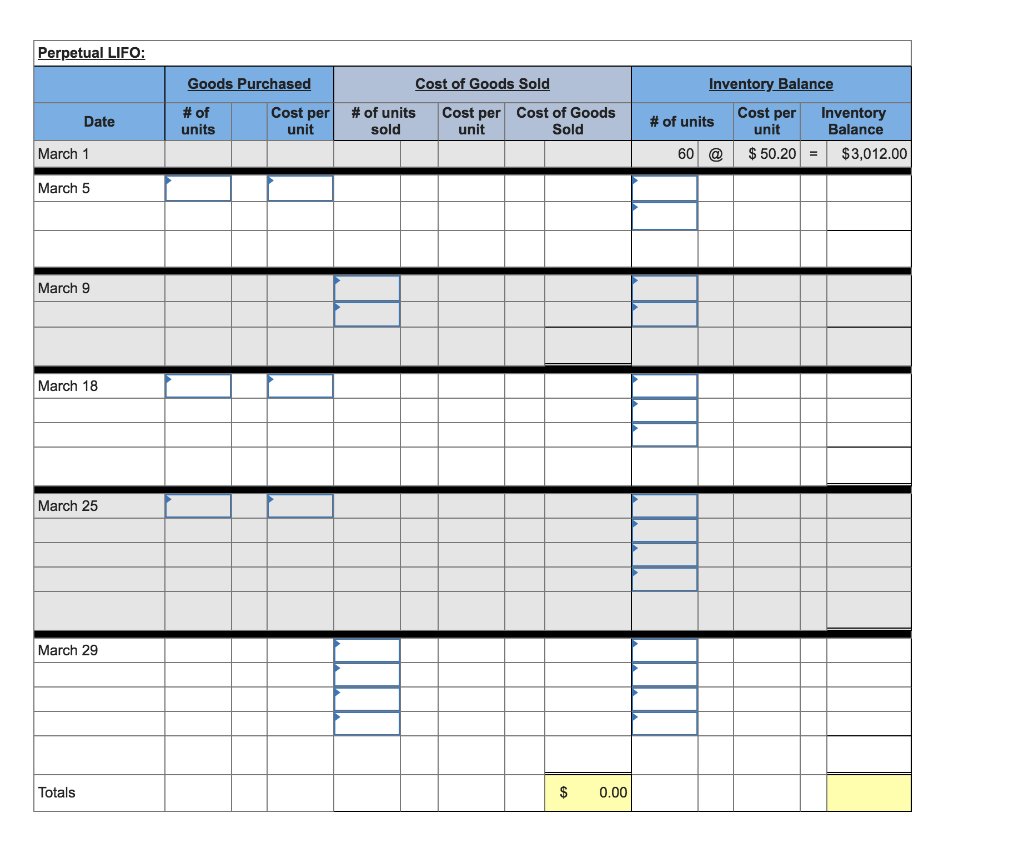

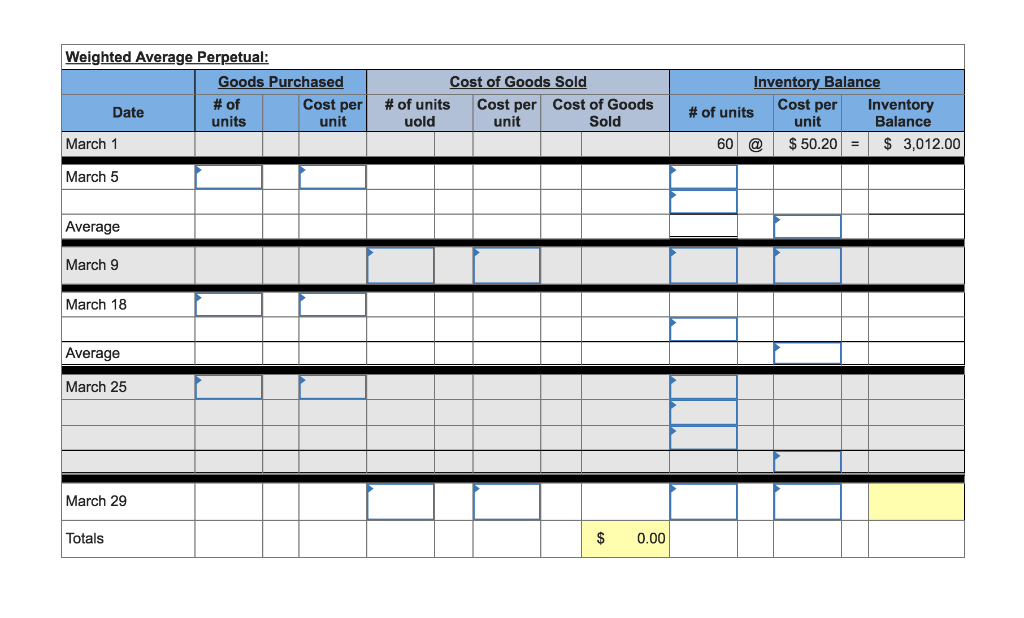

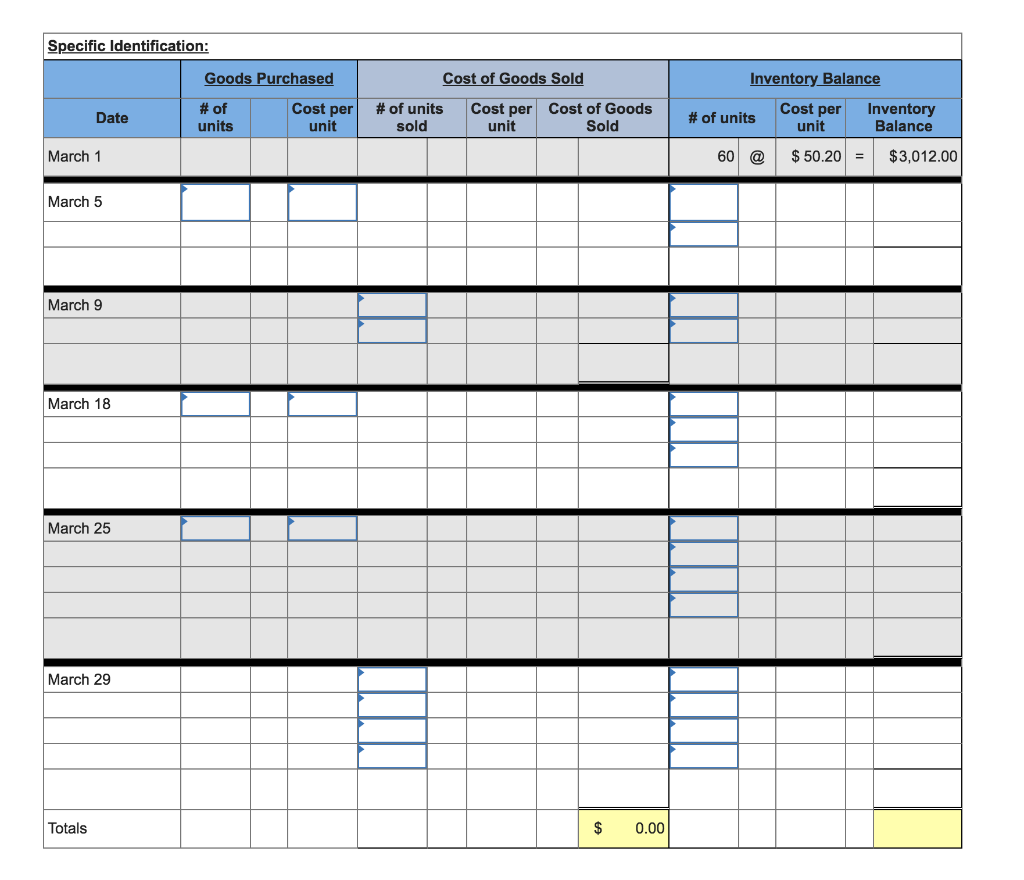

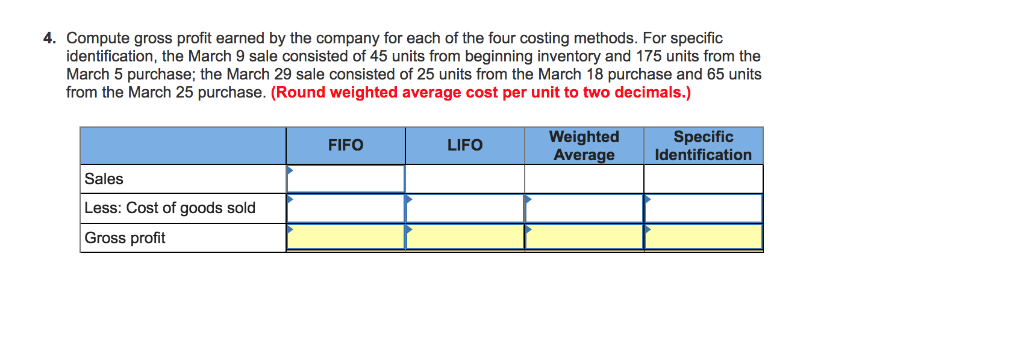

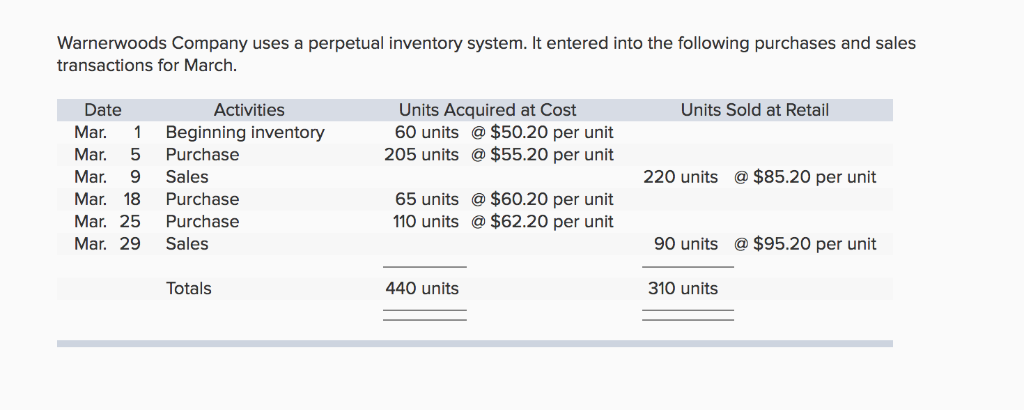

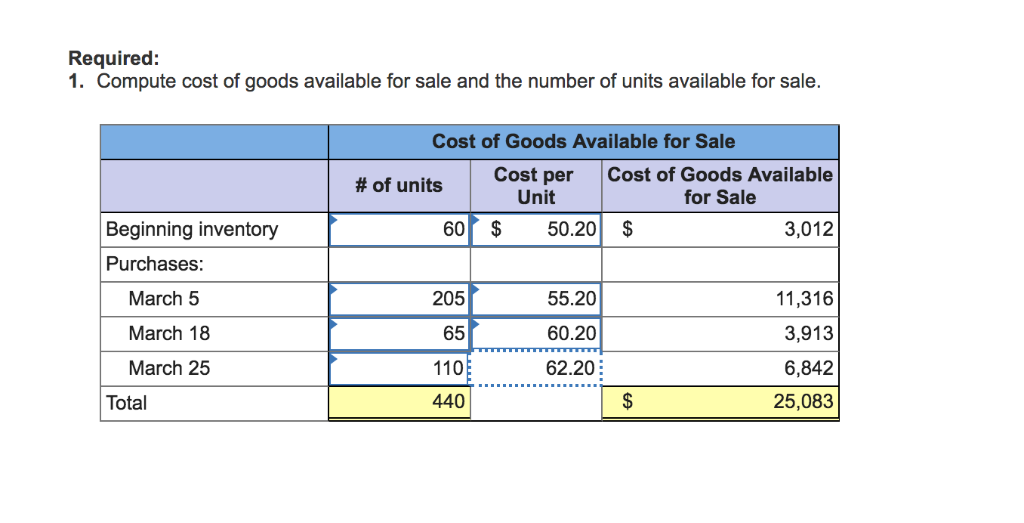

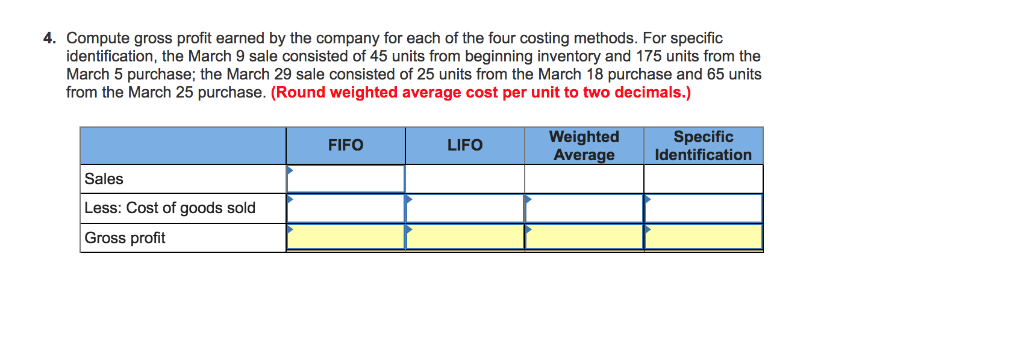

Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Units Acquired at Cost 60 units $50.20 per unit Date Mar. 1 Beginning inventory Mar. 5 Purchase Mar. 9 Sales Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales Activities Units Sold at Retail 205 units $55.20 per unit 220 units $85.20 per unit 65 units 110 units $60.20 per unit $62.20 per unit 90 units $95.20 per unit Totals 440 units 310 units Required: 1. Compute cost of goods available for sale and the number of units available for sale. Cost of Goods Available for Sale Cost per Cost of Goods Available # of units Unit for Sale Beginning inventory 60 $50.20$ 3,012 Purchases March 5 March 18 March 25 205 65 110 440 55.20 60.20 62.20 11,316 3,913 6,842 25,083 Total 2. Compute the number of units in ending inventory Ending inventory 130 units Perpetual FIFO Inventory Balance ood #of units chased oods Sol Cost per unit # of units sold Cost per unit Cost of Goods Sold Cost per Inventory Balance Date unit March 1 60 $50.20$3,012.00 60 $50.20$3,012.00 20555.2011,316.00 14,328.00 March 5 20555.20 $50.20 60 $50.20 3,012.00 0.00 $ 3,012.00 March 9 $55.20 $55.20 March 18 March 25 March 29 Totals $ 3,012.00 Perpetual LIFO: Goods Purchased Cost of Goods Sold Inventory Balance #of units Cost per unit # of units sold Cost per Cost of Goods Cost per Inventory Balance Date # of units unit Sold unit March 1 60$50.20$3,012.00 March 5 March 9 March 18 March 25 March 29 Totals $0.00 Weighted Average Perpetual: Goods Purchased Cost of Goods Sold Inventory Balance #of units Cost per # of units uold Cost per unit Cost of Goods Sold #Of units Cost per Inventory Date unit Balance March 1 60 $50.20 3,012.00 March 5 Average March 9 March 18 Average March 25 March 29 Totals $ 0.00 Specific Identification Goods Purchased Cost of Goods Sold Inventory Balance #of units Cost per unit # of units sold cost per | Cost of Goods #of units Cost per inventory unit Date unit Sold Balance March 1 60 $50.20$3,012.00 March 5 March 9 March 18 March 25 March 29 Totals $ 0.00 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, the March 9 sale consisted of 45 units from beginning inventory and 175 units from the March 5 purchase; the March 29 sale consisted of 25 units from the March 18 purchase and 65 units from the March 25 purchase. (Round weighted average cost per unit to two decimals.) Weighted Average Specific Identification FIFO LIFO Sales Less: Cost of goods sold Gross profit