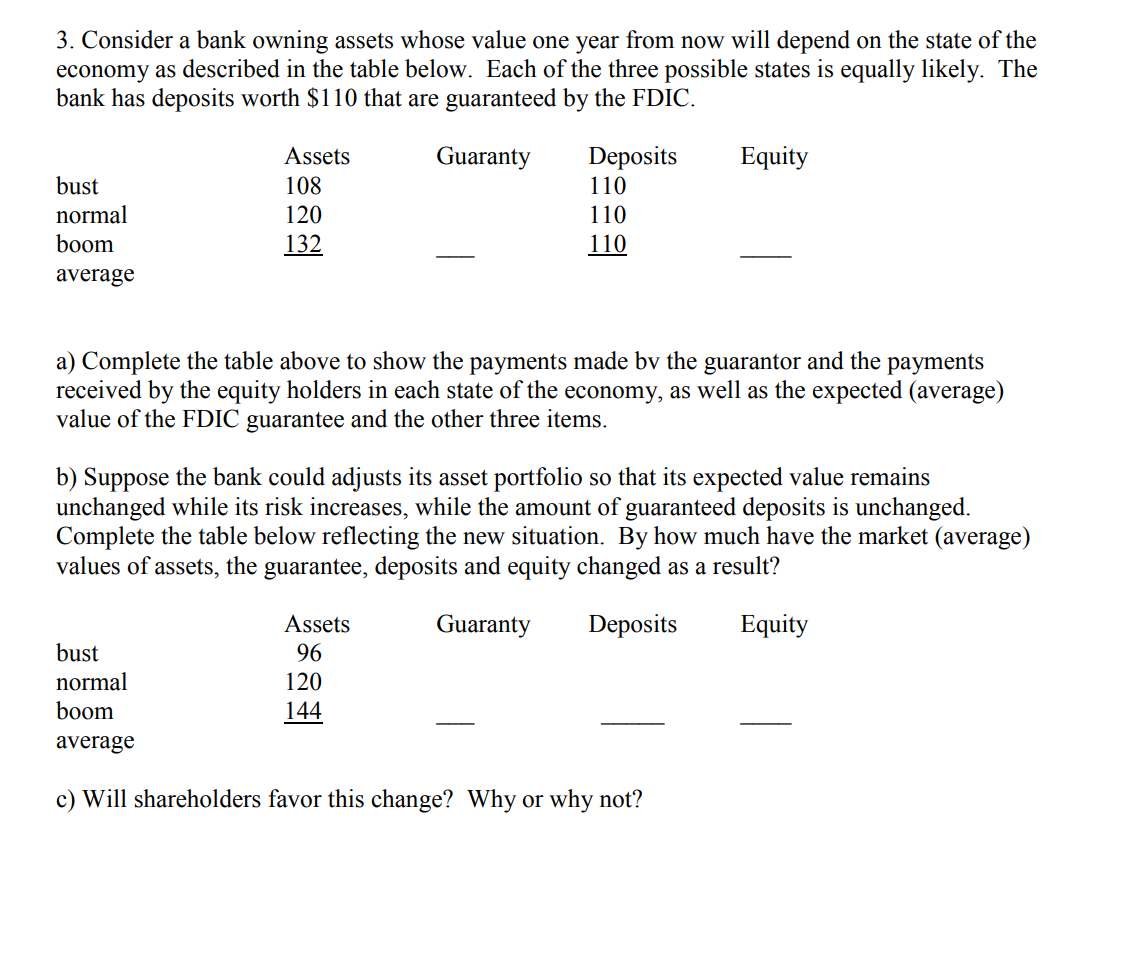

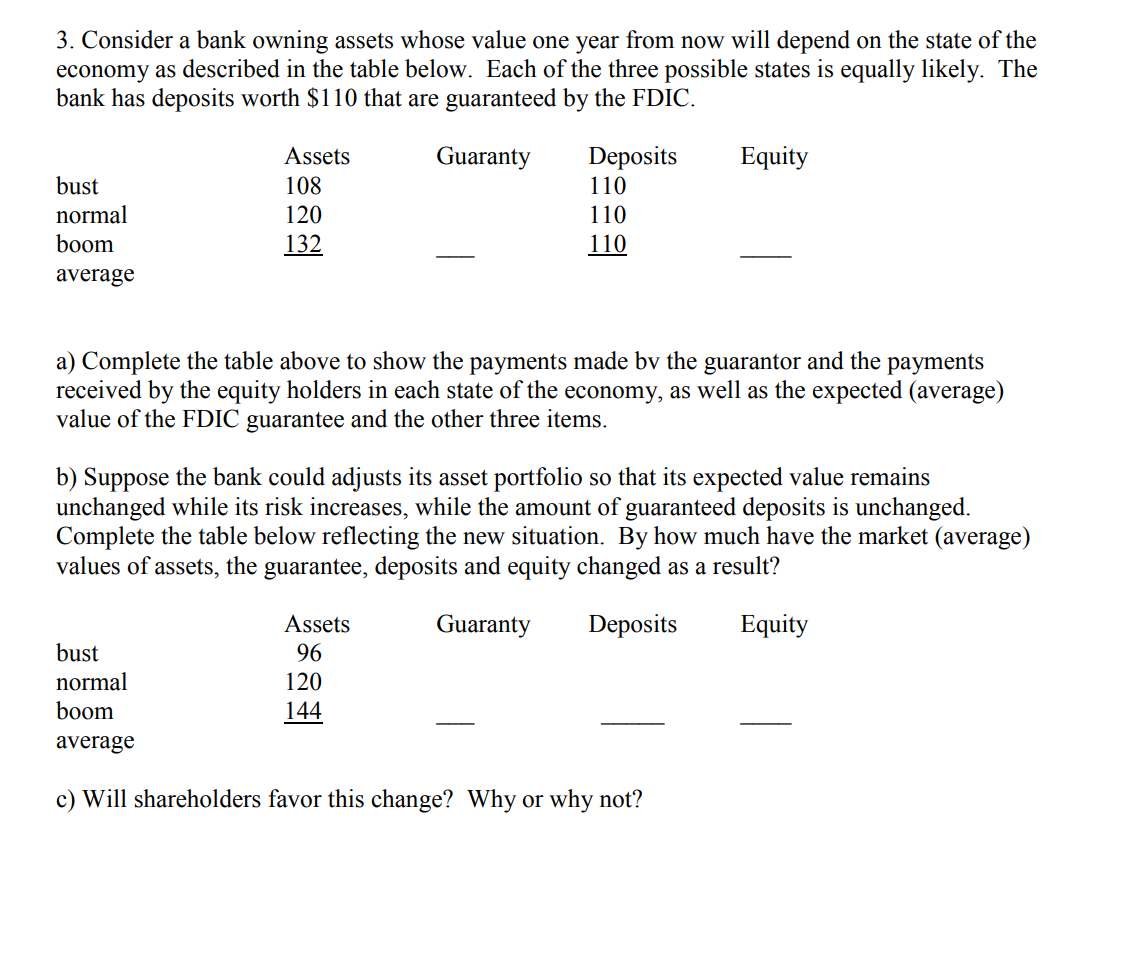

3. Consider a bank owning assets whose value one year from now will depend on the state of the economy as described in the table below. Each of the three possible states is equally likely. The bank has deposits worth $110 that are guaranteed by the FDIC. Guaranty Equity bust normal boom average Assets 108 120 132 Deposits 110 110 110 a) Complete the table above to show the payments made by the guarantor and the payments received by the equity holders in each state of the economy, as well as the expected (average) value of the FDIC guarantee and the other three items. b) Suppose the bank could adjusts its asset portfolio so that its expected value remains unchanged while its risk increases, while the amount of guaranteed deposits is unchanged. Complete the table below reflecting the new situation. By how much have the market (average) values of assets, the guarantee, deposits and equity changed as a result? Guaranty Deposits Equity bust normal boom average Assets 96 120 144 c) Will shareholders favor this change? Why or why not? 3. Consider a bank owning assets whose value one year from now will depend on the state of the economy as described in the table below. Each of the three possible states is equally likely. The bank has deposits worth $110 that are guaranteed by the FDIC. Guaranty Equity bust normal boom average Assets 108 120 132 Deposits 110 110 110 a) Complete the table above to show the payments made by the guarantor and the payments received by the equity holders in each state of the economy, as well as the expected (average) value of the FDIC guarantee and the other three items. b) Suppose the bank could adjusts its asset portfolio so that its expected value remains unchanged while its risk increases, while the amount of guaranteed deposits is unchanged. Complete the table below reflecting the new situation. By how much have the market (average) values of assets, the guarantee, deposits and equity changed as a result? Guaranty Deposits Equity bust normal boom average Assets 96 120 144 c) Will shareholders favor this change? Why or why not